In early 2024, the broader indices were driven higher, mainly by mega-cap growth stocks. But the market’s leadership has changed in recent months, with poor dividend and value stocks posting significant gains.

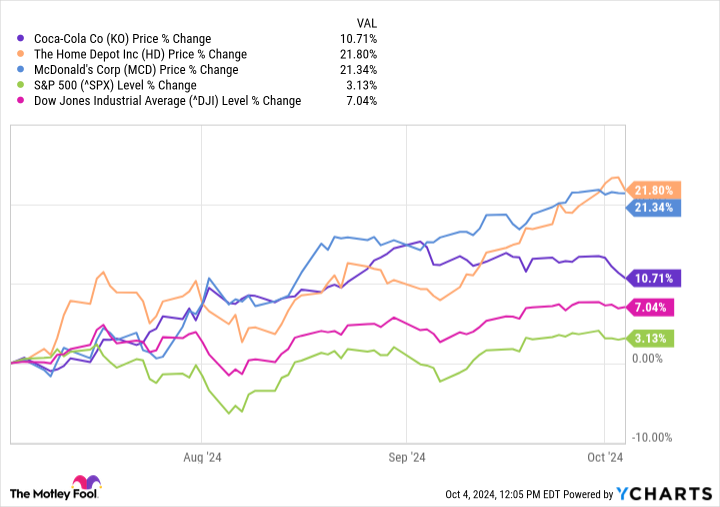

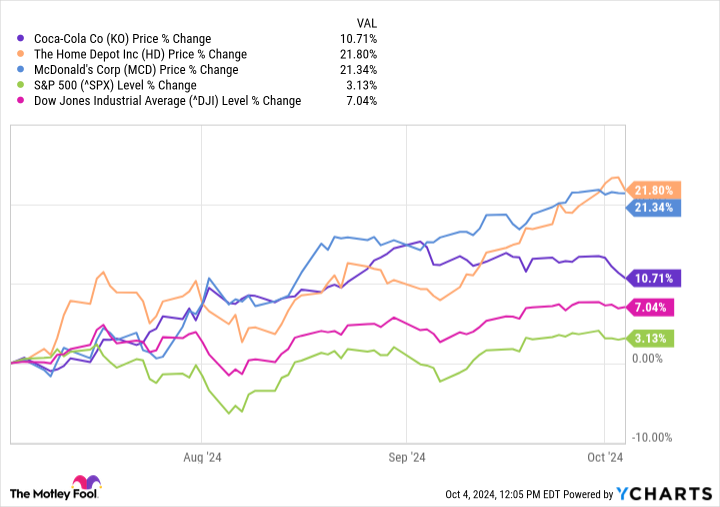

For example, Nvidia has fallen 3.1% over the past three months, while the S&P500 has risen by 3.2% and the Dow Jones Industrial Average has increased by 7.1%. Meanwhile, Dow components Coca-cola (NYSE:KO), Home Depot (NYSE: HD)And McDonald’s (NYSE:MCD) have increased even more.

Here’s why these three blue chip October dividend stocks could be solid buys for those looking to generate passive income.

Coca-Cola returns to growth

Coca-Cola is an excellent example of why a solid, low-growth company can be a great investment if it exceeds the investor exceptions.

Coca-Cola is an established, mature company with a global beverage portfolio. Investors are likely to buy and hold Coke stock because of stable earnings and dividend growth, and because it can deliver results regardless of what the economy or the rest of the stock market does. For this reason, Coca-Cola doesn’t need to deliver staggering double-digit earnings growth to impress investors; it just needs to make enough profit to justify reasonable dividend increases while maintaining a solid balance sheet.

Considering Coke’s most recent dividend increase was a healthy 5.4% increase and the company is expected to report record profits this fiscal year, it’s understandable why the stock has been in a slump in recent months.

After sales plummeted during the height of the pandemic, Coca-Cola has done a great job of weathering inflationary pressures. The company’s pricing power is on full display as it continues to maximize its growing portfolio of soft drinks, coffee, tea, juice, energy drinks, water and carbonated water.

The rise in Coca-Cola’s share price has pushed its yield down to 2.7% and its price-to-earnings ratio (P/E) above historical levels. However, Coca-Cola is well positioned to maintain high margins and pass on profits to shareholders.

Coca-Cola could pull out over valuation concerns. However, the underlying business is in excellent shape, suggesting Coca-Cola is still a good buy for long-term investors looking for reliable dividend stocks.

