(Bloomberg) — Bets for more Ether profits are rising after a surprise twist in U.S. regulations to allow exchange-traded funds for the digital asset, even as questions arise about the strength of demand for the products .

Most read from Bloomberg

The shift by the U.S. Securities & Exchange Commission catalyzed a 26% jump in the second-largest token in the seven days through Sunday, the biggest weekly advance since 2021’s crypto bull market, data compiled by Bloomberg showed.

Read more: US Paves Way for Ether ETFs in Test of Demand Beyond Bitcoin

Speculators can take heart from January’s record-breaking debut of U.S. spot Bitcoin ETFs, which have amassed $59 billion in assets. But Ether is less well known than Bitcoin, making investor interest in exposure more difficult to analyze.

Additionally, spot Ethereum ETFs will not participate in staking, the process of earning rewards by pledging tokens to hold the Ethereum blockchain. The omission threatens to undermine interest in the funds compared to holding the tokens.

Further SEC approvals are needed before issuers like BlackRock Inc. and Fidelity Investments may launch products, for which the timeline is unclear. Ether rose about 1% to $3,900 as of 8:38 a.m. in London on Monday, while Bitcoin was little changed at $68,500.

“Risk in Ether remains on the upside and pullbacks are a buying opportunity,” Chris Weston, head of Pepperstone Group Research, wrote in a note.

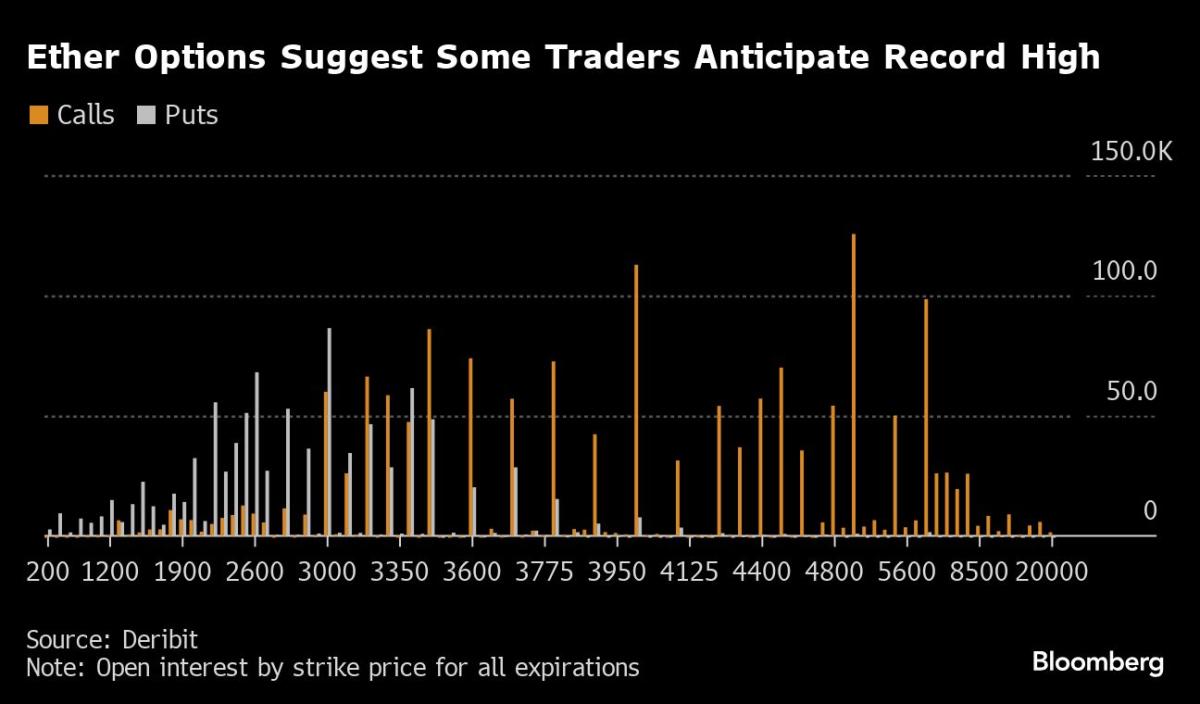

The charts below outline the scenarios for Ether after its 71% rise this year.

Bet on $5,000

The highest concentrations of bullish options bets indicate that some traders see Ether rising to $5,000 or even higher, according to figures from trading platform Deribit. The current spot Ether record is $4,866 from November 2021.

Volatility ahead

The gap between the T3 Ether Volatility Index – which uses option prices to provide a sense of expected 30-day swings in the token – and a similar measure for Bitcoin is about the widest since at least early 2023. That indicates that speculators expect greater expectations. fluctuations in Ether than in the largest digital asset.

Instructions on request

Some analysts see demand for futures hosted by Chicago-based CME Group Inc. as a window into the US institutional appetite for regulated cryptocurrency exposure. The level of open interest – or outstanding contracts – is increasing for CME Ether futures, but is much smaller than for CME Bitcoin futures, suggesting less institutional involvement in Ether and perhaps, by extension, the future Ether ETFs .

“The relatively low participation from the same institutions likely expected to flood into the Ether spot ETF at launch suggests that initial inflows could be disappointing,” wrote Noelle Acheson, author of the Crypto Is Macro Now newsletter.

Most read from Bloomberg Businessweek

©2024 BloombergLP