Gene editing, in which researchers manipulate patients’ genetic code to treat genetic diseases, has been around for decades. But it has made incredible strides in the past five years. CRISPR therapies (NASDAQ: CRSP)a mid-sized biotech company, has proven to be one of the most interesting players in this promising area.

The company’s progress hasn’t produced strong returns over the past five years — CRISPR Therapeutics has underperformed the market during that time. That said, there’s a lot to like about the biotech. It could even be a potentially millionaire-making stock. Here’s why.

Innovation pays off

Companies that turn shareholders into millionaires don’t happen overnight. It takes years — or decades — of solid performance. Some biotechs have succeeded. One thing they’ve had in common is their ability to develop breakthrough drugs fairly regularly, at least by industry standards, which can be once every five to 10 years.

Drugs that generate more than $1 billion in annual sales are a rare breed — and CRISPR Therapeutics will need to produce several of them in the coming years to become a millionaire. It’s already well on its way. The company was founded in 2013, had its initial public offering (IPO) in 2016, and last year received approval for Casgevy, a gene-editing treatment for two blood-related disorders: sickle cell disease and transfusion-dependent beta-thalassemia.

Casgevy, developed in collaboration with Vertex Pharmaceuticalshas undoubted blockbuster potential. The price in the US is $2.2 million. The total market that can be reached is about 35,000 patients in the US and Europe and another 23,000 in Saudi Arabia and Bahrain, where it is also approved. Moreover, although it will face competition from Blue Bird Biography In the US, there are no competing gene editing therapies in Europe and the Middle East.

It took about 10 years after CRISPR Therapeutics was founded to get approval for Casgevy, the first CRISPR-based gene editing therapy to be greenlit. The next breakthrough shouldn’t be so long in coming; the company has far more experience now than it did 11 years ago.

It also has more funding and five products in clinical trials. These include a pair of potential cancer treatments, two other therapies being investigated to treat various cardiovascular diseases, and one being developed as a potential therapy for type 1 diabetes. CRISPR Therapeutics has several more candidates in preclinical testing, not to mention a world of potential opportunities.

There are more than 7,000 rare diseases, affecting between 25 and 30 million Americans. CRISPR Therapeutics’ goal is to develop transformative gene-editing therapies, specifically where there is a high need — so there’s no shortage of potential targets.

There are no certainties

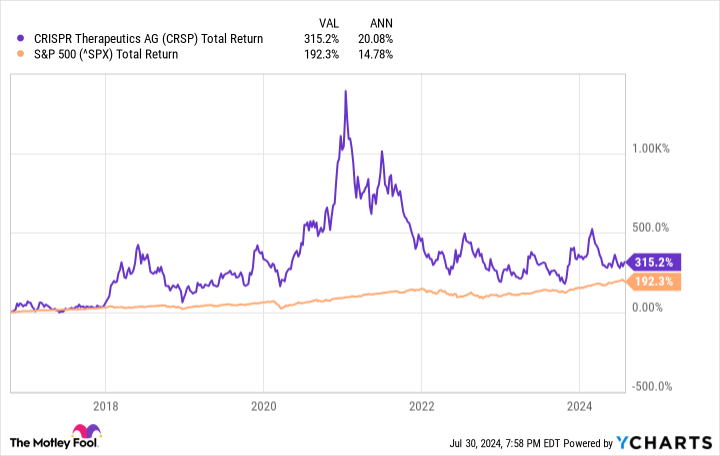

CRISPR Therapeutics stock has been crushing the market since its IPO, delivering an extraordinary 20.1% compound annual growth rate (CAGR). A lot has changed since then. The company is now a more mature, mid-cap biotech with a market cap of $4.79 billion, and generating these kinds of returns at these levels is harder; it will only get more challenging. Additionally, the market is less hospitable to unprofitable, growth-oriented stocks than it was in 2016 for a variety of reasons, including changing economic conditions (such as higher interest rates).

CRISPR Therapeutics is unlikely to produce a CAGR of more than 20% over the next decade, but it doesn’t need to do that to become a millionaire. The company could achieve this by shepherding its current programs through the clinical and regulatory maze that awaits before they can gain approval. The biotech should also turn a profit over the next five years or so — and maintain solid revenue and earnings growth thereafter — thanks in large part to the Casgevy windfall. And of course, its pipeline should yield brand new and exciting experimental gene-editing therapies.

If CRISPR Therapeutics can do enough of these things, millionaire-making status is well within reach. But there are also plenty of risks to consider, including the potential failure of its leading pipeline candidates.

So, what should investors do? In my opinion, CRISPR Therapeutics stock is worth buying and holding for a while. Its innovative potential and pipeline make it an exciting long-term option. Still, I’d suggest starting with a relatively small position, as a lot can go wrong with the company. There’s certainly huge millionaire potential here. But there’s also plenty of downside potential.

Should You Invest $1,000 in CRISPR Therapeutics Now?

Before buying shares in CRISPR Therapeutics, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and CRISPR Therapeutics wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $657,306!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends CRISPR Therapeutics and Vertex Pharmaceuticals. The Motley Fool recommends Bluebird Bio. The Motley Fool has a disclosure policy.

Prediction: CRISPR Therapeutics Stock Could Create Millionaires was originally published by The Motley Fool