Home Depot’s worst recession could be nearing an end

Home Depot’s results have been relatively weak in recent years. In the company’s latest report, it lowered its full-year guidance, expecting revenue and profit to be lower in fiscal 2024 than in fiscal 2023. Despite the bleak outlook, Home Depot has been one of the most popular stocks in the Dow Jones. just rose to a new all-time high on October 2.

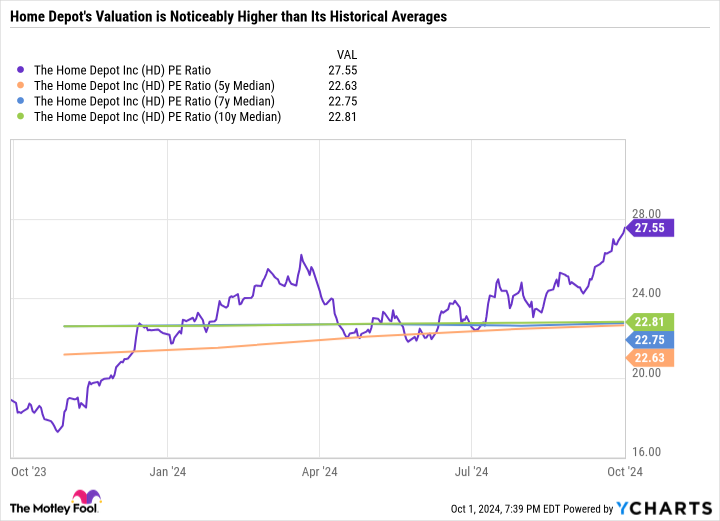

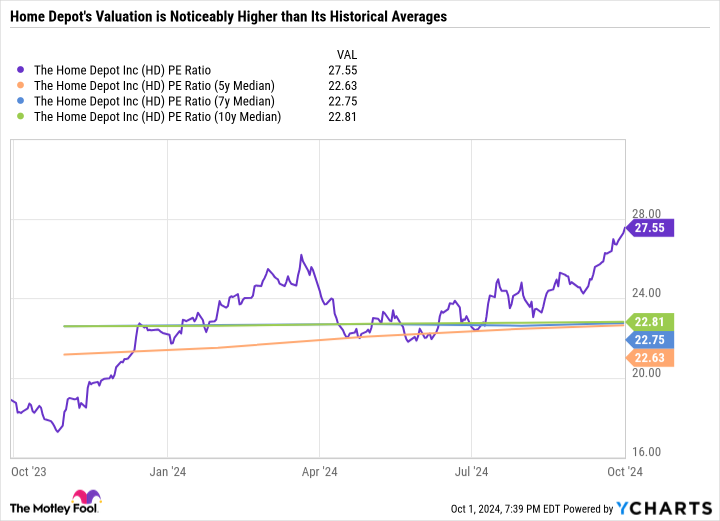

The two biggest factors likely driving Home Depot higher are that it was a cheap top dividend stock in an otherwise expensive market, and that lower interest rates could be a boon to the housing market, and in turn to the home improvement market. As you can see in the following chart, Home Depot’s price-to-earnings ratio was around the five-, seven-, and 10-year average, but has since risen in line with the higher share price.

Lower mortgage rates could spur an increase in consumer spending, which would help Home Depot’s future results. But it’s worth understanding that the rise in Home Depot stock isn’t based on what the company has done, but rather what it could do under more favorable economic conditions.

Given its expensive valuation, Home Depot is no longer an attractive buy. However, it could still be a good long-term buy and hold dividend stock.

The company has a proven track record of growing earnings and dividends at impressive rates and investing through the cycle. Home Depot made a massive $18 billion acquisition earlier this year, one of the largest in its history. This was done with the understanding that it might take some time for the move to bear fruit. There aren’t many companies that can make such an impact during an industry downturn.

With a 2.2% dividend yield, Home Depot could still be a good buy for investors who like the company’s strategic decisions and believe this could be a spiraling spring for a housing market recovery.

A healthier consumer would be excellent news for McDonald’s

In July, McDonald’s knocked on the door of a new 52-week low. Investors became concerned that the company was losing its pricing power and customers were increasingly seeking more affordable options. But McDonald’s is up nearly 20% over the past three months, hitting a new 52-week high.

This move could indicate that McDonald’s has turned the corner. But management is not confident about the company’s near-term prospects. People are still selective with their purchases, and lower interest rates are unlikely to change that behavior overnight.

