Lam Research (NASDAQ:LRCX) recently made two major announcements. First, it approved a 10-to-1 stock split, due on October 2. This will be the third stock split after the 3-for-2 split in 1993 and the 3-for-1 split in 2000.

Second, Lam approved a $10 billion buyback plan, with no end date. CFO Doug Bettinger said the buyback would be consistent with its “plan to return 75% to 100% of free cash flow to shareholders” through dividends and buybacks.

Lam’s shares rose slightly on the news, but the shares are already up about 64% in the past 12 months and are trading just 3% below their all-time high. Does the upcoming stock split and new buyback plan make the shares worth buying?

Why did investors become bullish on Lam?

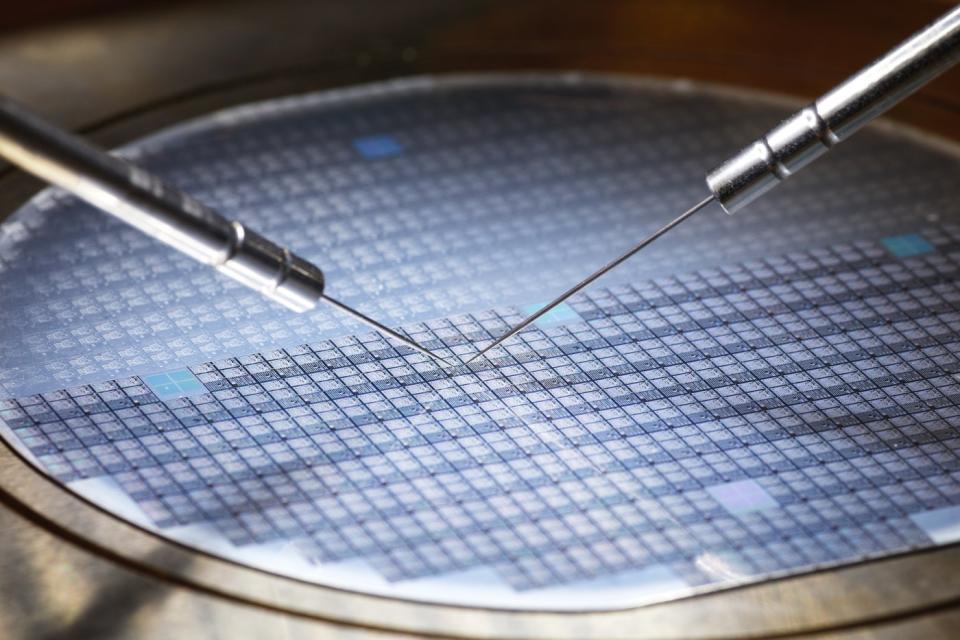

Lam Research is one of the world’s largest manufacturers of wafer fabrication equipment (WFE) for silicon wafer production. It is widely regarded as one of the cornerstones of the semiconductor industry ASML.

At first glance, Lam’s growth figures don’t seem impressive. In fiscal 2022 (which ended in June 2022), revenue and earnings per share increased by 18% and 22%, respectively. But in fiscal 2023, revenue and earnings per share both rose about 1%.

Like many other semiconductor equipment makers, Lam’s growth slowed as PC shipments fell in a post-pandemic market, the 5G upgrade cycle ended and US regulators blocked exports of higher-priced chips to China. Rising interest rates, geopolitical conflicts and other macroeconomic headwinds exacerbated those pressures.

For fiscal 2024, analysts expect revenue and earnings per share to fall 15% and 13%, respectively, as the slowdown continues. But on a sequential basis, Lam’s revenues and profits started growing again last year as margins widened.

|

Metric |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|---|---|---|---|---|---|

|

Sales growth (QOQ) |

(27%) |

(17%) |

9% |

8% |

1% |

|

Gross profit margin adjustment |

44% |

45.7% |

47.9% |

47.6% |

48.7% |

|

Operational margin adjustment |

28.3% |

27.3% |

30.1% |

30% |

30.3% |

|

EPS Growth (QOQ) |

(35%) |

(14%) |

15% |

10% |

4% |

Data source: Lam Research. QOQ = Quarter over quarter.

For the fourth quarter, Lam expects revenue to increase less than 1% sequentially, with an adjusted gross margin of 47.5% and an adjusted operating margin of 29.5%. It expects adjusted earnings per share to remain broadly flat sequentially.

Lam is not out of the woods yet, but appears to have reached his cyclical low. That’s why analysts expect revenue and earnings per share to rise 18% and 21%, respectively, in fiscal 2025. But at 27 times forward earnings, much of that recovery has already been factored into valuations. The low dividend yield of 0.8% will also not impress serious investors.

So what about Lam’s stock split and $10 billion buyback?

Lam’s 10-for-1 stock split could make the stock more attractive to smaller retail investors, increase trading volume through the options market and make it easier for employees to participate in the stock plans. But it doesn’t change the fundamentals or valuations; it cuts just a single piece of the cake into ten smaller pieces.

The $10 billion buyback is more significant because it is equivalent to almost 8% of Lam’s current market capitalization of $126 billion. However, Lam is under no obligation to actually repurchase all those shares, and no expiration date has been set for the plan. In other words, investors should simply trust Lam’s judgment when executing opportunistic buybacks.

Still, Lam’s previous buybacks were well timed. Over the past decade, it has bought back almost a fifth of its shares, while the stock rose about 1,350%. Over the past five years, it has bought back nearly 10% of its shares as the stock rose more than 430%.

Prior to the latest $10 billion buyback authorization, Lam approved a $5 billion buyback plan in May 2022 (with no end date). By the end of the third quarter of fiscal 2024 (which ended March 31), Lam had repurchased $3.8 billion. in shares under that plan. Therefore, we can assume that Lam will continue to actively buy back more shares every quarter.

Are Lam’s shares worth buying now?

Lam’s growth is likely to accelerate in the coming quarters as the semiconductor market stabilizes. The shares aren’t cheap, but continued buybacks should tighten valuations and consistently boost earnings per share. The stock split could also create more retail buzz for Lam, even if it won’t actually change underlying valuations.

Lam Research isn’t an exciting growth scenario, but it will heat up again as the PC market recovers, new smartphones arrive and the growing AI market drives more companies to upgrade their data center chips. The $10 billion buyback is just a sign that there is room to operate. So it’s not too late to buy the high-flying stocks.

Should you invest $1,000 in Lam Research now?

Before purchasing shares in Lam Research, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Leo Sun has positions in ASML. The Motley Fool has positions in and recommends ASML and Lam Research. The Motley Fool has a disclosure policy.

Does Lam Research’s $10 billion buyback make its shares worth buying? was originally published by The Motley Fool