Companies nowadays generate mountains of data. That data can be of great value, but only if it is properly accessed, visualized and used to improve decision-making. However, often that data resides in different software systems, with different chunks tucked away in platforms that can’t communicate with each other, making it difficult to see the full picture. For example, a company may have a customer service database, business management software, a marketing platform, and more. Uniting the data from all these platforms into one system and mining the integrated result for actionable insights is Palantir‘S (NYSE:PLTR) specialty and why there is a demand for her services.

The Palantir Artificial Intelligence Platform (AIP) is the company’s latest innovation and is packed with potential.

Customers flock to Palantir AIP

Imagine a wholesale supplier experiences a severe weather event that affects one of its centers. Management needs to know the most efficient alternative methods of keeping its customers supplied, and what effect its choices will have on margins. Or perhaps you manage a company’s inventory level planning and need to know what impact a price increase or decrease will have on demand. Or you want to automate your payment processing to suppliers by unifying documents such as purchase orders, invoices and warehouse receipts. These are all use cases for Palantir’s AIP.

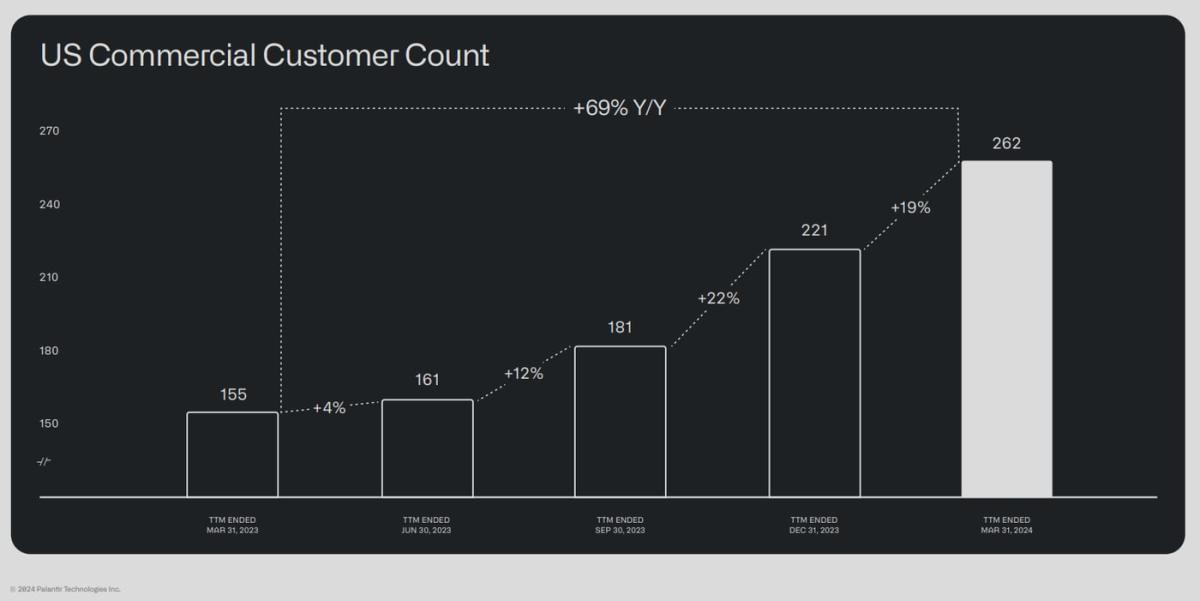

AIP uses large language models that allow its customers to ask questions in plain English and receive actionable answers. Selling a platform this complex is difficult. Researching use cases for other companies is useful, but it’s still difficult to visualize how a platform like AIP will work in a specific company. That’s why Palantir hosts “boot camps” where potential customers build use cases unique to their business in just a few days. These have proven to be a great tool for expanding Palantir’s customer base; the number of commercial customers in the US is exploding.

In the first quarter, that translated into a 40% year-over-year increase in U.S. commercial revenue to $150 million, and global commercial revenue growth of 27% to $299 million. Government revenue grew more slowly, at 16% to $335 million. Penetrating the commercial market will be critical to Palantir’s long-term success.

