(Bloomberg) — Underlying U.S. inflation is likely to moderate in April for the first time in six months, offering a glimmer of hope that price pressures will ease again after a series of upside surprises.

Most read from Bloomberg

The core consumer price index, which excludes food and fuel, rose 0.3% from a month earlier, after rising 0.4% in the first quarter. The Bureau of Labor Statistics will release its CPI report on Wednesday.

Compared to April 2023, the core CPI is expected to rise by 3.6%. While that annual increase would be the smallest in three years, it is still too fast to satisfy Federal Reserve policymakers, who want evidence that inflation is continually slowing as they debate the timing of rate cuts.

The headline CPI likely rose 0.4% for the third month in a row as gasoline prices hit a six-month high. While prices for core goods have largely fallen, underlying services costs remain high, explaining why inflation proved persistent in the first quarter.

Part of the Fed’s difficulty in pushing inflation back toward its 2% target lies with the resilient American consumer. Retail sales rose strongly in February and March, although economists’ forecasts for April suggest households were taking a breather. These figures will also appear on Wednesday.

On Tuesday, economists will analyze the government’s report on producer prices to assess the impact of categories such as health care and portfolio management that contribute to the Fed’s preferred inflation gauge: the personal consumption expenditures price index.

Other reports for the week ahead include home construction starts and industrial production for April.

Fed Chairman Jerome Powell will speak at an event for foreign bankers in Amsterdam on Tuesday. The Fed’s regional presidents, Loretta Mester of Cleveland and Raphael Bostic of Atlanta — both of whom will vote on policy this year — will also speak.

What Bloomberg Economics says:

“April’s core CPI report could look encouraging – we expect it to slow from March – but we see a significant chance that the month’s core PCE reading, a bigger concern for the Fed, remains robust could be.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For a full analysis, click here

Heading north, Canadian existing home sales data in April will reveal whether the spring market is heating up as buyers expect interest rate cuts. Data on the start of home sales, production and wholesale will also be released.

Elsewhere, figures on the strength of the Chinese and Japanese economies, wages data in Britain and the latest forecasts from the European Union will keep investors busy in the coming days.

Click here for what happened last week and below is our summary of what will happen in the global economy.

Asia

China will release a raft of data on Friday that is expected to show the second quarter has gotten off to a solid start, with growth in industrial production, retail sales and fixed asset investment accelerating year on year.

But the housing market slump will continue to pose risks, with property investment falling by more than 9%.

Japan’s economy is estimated to have contracted in the first quarter due to declining private consumption and business investment, as well as the first negative contribution from net exports in a year. These figures will appear on Wednesday.

According to Bloomberg Economics, growth is likely to rebound in the second quarter thanks to the recovery in auto production.

Malaysia will report gross domestic product figures on Friday.

Australian wage growth is likely to have risen slightly in the first quarter, with unemployment expected to rise to 3.9% in April.

Trade statistics are expected for Indonesia and Singapore, and the Philippines’ central bank is expected to keep its benchmark interest rate at 6.5% on Thursday.

Europe, Middle East, Africa

Britain will be in the spotlight with labor market data that could encourage policymakers to look for easing inflationary pressures.

According to economists’ average estimate, the average weekly wage, excluding bonuses, likely increased at an annual rate of 5.9% in the first quarter.

While still robust, the continued downward shift would cheer Bank of England officials, two of whom voted in favor of an immediate cut in borrowing costs on Thursday, while seven were in favor of no change.

In the aftermath of that decision, speeches from British policy makers will attract attention. Among them, the BOE’s chief economist, Huw Pill, will speak on Tuesday.

In the Eurozone, the calendar features several officials from the European Central Bank. Governors from the Netherlands, Germany, France and Italy will speak, among others. The ECB’s six-monthly review of financial stability will take place on Thursday.

Germany’s ZEW investor confidence rating on Tuesday will be a highlight in a quieter week for data. The final report on eurozone inflation in April will be published on Friday.

The Brussels-based European Commission will release economic forecasts for the region on Wednesday, including projections for growth, inflation, debt and deficits.

