Cathie Wood is known for her unique investing style. She favors high growth and disruption, but often seems cautious and willing to go where other Wall Street titans might be afraid to go.

But despite Wood’s strategy, it may seem to some that there is one risk she is not willing to take. In light of the recent comeback of meme stocks, the CEO of Ark Invest recently issued a warning to investors eager to get in on the action, sensibly warning that things will end badly for many who bet on speculative names like GameStop and AMC deposit.

“Buyers beware, there were a lot of people who were seriously injured during the first meme stock craze,” Wood said.

That said, it’s not like Wood has suddenly turned to value investing for inspiration. We’re still following her playbook of exposure to innovators and decided to take a deeper look at two of the lesser-heralded names that make up her Ark Invest portfolio.

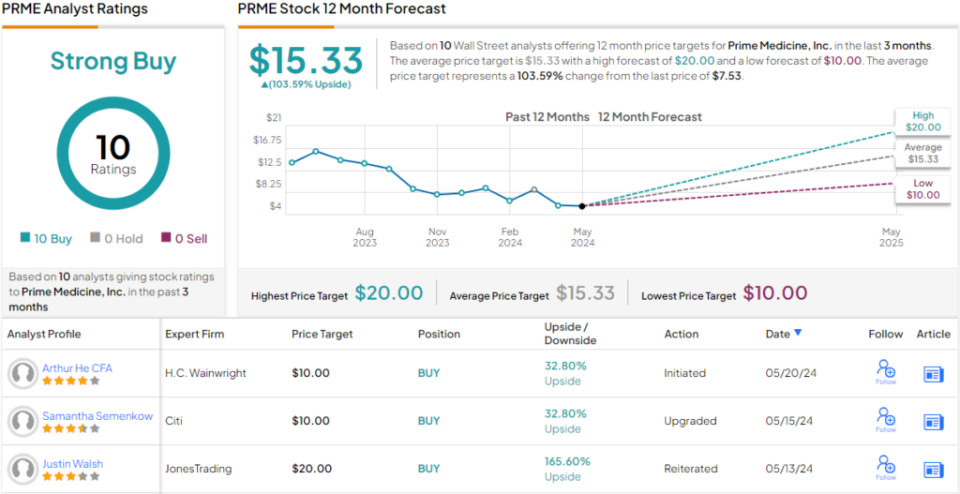

Here it appears that the Street is in sync with the Forest view; Both stocks are rated Strong Buys by analyst consensus, according to the TipRanks database. Let’s see why.

First medicine (PRME)

The first Wood-backed stock we’ll look at fits perfectly with Wood’s innovation-oriented investing style. Prime Medicine is a biotech company at the forefront of gene editing. Founded in 2019, the company’s innovative approach centers on the Prime Editing platform, a breakthrough technology that enables precise and flexible editing of the human genome.

Unlike traditional CRISPR methods, which typically cause double-strand breaks in DNA, Prime Editing uses a more sophisticated method with a ‘search-and-replace’ technique to make specific changes. This method significantly reduces the risk of unintended mutations, increasing the safety and effectiveness of genetic therapies.

Prime Medicine’s technology holds promise for treating a wide range of genetic conditions, potentially providing a cure for conditions for which limited or no treatment options currently exist. The company’s development efforts span key strategic areas including hematology, liver, eyes, neuromuscular diseases and lungs, although the majority of the pipeline is still in the preclinical stage. However, one drug is now ending up in the clinic.

In April, the FDA greenlighted the company’s investigative new drug (IND) application for PM359, which the editor-in-chief indicated would treat chronic granulomatous disease (CGD). This is the first-ever Prime Editor product candidate to make it this far, and Prime plans to initiate a Phase 1/2 study of the drug, with the first data from the study expected to be read in 2025.

Meanwhile, Wood significantly boosted Ark Invest’s stake in PRME during the first quarter, acquiring 2.85 million shares. The company’s total holdings now stand at almost 5.99 million shares, currently worth $45.13 million.

That will likely be seen as a good move by Chardan analyst Geulah Livshits, who is also pleased with the look of what’s on offer here.

“The platform nature of its technology means the company should be able to pivot more quickly for subsequent programs using the same production and delivery technology,” the five-star analyst explains. “Additionally, the current regulatory environment is highly supportive of transformative therapies for rare diseases, with FDA officials repeatedly indicating a desire to accelerate the development of such therapies, including through increased engagement, use of surrogate endpoints and flexible trial designs. We believe these factors can enable Prime to achieve sustainable growth by advancing programs within and beyond its current pipeline.”