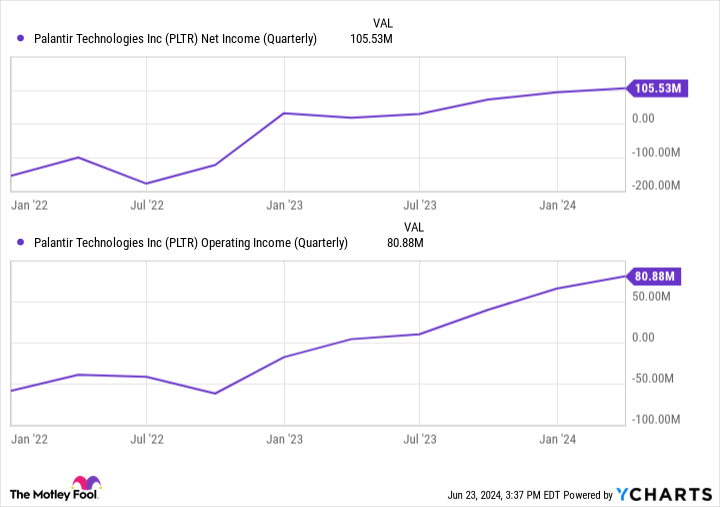

Total first-quarter revenue rose 21% year over year to $634 million, and Palantir increased its profitability. But not everyone is convinced.

Investigating the Palantir bear case

Palantir has a large following among retail investors and has sparked heated debates between bulls and bears in recent years. The company methodically discards many of the bear arguments. I’ll walk you through two of them.

First, many lamented the company’s continued unprofitability. This was a legitimate criticism, as the company had been making annual losses until 2023, when it became profitable. Palantir has posted net profits for the past six quarters and dramatically increased operating profit.

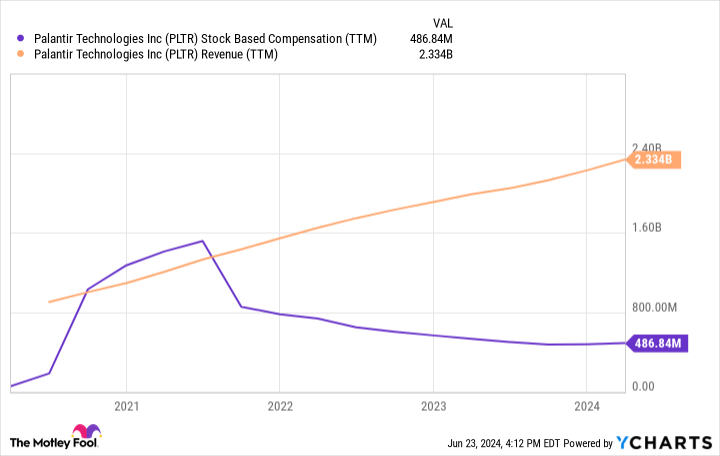

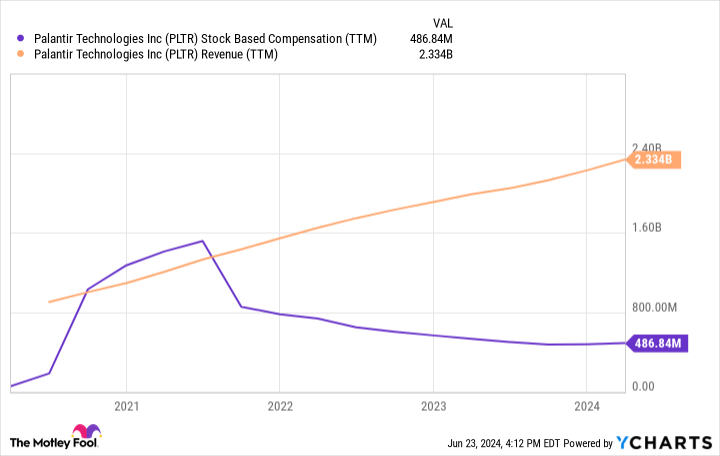

Second, Palantir pointed to the company’s extensive use of stock-based compensation to reward employees. The majority of such payouts typically go to top executives. However, the result of issuing a large number of new shares to pay your team is that the number of shares outstanding increases and the shareholders’ share of the pie decreases. However, Palantir has dialed back its stock-based compensation as revenues have increased.

