-

Diamond giant De Beers has seen its stock rise to $2 billionthe largest since the 2008 financial crisis, according to the Financial times. “It’s been a bad year for rough diamond sales.”

Falling demand for natural diamonds has helped push De Beers’ stock to $2 billion, the highest level since the 2008 financial crisis, the report said. Financial times.

In fact, the diamond giant’s value will remain hovering around $2 billion for much of 2024, the report said.

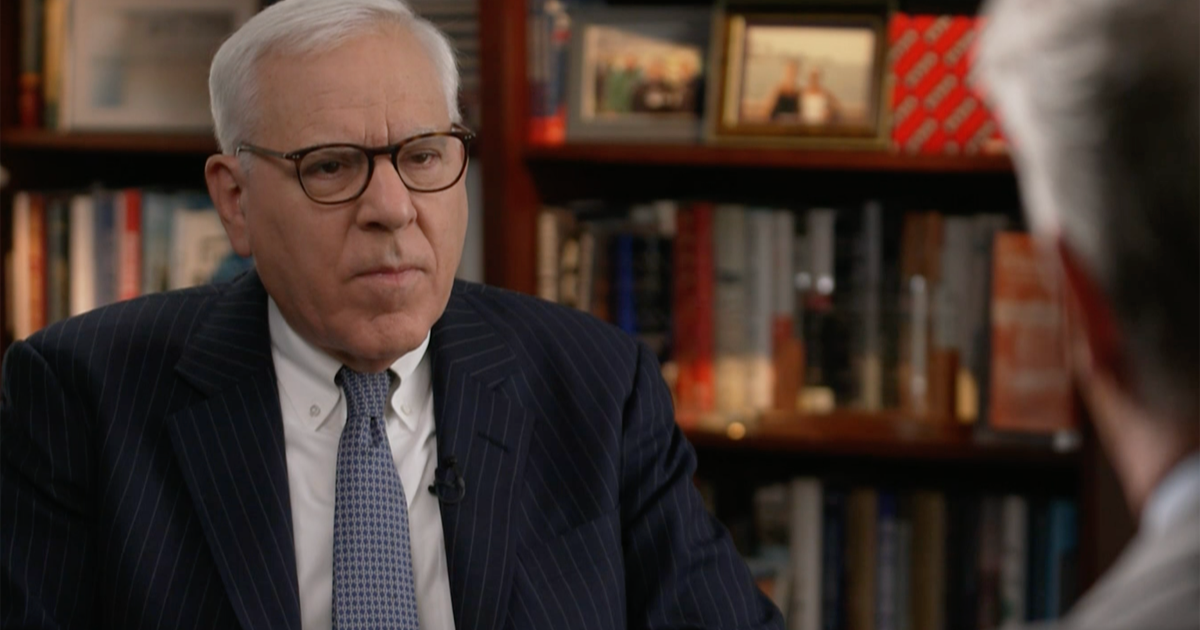

“It’s been a bad year for rough diamond sales,” CEO Al Cook told the newspaper FT.

De Beers did not immediately respond to a request for additional details about its inventory, including how much it was in previous years.

The company has faced several headwinds in recent years. China’s collapsing economy has put a major damper on the luxury sector, including the diamond sector. Generation Z’s preference for cheaper, lab-grown diamonds has driven down demand for natural stones. And the knock-on effects of COVID-19 were still reverberating, as weddings only returned to pre-pandemic levels earlier this year.

In the first half of 2024, De Beers’ sales fell about 20% compared to the same period a year ago, to $2.2 billion.

Meanwhile, parent company Anglo American announced plans earlier this year to spin off the company through a sale or an initial public offering.

The increased inventory comes as De Beers has doubled down on its retail segment, abandoned its own foray into lab-grown diamonds, cut production from diamond mines, launched a marketing campaign this fall and slashed prices.

CEO Cook is optimistic about a turnaround.

“Now that we are becoming independent, we have the freedom to focus on marketing as much as we do on mining,” he told the newspaper FT. “This feels like the right time for me to ramp up marketing and stand behind our brands and retail, even as we cut back on capital and expenditure on the mining side.”

But a recent report from McKinsey gave a more somber assessment, raising the possibility that lab-grown diamonds could take over, relegating the rest of the market to niche segments.

Alternatively, prices for lab-grown diamonds could fall so much that they become fashion accessories and no longer compete with natural rivals.

“On this point, assuming consumers cannot tell the difference between natural stones and LGDs, all diamonds could simply go out of fashion, lose their appeal and no longer be seen as a must-have for engagement rings,” it warned report.

This story originally appeared on Fortune.com