Much of the ongoing discussion about artificial intelligence (AI) revolves around the ‘Magnificent Seven’ stocks. Over the past eighteen months, major tech has made a series of high-profile multi-billion dollar investments in AI initiatives.

The leading companies in the Magnificent Seven include Nvidia And Amazon (NASDAQ: AMZN). While Nvidia appears to have strong momentum in all facets of the AI arena, I wouldn’t overly appreciate the company’s dominance.

Let’s take a look at what’s driving Nvidia’s growth right now, and explore how Amazon can leapfrog the company in the long run.

Nvidia is the AI chip leader, but…

Nvidia designs advanced semiconductor chips called graphics processing units (GPUs). GPUs have a variety of applications ranging from training large language models, machine learning, autonomous driving and more.

In addition to the technology sector, generative AI also has applications in healthcare. Nvidia’s GPUs are even used by leading pharmaceutical companies such as Novo Nordisk — the maker of Ozempic and Wegovy.

Unsurprisingly, Nvidia’s extensive reach has helped the company amass a staggering 80% share of the AI chip market.

While it may seem like Nvidia’s lead is insurmountable, keep in mind that the AI revolution is still in its early stages. While Amazon may be looking back, I’d say the company is just pacing and preparing for a marathon-style race.

…some in big tech are making their own moves

The AI startup scene is absolutely crowded. One of the most notable players is a machine learning company called Hugging Face, a unicorn with bragging rights Sales teamAmazon, Google, Nvidia, Intel, Advanced micro devices, QualcommAnd IBM as investors.

Do you notice anything about that investor syndicate? Many of them are chip companies or cloud computing specialists.

Conveniently enough, Amazon has both. In addition to Amazon Web Services (AWS), Amazon is developing a range of training and inference chips. These chips, aptly named Trainium and Inferentia, ignite new sources of growth for AWS as cloud computing becomes increasingly competitive.

Additionally, Hugging Face recently announced that it is partnering with AWS to deploy workloads on the latest version of Inferentia. I see this as a big win for Amazon, and it ultimately serves as a springboard for the company to move away from its reliance on Nvidia products in the long run.

Another way Amazon is starting to build some momentum is through its $4 billion investment in another AI startup, Anthropic. Like Hugging Face, Anthropic trains its generative AI models on Amazon’s Trainium and Inferentia chips and also uses AWS as its primary cloud provider.

If this isn’t enough to portray Amazon as a serious competitor in the AI space, consider the company’s planned $11 billion investment in data center construction. While Nvidia also competes in the data center space, companies like Amazon and Oracle have their own plans.

Is this a good time to invest in Amazon stock?

Right now, Amazon’s stock is trading for around $179 per share. This is quite close to the company’s all-time high of $189.

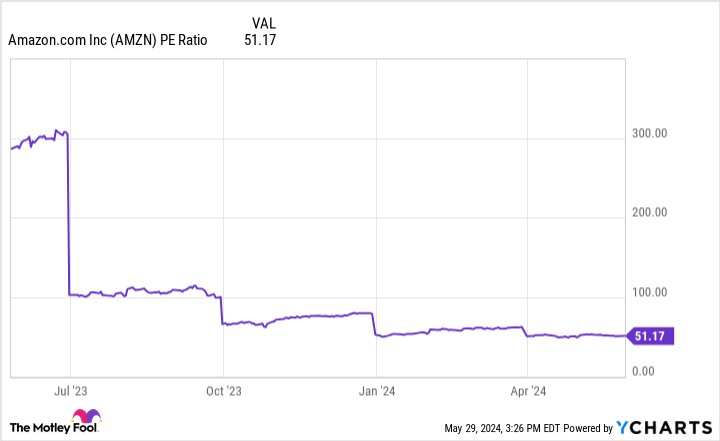

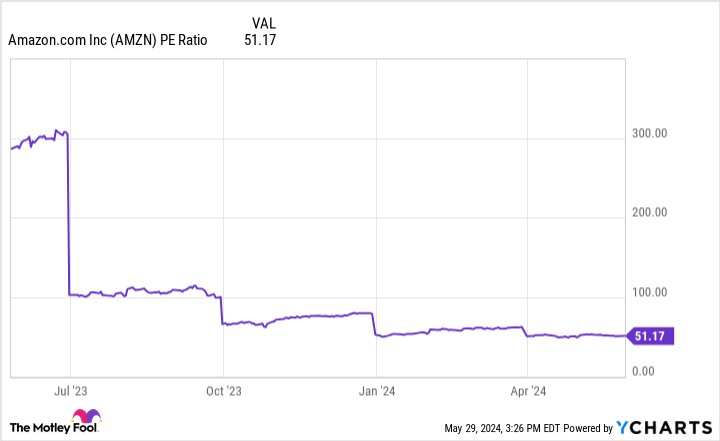

With that in mind, you might think that Amazon stock is expensive. However, the graph below indicates otherwise.

Over the past twelve months, Amazon’s share price is up about 50%. In contrast, the company’s earnings per share (EPS) over the last twelve months are up 181%.

Because the company’s earnings growth is accelerating more than its stock price, Amazon’s price-to-earnings ratio is de facto decreases year after year. This means that even though the stock price is at an all-time high, Amazon is technically cheaper today than it was last year.

I think Amazon is undervalued when it comes to AI. The company is investing aggressively and is already creating new momentum. I suspect the steps the company is taking today will pay off over time and give Amazon some flexibility over the competition.

To me, Amazon stock is dirt cheap and represents an attractive long-term opportunity in the AI space. While Nvidia will likely remain the poster child for AI in the short term, I think Amazon is making some smart chess moves that will ultimately put it in a superior position in the long term.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions at Amazon, Novo Nordisk and Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices, Amazon, Nvidia, Oracle, Qualcomm and Salesforce. The Motley Fool recommends Intel, International Business Machines, and Novo Nordisk and recommends the following options: long January 2025 $45 relying on Intel and short May 2024 $47 relying on Intel. The Motley Fool has a disclosure policy.

Did Amazon Just Say ‘Checkmate’ to Nvidia? was originally published by The Motley Fool