C3.ai (NYSE:AI) is a polarizing artificial intelligence (AI) stock. There was a lot of excitement in early 2023, but that has since evaporated as the stock is more than 30% below 2023 highs. However, in April that figure was only 55%, so the stock is gaining. some enthusiasm again.

Part of that is C3.ai’s achievements, as some parts of its business are starting to prove doubters wrong. But is this enough to convince more investors to buy this stock?

Demand for C3.ai’s products is increasing

C3.ai has evolved quite a bit as a company since its founding in 2009. It has gone from an energy management company to an Internet-of-Things (IoT) to an AI applications company. The latest shift, however, involves generative AI, which management believes will “change everything.”

The company provides ready-made AI models that can be deployed in common situations across many industries. This is an attractive proposition for many companies because they don’t have to hire software engineers to develop custom models. One of C3.ai’s largest emerging customers is the U.S. government, which accounted for nearly half of the company’s bookings in the fourth quarter of fiscal 2024, which ended April 30.

In the earnings press release, management said, “The interest we are seeing in our generative AI applications is astounding.” This supports what other AI companies like Palantir Technologies have said, and it bodes well for the future of C3.ai. But even now, C3.ai seems to be turning over a new leaf.

Great growth, but far from break-even

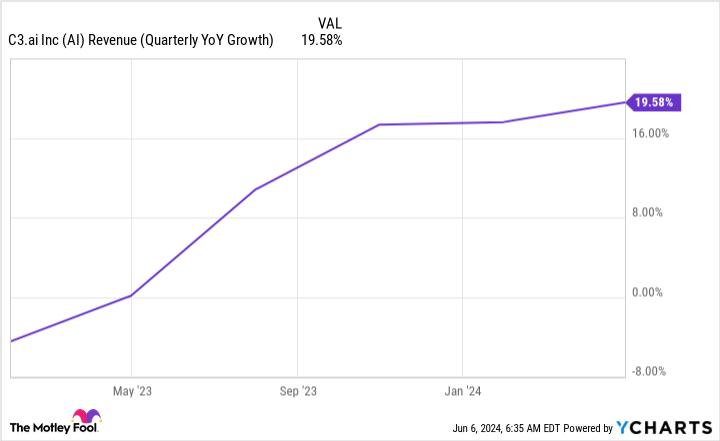

In the fourth quarter, revenue rose 20% year over year to $87 million. That’s a solid growth acceleration compared to previous quarters and a good sign for growth investors.

But the fourth quarter won’t be C3.ai’s peak. Management has also issued fantastic guidance, expecting the first quarter of fiscal 2025 (ending July 31) to be approximately $87 million, indicating 20% growth. For the full year, the company expects approximately $383 million, which would represent 23% year-over-year growth. Management clearly expects revenue growth to accelerate even further after the first quarter, which is music to investors’ ears.

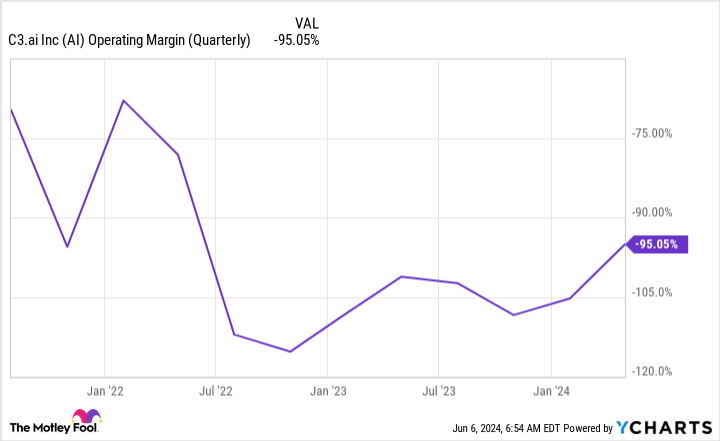

However, there is a downside to C3.ai stock. The company is one of the most unprofitable companies in the software industry. Although it generated nearly $87 million in revenue in the first quarter, the cost of those revenues was $35 million and operating expenses were $134 million. All told, that gave C3.ai an operating loss margin of 95%, meaning it would take at least double its current revenue to break even without increasing expenses.

That’s not great for investors and continues a trend of deep unprofitability. It could take years to get out of a hole this deep, and some investors aren’t patient enough to wait for C3.ai to flip the profitability switch.

There is one piece of hope, though: C3.ai is a small company. Quarterly revenue was only $87 million, which is quite small compared to other AI software companies like Palantir. As a result, the high unprofitability is a side effect of the company’s desire to capture as much market share as possible. While I’m not a fan of its unprofitability, this makes it somewhat palatable.

So, do I buy the shares? Not at this moment. I’m not a fan of the high losses at C3.ai’s current growth level. If C3.ai were to double its revenue year over year, I’d be willing to look past it. However, C3.ai is a much more attractive stock than it was a few months ago, thanks to strong guidance and revenue acceleration. It’s starting to emerge as one of the top AI picks and could (for me) even enter buy territory after a few quarters of solid growth and improving profitability.

Should you invest €1,000 in C3.ai now?

Before purchasing shares in C3.ai, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Keithen Drury has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Palantir Technologies. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

Did C3.ai just become a top artificial intelligence (AI) stock to buy? was originally published by The Motley Fool