Chipotle Mexican Grill (NYSE: CMG) Chipotle Inc. recently joined the growing list of top companies that have announced or completed stock splits. The fast-casual chain completed its move late last month, with shares trading at their post-split price on June 26. The move was a major one for Chipotle, as it marked the company’s first-ever stock split — and the 50-for-1 move was one of the largest in New York Stock Exchange history.

The restaurant chain made the move after its shares soared more than 300% over the past five years, recently topping $3,000. The split brought the price of each individual share down to around $60, making the stock more accessible to a wider group of investors. However, a stock split is merely a mechanical operation — it doesn’t fundamentally change anything, such as valuation or market value. This means it’s not a good idea to buy a stock therefore A stock split was implemented.

Since you may now be wondering how to best approach the Chipotle investment opportunity, here are three things you should know before buying or selling shares of this top restaurant chain.

1. Expansion drives revenue growth

Chipotle has steadily increased sales over time, even during tough times like the worst of the pandemic. Then Chipotle turned to its digital ordering platform, and that kept guests coming back.

But it’s important to note that Chipotle isn’t seeing huge growth at its individual restaurants year over year. Instead, it’s growing primarily by adding new restaurants. For example, in the most recent quarter, total sales rose more than 14% to $2.7 billion — but comparable restaurant sales rose just 7%. This isn’t a one-quarter thing; it’s an ongoing trend.

Of course, Chipotle still has a long way to go in its expansion plan, as it aims to expand from approximately 3,500 locations to 7,000 in North America, and it’s on track to achieve that goal. So there’s room for more growth. Still, the window of opportunity may be limited when it comes to comparable store sales growth, which could limit overall growth down the road.

2. Chipotle has quite a moat

A moat is a competitive advantage that comes in many forms. In the case of Chipotle, the company’s moat is the brand it has established, promising fresh, quality ingredients — and bringing back favorite recipes for a limited time. (Most recently, that included bringing Chicken al Pastor back to the menu.) As a result, customers have come back to Chipotle over time — and they’ve rushed to get their hands on these special menu items that won’t be around for much longer.

Staying ahead of competitors in the fast food and fast casual industry is especially challenging because new places are popping up all the time and people are always willing to at least give them a try. So it’s important to build relationships with customers over time to increase the potential for future revenue growth.

Chipotle’s moat is one reason investors were willing to pay thousands of dollars for a single share earlier this year — and at a high valuation. The chain has proven it can be a customer favorite over the long term, and that could help drive sales growth.

3. Appreciation is high

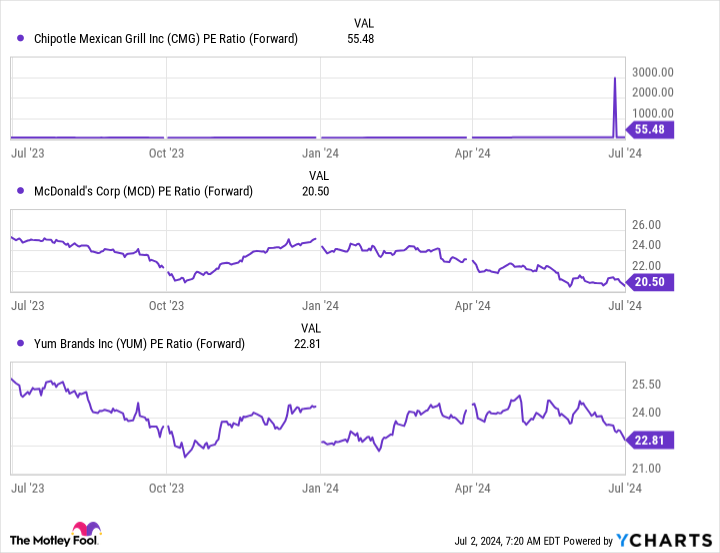

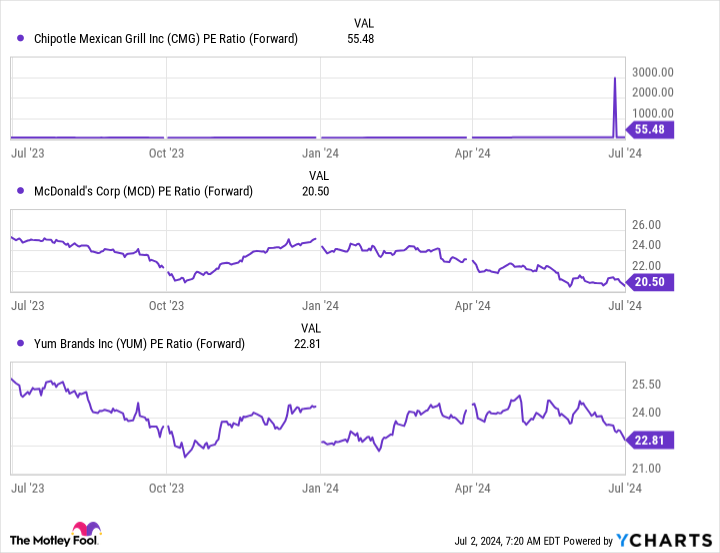

As I mentioned above, investors have been willing to pay top dollar for access to Chipotle stock. That hasn’t changed after the stock split. Today, the stock trades for more than 55 times expected earnings, which is very high for a restaurant stock. While the companies aren’t exactly the same, to make a rough comparison, fast food giants McDonald’s And Yummy! Brands exchange for about 20x.

While Chipotle may deserve a higher valuation than its peers, the current level still seems quite high. It could deter some investors from buying the stock, especially considering the company’s current growth and future prospects.

Should you buy or sell?

Should You Buy or Sell Chipotle Stock? The answer to this question depends on your investing style. If you’re looking to diversify and add a strong restaurant player to your portfolio, you might consider buying some Chipotle stock and holding for the long term. The growth, while not huge, isn’t over yet — and the stock could rise from its current level over the long term. So you could win by buying now and holding for a few years. This is also why you might want to hold on to at least some of your Chipotle stock if you’re a current shareholder.

But if you’re a value investor, you might want to cross Chipotle off your investing menu right now. The stock has gotten very expensive, which means it’s not a good fit for your strategy — and you’ll probably find a more palatable choice elsewhere.

Should You Invest $1,000 in Chipotle Mexican Grill Now?

Before you buy stock in Chipotle Mexican Grill, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $761,658!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Chipotle Just Split Its Stock. 3 Things to Know Before You Buy or Sell was originally published by The Motley Fool