Cathie Wood is the head of Ark Investment Management, which operates a family of exchange-traded funds (ETFs) focused on innovative technology stocks. Last year, Wood said software companies could be the next big opportunity in the artificial intelligence (AI) industry. She predicts that they will eventually generate $8 in revenue for every $1 they spend on AI data center chips from vendors like Nvidia.

And Wood has put her money where her mouth is. Since making that call, she has joined AI software companies like xAI, Anthropic and OpenAI through the private Ark Venture Fund. Additionally, Ark’s ETFs include several AI software stocks, including Tesla, Palantir, MetaplatformsAnd Microsoft.

Ultimately, if Wood is right about AI software companies, this is why Google is mum Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) could be among the biggest winners.

Alphabet transforms Google Search using AI

Alphabet is a technology conglomerate that is home to Google, YouTube, the self-driving vehicle company Waymo, and numerous other companies. Google Search accounted for more than half of Alphabet’s $84.7 billion in revenue in the second quarter of 2024, thanks to its 90% market share in the Internet search industry. But that dominance is facing its biggest test yet by AI.

AI chatbots, like OpenAI’s ChatGPT, provide instant answers to users’ questions, giving them quick access to information on virtually any topic. Google, on the other hand, requires users to search web pages to find the information they need and generates revenue by charging companies to promote their websites in search results. This makes the traditional search model of great importance for Alphabet.

But instead of defending what could eventually become outdated, Alphabet decided to make drastic changes. In many cases, users who search on Google Search now receive AI-generated, text-based answers above web search results, allowing them to access information faster. Google also launched AI Overviews earlier this year, taking it one step further.

Summaries contain text, images, and links to third-party websites to provide more complete answers to questions within Search. Furthermore, with the click of a button, the user can simplify or break down answers to gain a better understanding of the content. Alphabet has already found that links within Overviews receive more clicks compared to the same links in the traditional search format, so this new feature could be a big ad revenue driver in the future.

Additionally, Alphabet now offers its own family of AI models called Gemini (and a chatbot of the same name), which can answer complex questions and generate content such as text and images. For an additional fee, Gemini is already available as an add-on in Google Workspace, home to productivity apps like Gmail, Docs, Sheets, and more. As a result, it could become a powerful driver of subscription-based revenue over time.

Google Cloud is Alphabet’s fastest growing company

Search may be Alphabet’s largest business, but Google Cloud is growing twice as fast. It generated record revenue of $10.3 billion in the second quarter of 2024, up 29% from the year-ago period – compared to 13.7% growth in Search.

Google Cloud offers a portfolio of services to help businesses succeed in the digital age, including data storage, web hosting, and software development tools. However, the platform has also become a leading provider of AI services.

Developers can access the computing power they need to create AI software through Google Cloud data centers. To accelerate their progress, they can even use the latest off-the-shelf large language models (LLMs). This includes Gemini and more than 130 others from leading start-ups and external developers.

Google Cloud is also designing its own data center chips to give AI software developers more choices, helping the platform differentiate itself from other cloud providers that rely primarily on vendors like Nvidia. Google recently launched its sixth-generation tensor processing unit (TPU), called Trillium, which achieves nearly five times the maximum computing performance of the previous generation.

Most AI developers pay per minute for computing power, so faster chips can significantly reduce costs. And to return to Wood’s prediction: If Google makes its own chips at scale, the payoff could be significantly greater if it uses them to make software – or leases them to other developers – because it doesn’t need billions of chips to send dollars to suppliers like Nvidia.