“With Prime on track to initiate IND enablement activities for 1+ programs in its in vivo delivery franchise and to nominate a DC for RHO adRP in 2024, we believe the company is positioned for value inflection as it transitions from developing a collection of (interesting) scientific projects to advance a product pipeline,” continued Livshits.

In short, Livshits rates PRME stock a Buy, while her $17 price target suggests the stock has room for outsized 140% growth over the next year. (To view Livshits’ track record, click here)

Livshits’ bullish view on PRME is not an anomaly. All nine other recent analyst ratings are positive, so the consensus here is obviously a Strong Buy. With an average target of $15.33, investors could potentially earn ~104% returns over the next year. (To see PRME stock forecast)

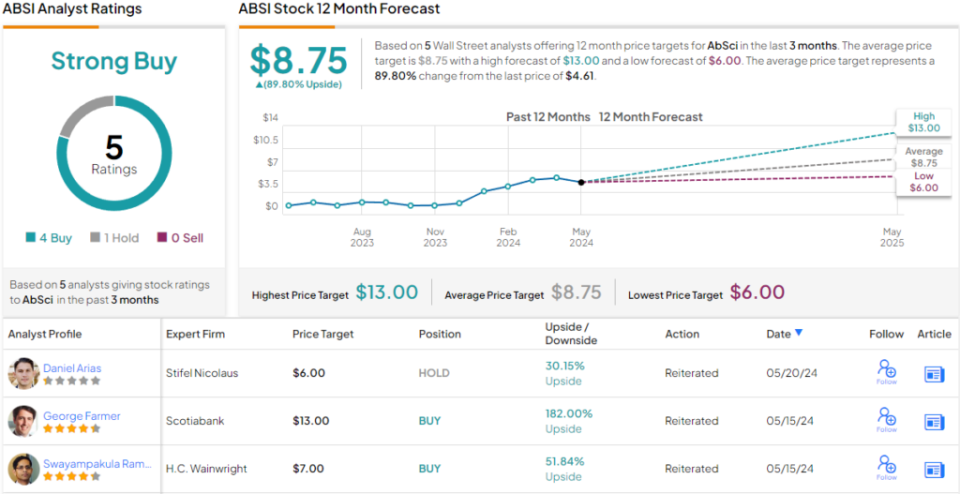

AbSci (ABSI)

We’ll stay in the biotech space for Wood’s next pick. AbSci is a company that is taking advantage of the hottest trend of the current market: it is using generative AI for drug development.

Describing itself as an AI drug development company, AbSci’s platform can produce high-affinity antibodies that target specific epitopes entirely through computer simulations. Reflecting their motto: “the data to train, the AI to create, and the wet lab to validate,” AbSci can generate antibody drug candidates much faster than traditional laboratory techniques. By streamlining traditionally laborious steps, AbSci aims to reduce costs and accelerate time to market for new biologics, meeting critical healthcare needs.

That said, the pipeline is still in its early stages. Among the drugs currently in development, the company is working on ABS-101, potentially a best-in-class anti-TL1A antibody for which it initiated IND-enabling studies in February. The company expects Phase 1 clinical trials for ABS-101 to begin early next year, with an interim data readout planned for the second half of 2025. In addition, proof-of-concept results are expected for the new drug candidate for immune-oncology ABS-301. around mid-2024.

As for Wood’s involvement, her firm, Ark Invest, took a new position in ABSI stock in the first quarter, acquiring nearly 3.28 million shares worth $14.87 million.

The company also has a fan: George Farmer of Scotiabank, who believes investors should seize an opportunity while it’s still in its early stages.

“We recommend purchasing ABSI shares to capture the value potential of the company’s novel AI-based drug development strategy and the early stage biologics pipeline on which it is based,” Farmer said. “Why? Preclinical results to date support the competitive advantage that ABS-101, an AI-optimized anti-TL1A therapeutic, may have over existing agents in clinical development for addressing the massive inflammatory bowel disease (IBD) treatment market.

Therefore, Farmer rates ABSI an Outperform (i.e. Buy), in addition to a $13 price target. The implication for investors? An advantage of no less than 182% compared to current levels. (To view Farmer’s track record, click here)

Most of Farmer’s colleagues agree with his assessment. Based on a mix of 4 Buys to 1 Hold, the stock claims a Strong Buy consensus rating. The forecast calls for one-year returns of ~90%, as the average price target is $8.75. (To see ABSI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.