Shares of a company involved in electric vehicles (EV), energy storage and artificial intelligence (AI) Tesla (NASDAQ: TSLA) are trading down about 40% from their peak. Falling sales in the company’s EV segment, which currently accounts for the lion’s share of revenue and profit, have dampened Wall Street enthusiasm for the stock, despite the company’s potential in robotics and autonomous vehicle technology.

However, Cathie Wood, who manages billions of dollars for Ark Investment Management, has been buying Tesla stock en masse for her firm’s exchange-traded funds (ETFs). Since the end of 2023, Ark’s total Tesla position has grown from 3.8 million shares to 5.3 million.

Wood built her reputation in part on her foresight about Tesla stock. Should investors now follow her lead and buy it for its supposed AI benefits?

Wood has previously made big profits at Tesla

Wood founded Ark Invest in 2014. The firm operates several actively managed exchange-traded funds (ETFs), most of which focus on different categories of growing, innovative companies. Its flagship fund is the Ark Innovation ETFBetween 2017 and 2019, Wood invested heavily in Tesla, which was trying to avert bankruptcy by ramping up production of the Model 3.

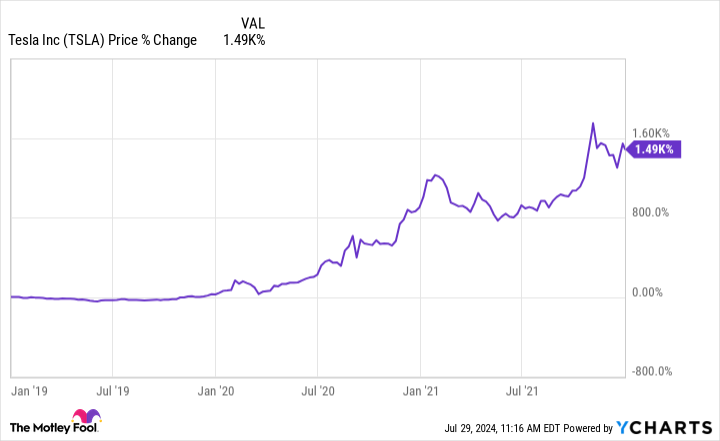

Tesla overcame its challenges, the company thrived, and its shares rose nearly 1,500% in the three years since January 2019:

But Ark’s reputation has suffered since then. Market sentiment toward speculative growth stocks fell as the Fed raised rates to combat inflation, and their valuations fell as well. Many of Ark’s holdings are still well below their previous highs. The Ark Innovation ETF has dramatically underperformed the S&P 500 since early 2022.

Now, however, Wood appears to be leaning on Tesla again, hoping for a big profit to get her funds back on track. Her new investment thesis for Tesla attributes it to eye-popping investment potential.

Why Wood Thinks It Will Happen Again

Ark updated its long-term Tesla forecast this year, setting its expected value in 2029 at $2,600 per share. That’s more than 10 times what the company is worth today.

Both CEO Elon Musk and Wood have high hopes for Tesla’s autonomous driving technology. During the company’s Q2 earnings call, Musk even said that investors should sell their Tesla stock if they don’t believe the company can bring a self-driving EV to market, because “Tesla’s value is overwhelmingly autonomy.” Likewise, Ark’s projections estimate that about 90% of Tesla’s enterprise value and profits will come from autonomy in 2029.

Autonomy, also known as full self-driving, would provide Tesla with opportunities for high-margin revenue, potentially offsetting the impact of lower-margin electric vehicle sales. It could launch a robotaxi business that could challenge traditional ride-sharing models by dramatically reducing operating costs. Tesla plans to unveil its robotaxi EV in October.

Tesla has been developing this technology for the past decade, but advances in AI in recent years have accelerated progress. The company’s version 12 software is reportedly a huge improvement; Tesla rewrote its software to use neural network technology instead of code to interpret the vehicle’s environment.

Should Investors Buy Tesla Today?

Tesla is likely overvalued today based on its recent earnings. But the company’s lofty goals and public profile have earned it an investor base that seems more focused on the long-term story than on quarterly earnings. That’s not to say shareholders have been misled; Tesla has a reputation for missing promised dates, but it has delivered often enough that the stock has outperformed the market.

Elon Musk is arguably Tesla’s biggest asset and risk in the long run. Musk has made Tesla what it is today. On the other hand, Musk is a very public and outspoken figure who occasionally draws criticism that exposes Tesla to unnecessary bad publicity. It’s an unfair and frustrating situation for shareholders who have to take the good with the bad. In June, investors voted to restore Musk’s $44.9 billion pay package, a sign that shareholders still think Tesla is better with Musk than without him.

So, should investors buy Tesla today? It comes down to a simple question: Do you believe the company will bring autonomous driving technology to market?

The bottom line is that Tesla is a stock with a wide range of potential long-term results. Perhaps Ark’s predictions are too optimistic. Still, Tesla stock could still deliver strong returns if the company produces an autonomous driving system that meets the standards of regulators (and customers) and launches a robotaxi service. But investors also need to recognize the risks and downsides if the company doesn’t overcome the remaining technological hurdles.

Those who believe in Tesla’s vision for autonomous driving should consider building their positions in the stock slowly and steadily using a dollar-cost averaging strategy. They should also keep it as a small part of a diversified portfolio. If Ark’s predictions prove even remotely accurate, you won’t need a lot of Tesla stock to enjoy portfolio-changing returns.

Should You Invest $1,000 in Tesla Now?

Before buying Tesla stock, here’s what to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $717,050!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Cathie Wood of Ark Buys This Top Artificial Intelligence (AI) Stock Hand Over Fist was originally published by The Motley Fool