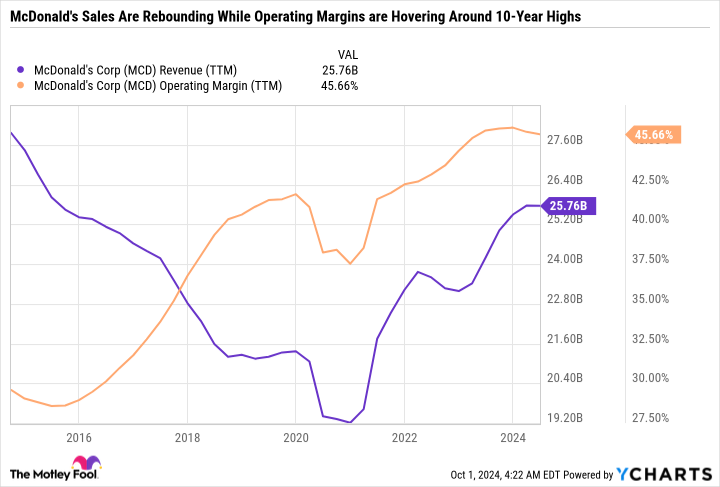

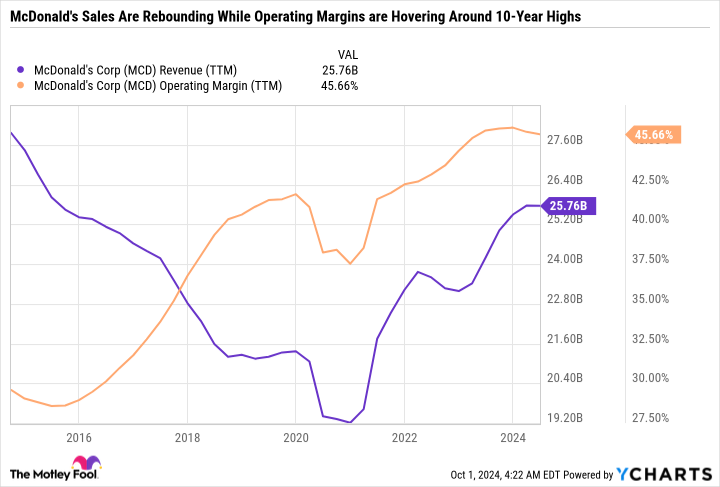

It’s also worth understanding that McDonald’s isn’t a company that should be valued using traditional metrics like price-to-earnings ratio, because only 5% of its stores are owned and operated by the company. The franchise business model can result in inconsistent revenue, so it’s better to look at McDonald’s revenue and operating margin over a longer period of time.

As you can see in the chart, McDonald’s sales have recovered from the pandemic lows, and the company has expanded margins, indicating it has plenty of room to cut prices if necessary, or expand promotions , like the $5 meal deal.

At McDonald’s, it appears that investors are taking an ultra-long-term view on the stock, looking at where the company will be in at least a year, rather than where it is today.

Another catalyst that could drive share price growth is China. China recently announced a stimulus package aimed at boosting economic growth and boosting consumer spending. Given its presence in the country, a potentially stronger Chinese economy is great news for McDonald’s.

McDonald’s is no longer the screaming buy it was a few months ago, but it still stands out as a worthwhile dividend stock to buy now. McDonald’s recently increased its dividend by 6% to $1.77 per quarter, or $7.08 per year – for a forward yield of 2.3%. That’s not a bad passive income source, considering the S&P 500 yields just 1.3%.

3 reasonable buys for long-term investors

Coca-Cola, Home Depot, and McDonald’s are three phenomenal companies that were bargains but have experienced significant increases in their stock prices in a relatively short period of time. Every time a stock makes a big move based on expectations, the company is put under pressure to deliver results or face a drop in share price.

While all three companies don’t offer as good a deal as they did earlier this year, they aren’t necessarily too expensive for investors looking for top dividend stocks. In fact, these are exactly the kinds of companies that investors can count on during a recession.

If you’re willing to invest in quality, it may be wise to evaluate all three stocks closely, keeping in mind that the current rally could cool off quickly.

Should You Invest $1,000 in Coca-Cola Now?

Before you buy Coca-Cola stock, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has and recommends positions in Home Depot and Nvidia. The Motley Fool has a disclosure policy.

Coca-Cola and these two red-hot Dow Dividend stocks are up 10% to 22% in three months, and could still be worth buying in October. originally published by The Motley Fool