Enterprise Product Partners (NYSE: EPD) has been a model of consistency for years and the second quarter results continue to demonstrate this. However, the company is working to take growth to the next level in the coming years through a number of growth projects.

Let’s take a closer look at the midstream company’s second-quarter results, distribution, long-term outlook and whether now’s a good time to buy the stock.

A consistent performer

The key to Enterprise’s success over the years has been consistency, which has allowed the pipeline company to grow its distribution despite the ups and downs of the energy market for 26 years.

For Q2, Enterprise saw its total gross operating margin increase nearly 11% to $2.4 billion. Its adjusted earnings before interest, taxes, depreciation and amortization ( EBITDA ) meanwhile rose 10% to nearly $2.4 billion.

It generated distributable cash flow of $1.8 billion and adjusted free cash flow (FCF) was $814 million. FCF was lower compared to a year ago as the company increased its capital expenditures (capex) for new growth projects.

Enterprise slowed its growth projects during the pandemic, but began ramping them up again last year. Projects naturally take time to build and scale, so the impact of this increased spending will grow over time.

The company plans to spend $3.5 billion to $3.75 billion on growth capex this year and another $3.25 billion to $3.75 billion next year, after spending about $3.5 billion in 2023. That compares with growth capex of just $1.4 billion in 2022.

It currently has $6.7 billion in projects under construction, most of which will be completed sometime in 2025 or later. The company also just announced that it will expand its Enterprise Hydrocarbons Terminal in the Houston Ship Channel. The project will add additional propane and butane export capabilities, with phase one of the project scheduled for completion in the second half of 2025 and phase two coming online in the first half of 2026.

Enterprise is very focused on export markets and this project will only add to its strong export position of liquefied petroleum gas (LPG). The company is also looking to enter the oil export market with its proposed Sea Port Oil Terminal (SPOT) project.

Over the past five years, Enterprise has averaged about a 13% return on invested capital, so these growth projects should deliver meaningful growth for the company in the coming years. At a similar rate of return, the roughly $10.5 billion in growth capex spent between 2023 and 2025 should translate into about $1.4 billion in incremental annual gross operating margin for the company. That would represent about 15% growth from the $9.4 billion in gross operating margin it generated in 2023.

Continued growth of distribution in the offing

Enterprise announced a quarterly distribution of $0.525 per unit for Q2. That was up 5% year over year and up 2% sequentially. The stock now has a forward yield of about 7.2%

In the quarter, the distribution coverage ratio was 1.6 times based on distributable cash flow, demonstrating that distribution is well covered.

It ended the quarter with 3x leverage. It defines leverage as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted EBITDA. This leverage is considered low in the midstream space given the strong cash flow generation of these businesses.

The company also spent $40 million buying back its own shares in the quarter. Enterprise has about $1 billion left of its $2 billion buyback plan.

With a strong balance sheet and robust coverage ratio, Enterprise appears well positioned to continue to steadily expand its distribution while increasing its capex to fuel future growth.

Is it time to buy the stock?

Enterprise has a long history as one of the most consistent performers in the midstream space and is only now starting to grow. It has one of the most attractive integrated systems in the U.S. and should benefit greatly from increased demand for artificial intelligence (AI)-related power consumption, as well as export demand.

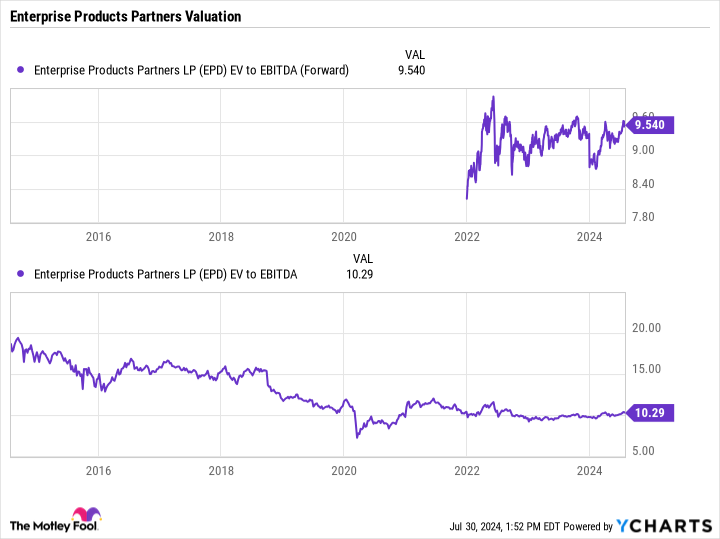

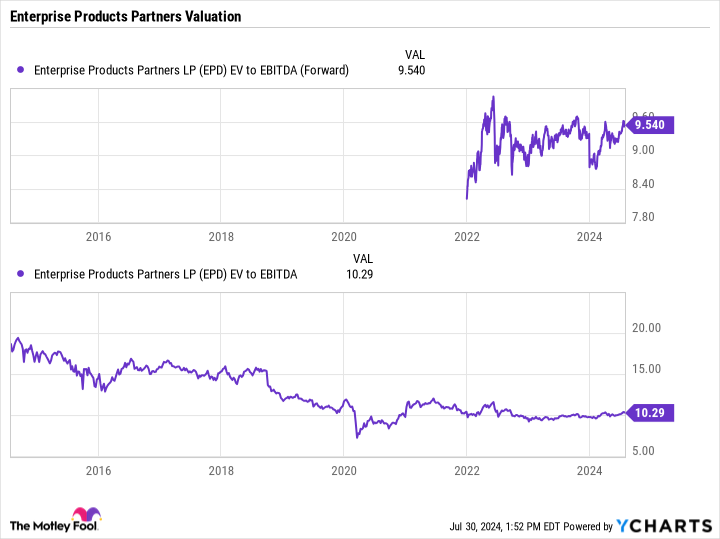

The company trades at a forward enterprise value-to-adjusted-EBITDA (EV/EBITDA) multiple of approximately 9.5. This compares with a trailing EV/EBITDA multiple of over 15 before the pandemic, while the midstream sector as a whole traded at a multiple of 13.5+ between 2011 and 2016, when companies were generally in poorer financial shape.

Note that midstream companies are often valued using an EV/EBITDA multiple because this takes into account debt levels and excludes non-cash depreciation.

Overall, now appears to be a good time to buy Enterprise shares, given its attractive valuation relative to historical levels, consistent performance over the years, and the growth the company is expected to experience in the coming years.

Should You Invest $1,000 in Enterprise Products Partners Now?

Before buying shares in Enterprise Products Partners, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $657,306!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Geoffrey Seiler has positions in Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Consistent Enterprise Product Partners Looks Poised to Kick Growth Up a Notch was originally published by The Motley Fool