There are plenty of investors who dream of hitting a home run with stocks in their portfolio (in this case, a home run is defined as a stock that doubles or more after buying shares) in less time than the market average. The broader market averages an annualized return of roughly 10% over time, meaning doubling your money is about seven years average.

These “home run” investment opportunities are hard to find, but they are out there and don’t require investors to take too bold risks. Three Motley Fool contributors were asked to make suggestions on potential homerun growth stocks and got it Metaplatforms (NASDAQ: META), Now Holdings (NYSE: NOW)And SentinelOne (NYSE:S). All three have a 100% future investment benefit.

Here’s what you need to know about each.

Investing in companies with high switching costs is a great way to double your money

Jake Lerch (metaplatforms): For investors looking to double their money, Metaplatforms has already shown its potential to do so many times. Only in the past 18 months has Meta stock done that more than tripled in value. That’s because Meta has become one of the best companies in the world at turning revenues into profits and profits into shareholder returns.

Over the past twelve months, Meta generated a whopping $143 billion in revenue. Of that $143 billion, the company posted $46 billion in net income — a profit margin of 32%. Meta used some of that net income to make strategic buybacks Last year, shares were worth $25 billion, effectively reducing the number of shares outstanding by 1.4%. These buybacks strengthen the value of the remaining shares on the market. In addition to the share price increase, Meta is now also paying a quarterly dividend, a move that diversifies shareholder returns and increases the attractiveness of its shares to a broader investor base.

Considering the size of its operations, Meta’s user base is huge, at over 3.2 billion active people using the platform every day – you would think the continued growth would slow down. However, the company remains well positioned to stay in business the revenue stream grows and profits increase. One reason is that the platforms (Facebook, Instagram and WhatsApp) benefit from higher switching costs. Social media platforms come with high switching costs, as many users spend years – even decades – refining their preferences in these social media networks. They follow the feeds of family, friends, acquaintances and celebrities; they seek out hobbyist communities and local businesses.

It is difficult to recreate that established network elsewhere. This can be a long process and most people are unwilling to start from scratch. That gives the established network an edge and makes Meta likely to stay. For investors looking to double their money, this gives Meta an advantage in its growth efforts.

Growth investors should no longer overlook this Brazilian fintech

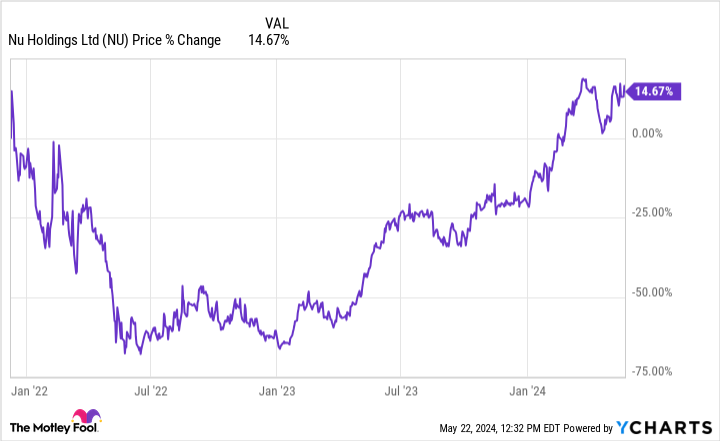

Will Healy (Now Holdings): This Latin American digital banking stock should do just that at least to double in value in the coming years, and not just because the value has increased by more than 80% in the past year.

Granted, parent company NuBank isn’t on the radar of most U.S. investors. Although Warren Buffett’s team at Berkshire Hathaway has a position, the company is largely unknown in the US, and winning with the stock requires investors to understand a different financial culture.

Unlike the US, Latin America remains a predominantly cash-based society, where hundreds of millions of adults do not have a bank account or credit card. NuBank, the largest digital banking platform outside Asia, is changing that. In one year, almost 6 million Brazilians obtained their first credit card through Nu, adding them to the credit market. Now has just surpassed 100 million customers. At the end of the first quarter of 2024, 92 million of these customers were in Brazil, representing approximately 54% of the country’s adult population.