Using stock-based compensation also helps companies preserve their money. Palantir ended the first quarter with $3.9 billion in cash and investments on its books and no long-term debt.

Is Buying Palantir Stock a Good Idea?

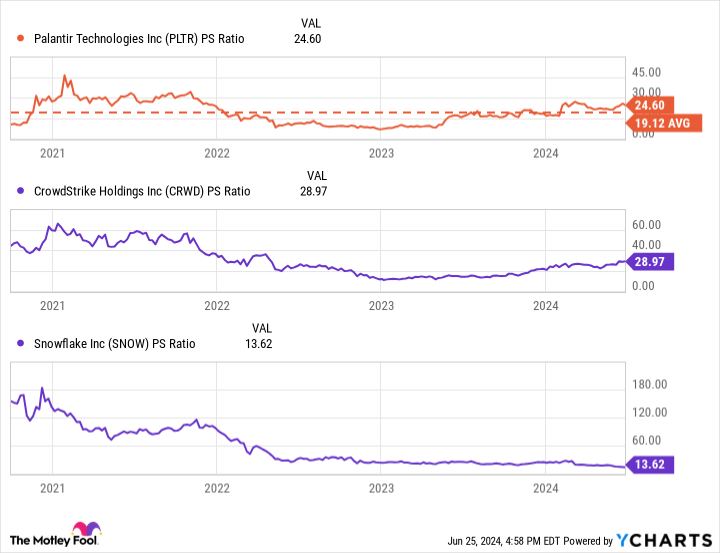

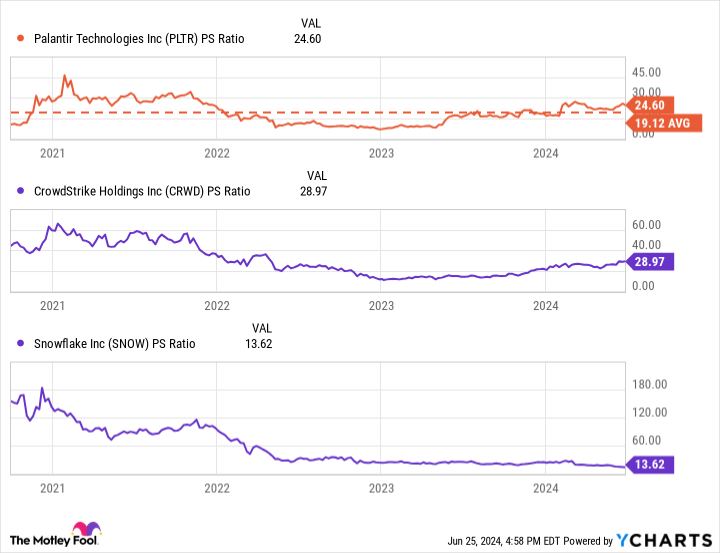

Another reason why some investors remain in the Palantir bear camp is its high valuation. The stock trades at almost 25 times current sales. That is a lower price-to-sales ratio CrowdStrike and a higher than Snowflake — both of which, like Palantir, are fast-growing software companies with a market cap of less than $100 billion.

The stock is also trading at a higher valuation than its historical average. However, Palantir is the most profitable of the three tech companies. Over the last four reported quarters, Palantir generated nearly $200 million in operating profit, compared to $24 million for CrowdStrike and a loss of $1.2 billion for Snowflake.

Investors can afford to be patient if they choose to buy Palantir stock. The best strategy would be to build your stake gradually and steadily so that you can profit from any price declines that may occur. A dollar-cost averaging strategy can reduce the short-term risk of investing in high-priced stocks.

Palantir has established itself as a leader in data and artificial intelligence management. Although the valuation is high, profits are growing and the company is in a strong financial position to excel in the long term.

Should You Invest $1,000 In Palantir Technologies Now?

Before you buy shares in Palantir Technologies, you should consider the following:

The Motley Fool Stock Advisor analyst team just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $759,759!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the performance of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Bradley Guichard has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.

Palantir’s Untapped Potential: Decoding the AI Stock’s Long-Term Value for Strategic Investors was originally published by The Motley Fool