The stock market has not rewarded Micron technology (NASDAQ: MU) enough for the excellent growth it is showing in 2024, as evidenced by the 26% rise in the memory specialist’s shares so far this year.

It’s also worth noting that Micron shares are down nearly 30% since hitting a 52-week high two months ago. However, that’s good news for savvy investors looking to add to a company that’s well-positioned to capitalize on the burgeoning adoption of artificial intelligence (AI) hardware across multiple end markets, such as data centers, smartphones and personal computers (PCs).

Below you can read more about the reasons why buying Micron Technology seems like a logical choice right now.

Micron Technology could sustain its impressive growth in the long term

The memory industry that Micron Technology operates in has historically been a cyclical industry, going through boom and bust cycles based on supply-demand dynamics. In the past, when demand for memory chips increased, chipmakers like Micron would typically increase production to meet it. However, a drop in demand meant they were left with more supply, leading to a sharp drop in prices that crushed their revenues and margins.

The good news is that the memory industry’s boom and bust cycles are likely over. Grand View Research estimates that the annual revenue of the global memory market could grow from $111 billion in 2024 to $240 billion in 2030. AI is poised to play a major role in the growth of this market, as demand for high-bandwidth memory (HBM) used in the creation of AI chips is growing much faster.

More specifically, the HBM market is estimated to reach nearly $86 billion in annual revenue by 2030, up from $1.8 billion last year, representing a compound annual growth rate of 68% over this period. And what’s more, this isn’t the only market where AI will drive a big jump in memory consumption.

According to Micron, AI-enabled PCs powered by neural processing units to handle AI workloads are expected to feature 40% to 80% more dynamic random access memory (DRAM) to enable faster computing. Micron also points out that flagship Android smartphones will feature a 50% to 100% increase in DRAM content over last year’s models to support generative AI applications.

When we take a closer look at the potential growth that these three markets will show in the long term, it becomes clear that Micron is at the beginning of a major growth curve. For example, the global data center market is expected to triple in revenue between 2024 and 2034, reaching $776 billion in annual revenue after ten years.

The AI-enabled smartphone market, on the other hand, is expected to grow at a compound annual rate of 28% through 2030. Likewise, the global PC market is expected to see a healthy 8% compound annual growth through 2030, generating nearly $257 billion in annual revenue. So Micron’s company has multiple growth engines that could save the memory industry from going bankrupt again.

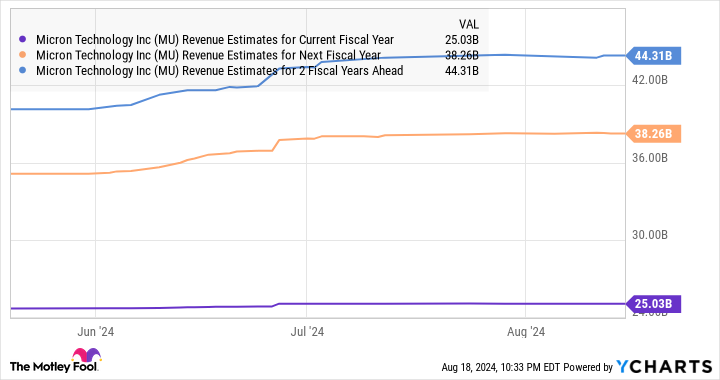

Analysts therefore expect the company to continue its impressive growth in the coming years, following the expected 61% growth in turnover this year to 25 billion dollars.

The valuation and potential upside make the stock a no-brainer

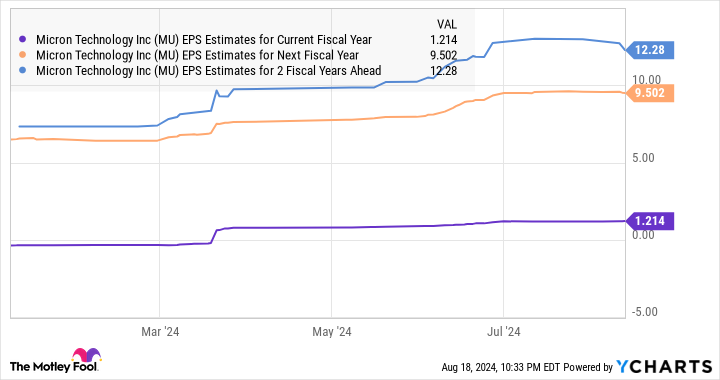

We’ve already seen that Micron is showing excellent revenue growth. And more importantly, that will also lead to a meaningful increase in earnings. The company suffered a loss of $4.45 per share last year, and the chart tells us that it will be back in the black in the current fiscal year. And more importantly, Micron’s earnings growth forecast for the next few years is also pretty solid.

Given the excellent growth this semiconductor stock is likely to deliver, buying it now is a no-brainer. That’s because Micron currently trades at just 11.7 times forward earnings, a huge discount to the Nasdaq-100 the expected gain of the index of 27 (using the index as a proxy for technology stocks).

Citigroup recently reiterated a $175 price target on Micron and reaffirmed its Buy rating on the stock, pointing to a 62% upside from current levels. Meanwhile, the stock has a median price target of $165 for the next 12 months according to 41 analysts covering Micron (93% of whom rate it a Buy). That would represent a 54% upside from current levels.

Investors would therefore be wise to buy Micron Technology before the stock market recovery gains momentum, given its very attractive valuation and great growth prospects.

Should You Invest $1,000 in Micron Technology Now?

Before buying Micron Technology stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $758,227!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Down 30%, Now’s a Great Time to Buy This Artificial Intelligence (AI) Growth Stock While It’s Incredibly Cheap was originally published by The Motley Fool