Alphabet stocks are cheap, but there’s one big caveat

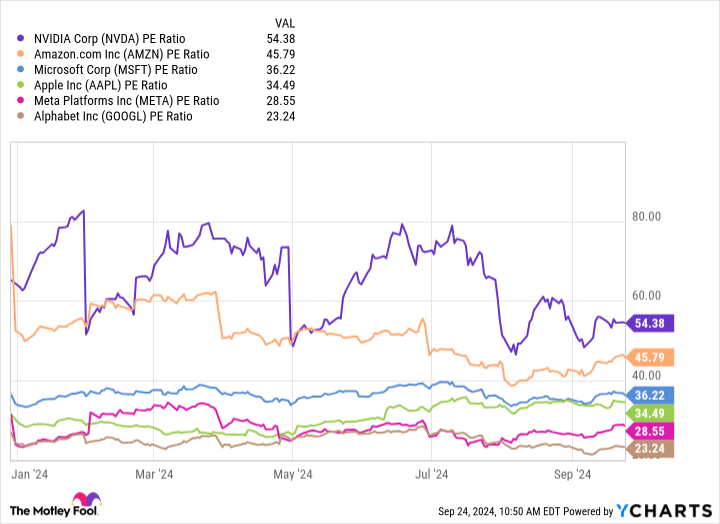

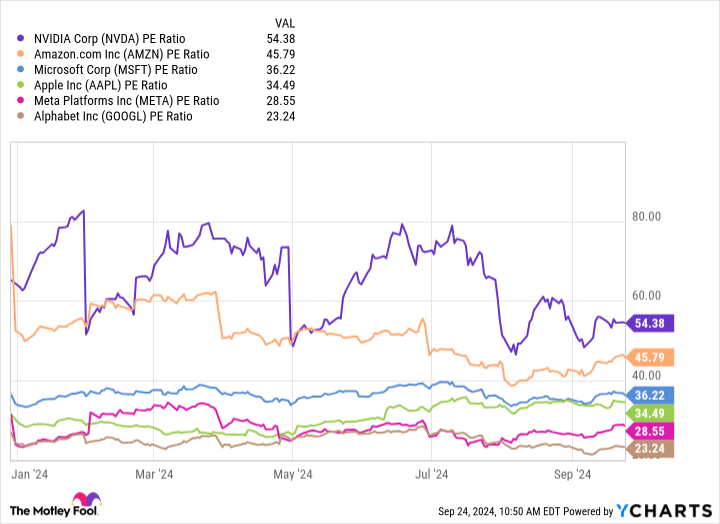

Alphabet generated earnings per share of $6.97 over the last four quarters, and based on the share price of $161.85 at the time of writing, the company is trading at a price-to-earnings (P/E) ratio of 23.2. That makes Alphabet the cheapest of all US tech companies valued at $1 trillion or more:

But there’s one glaring problem, and it has nothing to do with the company’s growth or its position as an AI powerhouse.

The U.S. Department of Justice (DOJ) filed an antitrust lawsuit against Alphabet in 2020, alleging the company engaged in monopolistic practices by paying Apple as much as $20 billion a year to make Google the default search engine on its devices. Unfortunately for Alphabet, the judge in the case decided last month and sided with the DOJ.

It is unclear what the consequences will be. Alphabet may have to pay a financial penalty, or the government could force a breakup of the entire company. The latter would create significant uncertainty for investors, as Alphabet would likely have to sell certain parts of its business to convince the DOJ that it will not engage in anticompetitive behavior in the future.

Many Wall Street analysts say a breakup would be an extreme and unlikely outcome. Technology analyst Dan Ives of Wedbush Securities believes Alphabet will reach a settlement with the DOJ within the next 18 months to resolve the case. That could entail a financial penalty and some changes in the way Alphabet interacts with its partners.

If there is no settlement, it could take years to reach a final resolution while Alphabet appeals the judge’s decision, so the status quo should hold for now. Therefore, Alphabet’s stock looks like great value at its current price, and if the company emerges from this regulatory situation intact, it could look like an absolute bargain, given Cathie Wood’s AI software forecast.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Cathie Wood Says Software Is the Next Big AI Opportunity – 1 Spectacular Stock You’ll Regret Not Buying If She’s Right Originally published by The Motley Fool