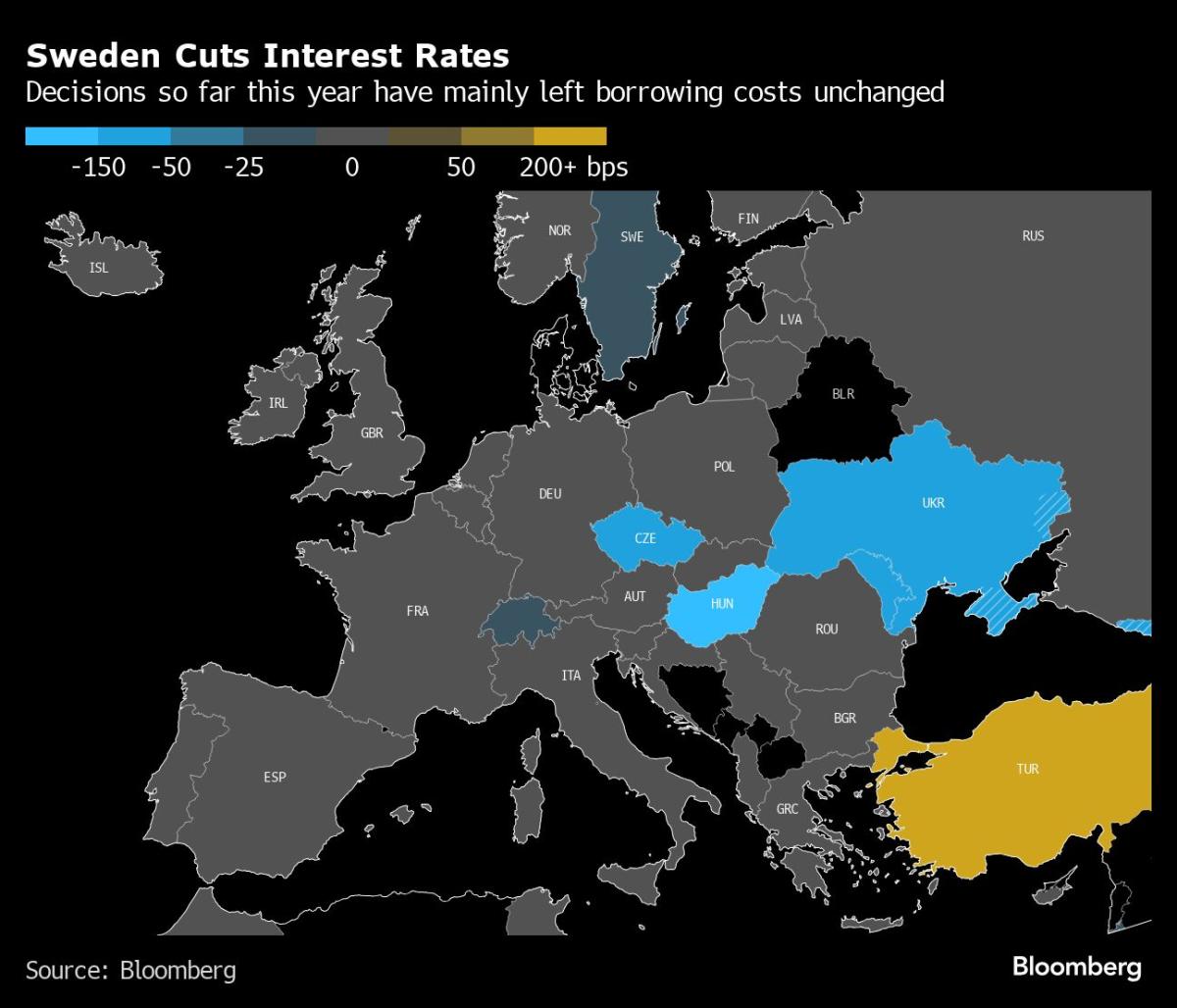

In Sweden, where the Riksbank cut rates on May 8 and has pledged more this year, the minutes of that decision will be released on Wednesday, along with the latest inflation figures.

GDP figures for Norway and Poland will be published next week.

Romania’s central bank may make its first interest rate cut in three years on Monday, as inflation there gradually declines. The country’s latest consumer price and growth figures will also be announced in the coming days.

Further east, Russian inflation is likely to have remained close to 7.7%, based on weekly data from the Ministry of Economy. Meanwhile, GDP figures could point to picking up growth in the first months of 2024.

Bloomberg Economics estimates that Russia’s economy grew at an annual rate of 5% in the first quarter, up from 4.9% in the previous three months, supported by war spending and consumer confidence.

Towards the south, Israeli inflation is likely to have fallen to 2.5%, further evidence that the country’s war against Hamas has had little impact on the rise in the cost of living.

In Nigeria, consumer price growth is forecast to have accelerated to over 34% in April, partly due to a three-fold increase in electricity prices for some urban consumers.

Elsewhere in Africa, two central bank decisions are in the pipeline:

-

Zambia’s policymakers are likely to raise key interest rates for the sixth consecutive time on Wednesday to support the kwacha, which is at a record low against the dollar.

-

Angola’s monetary authority could follow suit on Friday and raise the benchmark for the second time in a row to combat inflation, which is expected to continue rising as fuel subsidies are rolled back.

Latin America

The Colombian economy may have recorded modest growth in the first quarter, driven by stronger-than-expected output in February.

The central bank has raised its growth forecast for 2024 from 0.8% to 1.4%, while lowering its estimate for next year from 3.5% to 3.2%.

Figures on industrial production, manufacturing and retail trade, which have not shown positive figures for twelve months, are also available.

Brazil’s economy recovered at the end of the year and remained solid in the first two months of 2024. February’s GDP print was slightly better than expected thanks to a minimum wage increase and government income support to lower-income households.

Peruvian GDP figures for March may have lost some momentum after a higher-than-expected release in February.

The economy is expected to recover from the 2023 recession, but the damage has already been done: the number of Peruvians living in extreme poverty reached an 11-year high last year.

In Uruguay, inflation of 3.68%, well within the central bank’s target, could prompt policymakers to cut borrowing costs for the second time in a row from the current 8.5% on Thursday.

Argentine President Javier Milei’s so-called shock therapy for the country’s crisis-ridden economy is showing results on inflation.

Analysts now see a month-on-month print of 9% in April, down from the 13% forecast in January, with the year-end down nearly 66 percentage points at 161.3%.

–With assistance from Robert Jameson, Monique Vanek, Piotr Skolimowski, Paul Wallace, Tony Halpin and Brian Fowler.

Most read from Bloomberg Businessweek

©2024 BloombergLP