If you’re an investor who doesn’t yet have access to billions of dollars in capital, you can probably learn a thing or two from those who do. Fortunately, it’s not that hard to keep tabs on the world’s most successful investors.

Every three months, people who manage portfolios worth $100 million or more must report their trading activities to the Securities and Exchange Commission. A quick look at the latest disclosures shows that a handful of billionaire investors bought millions of shares of two dividend-paying stocks that currently offer ultra-high yields.

Shares of Pfizer (NYSE:PFE) And Annaly Capital (NYSE: NLY) offer returns that are several times higher than the average stocks in the benchmark S&P 500 Table of contents. Unfortunately, stocks rarely offer such high returns unless there is a good reason to worry about their ability to maintain their payout.

Let’s take a look at their recent performance to find out whether following the lead of billionaire fund managers makes sense for your portfolio.

Annaly Kapitaal

Annaly Capital is a real estate investment trust (REIT) that buys mortgage-backed securities (MBSes) instead of real estate. It makes its living from the margins between its short-term borrowing costs and the interest it earns from the hopefully higher-yielding MBS in its portfolio.

At recent prices, Annaly shares offer a stunning 13.6% yield. The huge yield attracts funds run by billionaires. Citadel Advisors, run by Ken Griffin, and Millennium Management, run by Israel Englander, bought shares in the first quarter.

Annaly Capital doesn’t own real estate, so it has to use its MBS portfolio to secure loans. It doesn’t happen often, but from time to time the value of its MBS can decline. When this happens, lenders demand more capital and the company can end up selling off parts of its portfolio at rock-bottom prices.

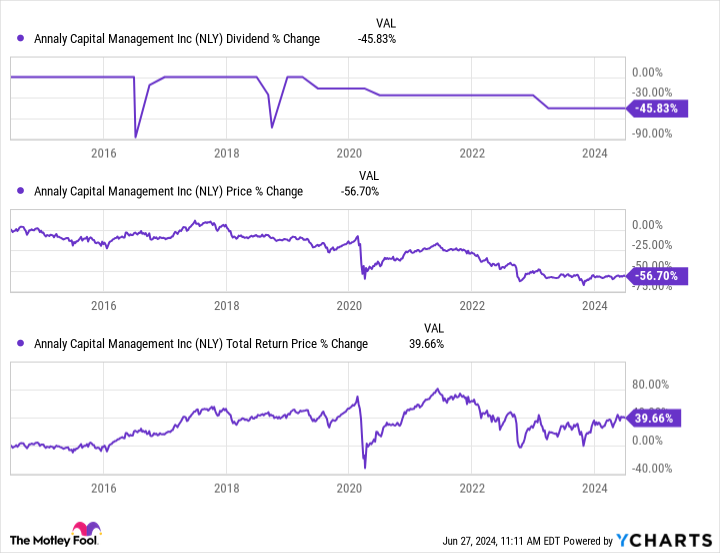

Before you start filling your portfolio with Annaly Capital stock, it’s important to realize that the company has cut its dividend by 45.8% since 2019. Investors who bought the stock and reinvested all the dividends have only gained about 39% over the past ten years. .

While there’s a good chance you can also make a profit by buying Annaly Capital now and holding it for the long term, the unpredictability of the dividend makes it a poor choice for most income-seeking investors.

Pfizer

In the first three months of 2024, Two Sigma’s John Overdeck and David Siegel bought 18.9 million shares of Pfizer. The stock has fallen by more than half since its peak in late 2021.

Pfizer has fallen as record sales of its COVID-19-related products evaporated faster than the market expected. But now that the worst is over, the stock looks like a great bargain.

Pfizer shares fell, but the company still increased its dividend payout last December for the 15th year in a row. The stock offers a yield of 6.2% at recent prices, which is about 4.6 times what you’d receive from the average dividend payer in the S&P 500.

At current prices, you can buy Pfizer for around 11.6 times forward earnings. That’s a fair valuation for a company that you expect to grow at a snail’s pace. A look at the drugmaker’s recent performance and outlook suggests that it will grow much faster than the market expects.

Pfizer reinvested mountains of COVID-19-related profits into new drugs, many of which are already on the market. Excluding COVID-19-related sales and the negative effects of a stronger U.S. dollar, sales in the first quarter rose 11% year-over-year.

Pfizer has the longest list of innovative new drugs in the pharmaceutical industry, and it is still growing relatively quickly. The FDA approved nine of the company’s new drugs in 2023, and they’re poised to fuel growth over the next decade. Adding a few stocks to a diversified portfolio seems like a relatively safe way for income-seeking investors to increase their passive income stream.

Should You Invest $1,000 in Annaly Capital Management Now?

Consider the following before purchasing shares in Annaly Capital Management:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

2 Extremely High Yield Dividend Stocks That Billionaires Are Buying Left and Right: Are These Smart Buys for You in July? was originally published by The Motley Fool