(Bloomberg) — Chinese solar panel makers have endured an earnings season bloodbath, but there are tentative signs that the massive surpluses plaguing the sector are starting to ease.

Most read from Bloomberg

Longi Green Energy Technology Co. and five other leading solar companies collectively lost $2 billion in the first half of the year after a factory-building frenzy in recent years created overcapacity that drove prices to record lows. Some smaller companies have already been forced to restructure, while rising trade tensions with the U.S. and Europe could jeopardize exports.

The financial pain appears to be planting the seeds for a turnaround, though a meaningful recovery is unlikely until next year. Goldman Sachs Group Inc. sees a looming wave of factory closures that would rebalance the market, while Morgan Stanley thinks equipment prices have already bottomed out.

Longi said it hoped to “push the industry out of a quagmire of low-price competition” by raising prices of solar wafers this week. TCL Zhonghuan Renewable Energy Technology Co. also said this week it will raise prices of three types of wafers, according to a report in Chinese media.

“I don’t know if prices can fall any further than this point, it’s just too much for even the biggest players,” said Cosimo Ries, an analyst at Trivium China in Shanghai. “It’s still going to be a pretty painful year, and maybe longer, before that capacity is freed up.”

The plight of the Chinese solar industry began three years ago, when demand for panels skyrocketed. Prices rose and ambitious expansion plans were made, resulting in a far too large supply.

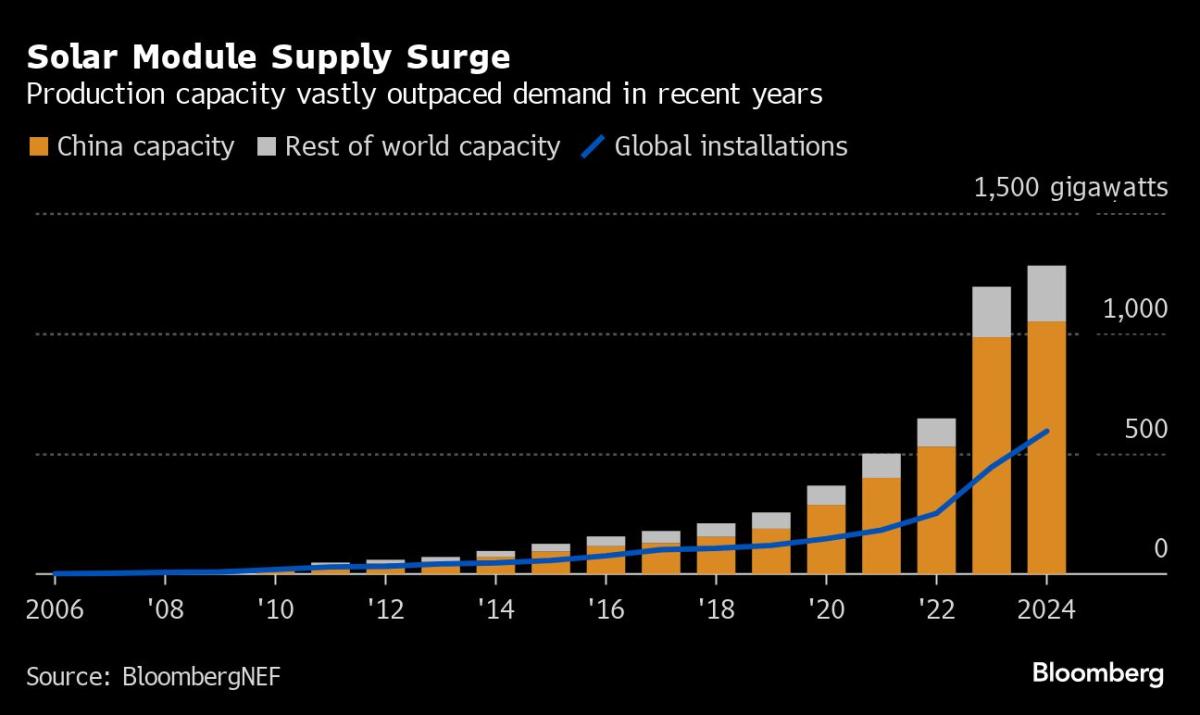

The industry ended 2023 with the potential to produce 1,154 gigawatts of solar — more than double the capacity it had two years earlier. Expected demand this year is just 593 gigawatts, according to BloombergNEF.

The health of China’s solar industry, which accounts for about 80% of global production, is crucial to the fight against climate change. Its problems highlight the difficulty of matching production and demand in the many fast-growing sectors tied to the energy transition.

The growing rivalry between the US and China is also making life harder for Chinese manufacturers. Washington plans to double import tariffs on the country’s solar equipment to 50% and is also going after Chinese companies that have set up factories in Southeast Asia.

Trade relations between Beijing and the European Union, a key market for Chinese solar equipment, are also deteriorating. A growing battle over subsidies has led to a tit-for-tat dispute that began with electric vehicles and has since spread to pork, dairy and brandy.

“Chinese manufacturers are responding to poor profitability and uncertainties surrounding market access restrictions in the U.S. and EU,” Goldman analysts including Trina Chen said in a note this month. “The Chinese solar industry is entering the final phase of a downturn, with a cyclical bottom likely in 2025.”

Longi’s profit suffered the most, as it posted a net loss of 5.2 billion yuan ($740 million) in the first six months of the year, after a profit of 9.3 billion in the same period in 2023. Tongwei Co. and TCL Zhonghuan Renewable Energy Technology Co. each reported losses of more than 3 billion yuan. JA Solar Technology Co., Xinjiang Daqo New Energy Co. and GCL Technology Holdings Ltd. were also in the red for the period.

“Given the rapid expansion of the industry’s production capacity in the past two years and the complex global trade environment, the industry has entered a period of deep adjustment,” Longi said in its earnings report.

Several executives at top Chinese companies have called on the central government to intervene to help the industry get back on its feet. The menu of options presented included regulating which new factories can be built, cracking down on less efficient facilities, limiting price cuts and promoting consolidation.

Some of that action is already happening. Tongwei bought Jiangsu Runergy New Energy Technology Co. earlier this month in the industry’s first major consolidation move during the downturn, and expansion plans at several other companies have been delayed or canceled.

Still, it will likely take another six to 12 months for solar farm prices to return to breakeven, Morgan Stanley analysts including Eva Hou said in a report.

“The industry will need to further reduce production costs or take capacity consolidation to a higher level to bring prices back to sustainable levels in the supply chain,” she said.

–With assistance from Stephen Stapczynski.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP