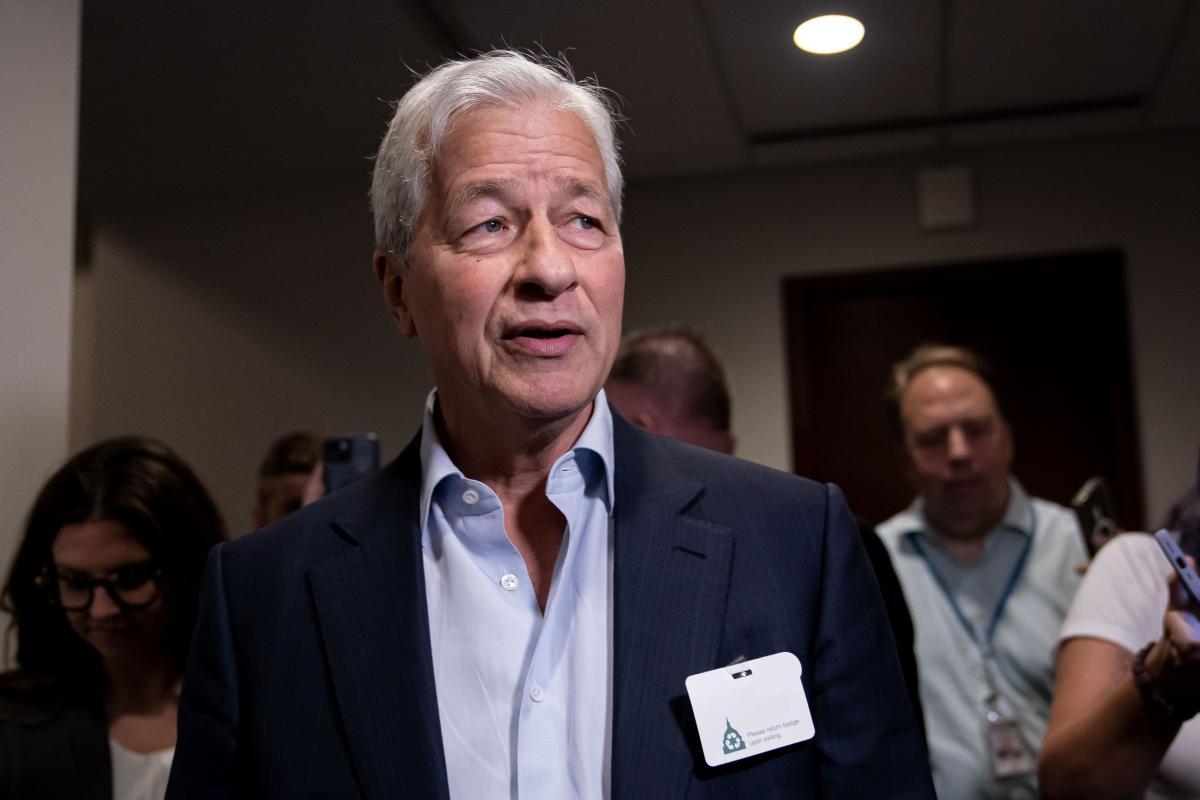

(Bloomberg) — Jamie Dimon said he expects problems to emerge in the retail lending space and warned that “there could be hell,” especially as retail clients gain access to the booming asset class.

Most read from Bloomberg

“Do you want to give retail customers access to some of these less liquid products? The answer is: probably, but don’t pretend there’s no risk involved,” said the CEO of JPMorgan Chase & Co. Wednesday at an industry conference. “Retail customers tend to go out and call their senators and congressmen.”

JPMorgan and other lenders are competing with the $1.7 trillion private credit industry, with giants like Apollo Global Management Inc. entering into bigger and bigger deals. But the banks have been trying to make their own ground: Dimon’s company has earmarked more than $10 billion of its own balance sheet for direct lending and is setting up a partnership. The asset manager is also on the hunt for a private credit company, Bloomberg reported last week.

Dimon said Wednesday that his company aims to be product agnostic in its lending to customers, and that his company also banks many of the major private lending stores. Some in the industry are “brilliant,” he said, but not all, and problems in the market are often caused by the “not good.”

The longtime CEO wrote in his annual letter to shareholders that the private credit sector has not yet been tested by bad markets, which tend to expose the “weaknesses of new products.”

“I’ve seen a few of these deals that have been rated by a rating agency, and I have to admit, it shocked me what they got,” Dimon said Wednesday. “It reminds me a bit of mortgages.”

Read more: JPMorgan looks to grow private credit institutions in ‘hot sector’

Most read from Bloomberg Businessweek

©2024 BloombergLP