On July 19, a defect in a software update from a cybersecurity specialist CrowdStrike (NASDAQ: CRWD) caused one of the largest IT failures in history. Around the world, flights were canceled, financial institutions were unable to process transactions and investors panicked.

At the time of the outage, CrowdStrike shares were trading near record highs. But less than a month later, the stock had already fallen more than 40%.

I don’t believe investors behaved irrationally. In its filings with the Securities and Exchange Commission (SEC), CrowdStrike’s own management says: “If our solutions… contained defects, errors or vulnerabilities, our brand and reputation would be harmed, which would negatively impact our company and business results.”

In short, the software had the defect and caused the failure. That’s why I believe so terribly It’s safe to say that CrowdStrike was at increased risk of reputational damage. Realizing this, investors behaved rationally by selling their positions in CrowdStrike stock.

But it could still turn out to be a wrong decision. If what CrowdStrike co-founder and CEO George Kurtz just said is true, then this cybersecurity company has already bounced back, almost as if nothing happened.

Is CrowdStrike’s reputation really still intact?

On September 17, Kurtz gave a presentation at the Fal.Con conference. And during his presentation, he casually noted, “Our pipeline generation has returned to pre-incident levels.” But there is nothing informal about this statement.

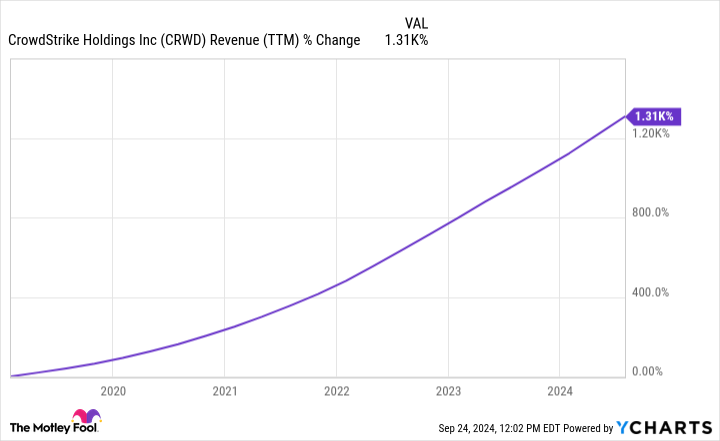

For context, CrowdStrike is an absolute powerhouse of a growth company. It grows by attracting new customers to its cybersecurity platform and by selling its customers one of its many cybersecurity products. With both growth engines running, revenue growth has been spectacular.

The downside to growth of this caliber is that investors have driven CrowdStrike stock to an expensive valuation; its shares traded at nearly 30 times trailing sales earlier this year.

Therefore, the IT outage created two problems for CrowdStrike shareholders. First, growth may have been hurt by customers switching providers or hesitating to sign new deals. Second, if growth were to slow, CrowdStrike’s premium valuation would fall, which would also drag the stock down.

However, according to Kurtz’s pithy statement, CrowdStrike’s company appears to have avoided long-term reputational damage. Investors can therefore breathe a cautiously optimistic sigh of relief.

Business as usual for CrowdStrike?

Sometime around 2030, CrowdStrike aims to generate more than $10 billion in recurring revenue annually. For perspective, the company had $3.8 billion in annual recurring revenue as of fiscal second quarter 2025.

CrowdStrike’s second quarter ended on July 31. It was therefore not clear at that time whether the incident on July 19 had caused any real disruption. But according to Kurtz, the pipeline of potential new deals is full and the company’s vision remains firmly fixed on the $10 billion target.

The company is not expected to report financial results again until the end of November. So investors should wait patiently for more signals about the company’s health. But according to Kurtz, CrowdStrike has already recovered from the IT outage. And if that’s really the case, then that’s extremely good news for long-term investors.

As for what could go wrong with a software company like this, CrowdStrike just endured a very bad scenario. I’ll stop calling it a worst-case scenario because a breach would be even worse. But causing a major disruption in a competitive field can ruin a company.

Still, CrowdStrike could overcome the short-term setback. If it can recover from this, CrowdStrike can likely bounce back from a lot of things in the future. And that’s why Kurtz’s comments about the company’s pipeline are very important to investors.

Should you invest $1,000 in CrowdStrike now?

Consider the following before purchasing shares in CrowdStrike:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in CrowdStrike. The Motley Fool has a disclosure policy.

CrowdStrike caused one of the largest IT outages ever. You will never believe what the CEO said is happening to the company now. was originally published by The Motley Fool