To continue its rapid growth, Nu has expanded into Mexico and Colombia. The company has more than 900,000 Colombian customers. Additionally, it added 1.5 million customers in Mexico in the first quarter alone, bringing the total to more than 6.6 million. Such successes indicate that the business model is working in more than one country.

Naturally, the financial figures reflect this growth. Sales were $2.7 billion in the first quarter, an annual increase of 69%. Operating costs rose just 48%, allowing net profit to rise to $379 million, compared to $142 million in the same quarter last year.

Furthermore, with the aforementioned gains over the past year, the fintech stock has bounced back from an ill-timed IPO in late 2021.

Despite Nu’s rising share price, investors are probably not too late. The price/earnings ratio is around 45, a low level considering the enormous growth. Furthermore, a doubling in share price could be just the beginning for Nu Holdings as the company looks to repeat its success in Brazil in other countries as well.

SentinelOne’s small size but cutting-edge technology makes it a sensible bet for a doubles match

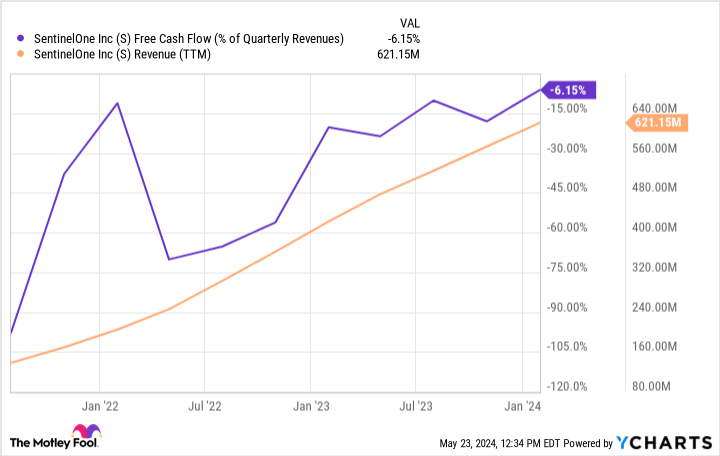

Justin Pope (SentinelOne): Cybersecurity stock SentinelOne was a pretty easy pick. Cybersecurity is critical to businesses and will likely become even more important as artificial intelligence (AI) and other technologies draw more companies to the cloud. According to research from Spherical Insights, the global cybersecurity market will grow at double-digit annual rates to a $501 billion market by 2030. Today, SentinelOne’s trailing-twelve-month revenue is just $621 million, less than one percent of that.

How will SentinelOne make its presence felt? Well, it’s already starting. SentinelOne uses AI to run its security platform. It proactively looks for potential threats and often addresses them before they become a problem. Multiple third-party companies and testing agencies have praised SentinelOne’s technology. The company has also aggressively expanded beyond its core endpoint security market, launching products to secure data warehousing, cloud and identity. It is also launching generative AI features to improve its existing products.

The new products are delivering some of the best revenue growth you’ll find on Wall Street. Revenue grew 38% year-over-year last quarter, and SentinelOne’s profit margins are rapidly improving and moving toward profitability as the company grows.

Ultimately, SentinelOne is a small (but sophisticated) player in a huge market. The company is worth ‘only’ $6 billion in enterprise value and is trading at its lowest valuation since its IPO. Strong revenue growth, a cutting-edge AI-powered product, and eventual earnings should push the stock to potentially double or more from current levels. It is impossible to predict when this will happen, but it is clear that there is still a lot of room to rise further from here. That could mean big things for investors’ portfolios.

Should You Invest $1,000 in Meta Platforms Now?

Before you buy shares in Meta Platforms, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Jake Lerch has no position in any of the stocks mentioned. Justin Pope has positions in SentinelOne. Will Healy has positions in Berkshire Hathaway and Nu Holdings. The Motley Fool holds positions in and recommends Berkshire Hathaway and Meta Platforms. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

Do you want to double your money? Start with these 3 popular growth stocks. was originally published by The Motley Fool