Energy transfer (NYSE:ET) continued to build its pipeline and midstream empire when it recently announced the acquisition of WTG Midstream. With a price tag of around $3.25 billion, this is by no means a transformative deal for a company with a market cap of over $52 billion.

However, it’s a good example of what the company is doing right and why investors should remain excited about the stock.

imperial building

In the past, institutional investors have criticized Energy Transfer for being more concerned about empire building than shareholder returns. In some respects this criticism is justified, but in other respects it is not.

Energy Transfer has been somewhat ahead of the curve in building its midstream empire and had to cut its distribution in half during the pandemic to help reduce debt and leverage. However, it also quickly returned to good financial condition and has since increased its distribution above pre-cut levels.

That said, I think Energy Transfer not always listening to the critics is a good thing, because management is playing the long game, while many institutional investors are not in stocks for the long term. Energy Transfer has a long history of buying assets and making them more valuable as part of the integrated system.

Some examples include the company’s acquisition of Semgroup in late 2019 due to the underutilized Houston Fuel Oil Terminal. The company then built a crude oil pipeline to the terminal, allowing it to transport crude oil from the Houston market to other locations. It then bought Enable in 2021, converting some pipelines to different products and connecting them to its system to give customers access to higher-end markets.

Last year it acquired Lotus Midstream and Crestwood Equity Partners, which owned one of the largest gathering systems in the Bakken that it was then able to connect to its long-haul Dakota Access Pipeline.

The Crestwood and Lotus acquisitions also expanded Energy Transfer’s assets in the Permian, which will also happen with the WTG acquisition. With the WTG deal, Energy Transfer will add more than 6,000 miles of natural gathering pipelines and eight processing plants in the Permian, along with two facilities under construction. It will also acquire a 20% stake in the BANGL NGL pipeline, although the other owners will have the right to acquire the asset first.

Energy Transfer will pay $2.45 billion in cash and approximately 50.8 million units in the deal. It expects this to immediately add $0.04 to distributable cash flow (DCF) per unit next year, rising to $0.07 by 2027.

The company said the deal will give it access to a growing supply of natural gas and NGL (natural gas liquids) volumes, which will help improve its overall Permian business. With the Permian still the most important oil basin in the US, continuing to acquire midstream assets in the basin to build out its system in the area is a smart long-term move. The company has restructured its balance sheet to make this a mostly cash deal and have it immediately contribute to its DCF per unit growth.

What’s most important about the deal, however, is that it continues to expand the company’s size in the Permian and could complement and feed the proposed Warrior Pipeline, which the company says would provide access to nearly every major city gate in the Permian region. state of Texas.”

A great value

Through growth projects and acquisitions, Energy Transfer has created one of the most impressive integrated midstream systems in the US. And while some have criticized its empire building and would prefer to see it take action such as buying back its undervalued shares, the company is making no apologies for its strategy. and long-term goals.

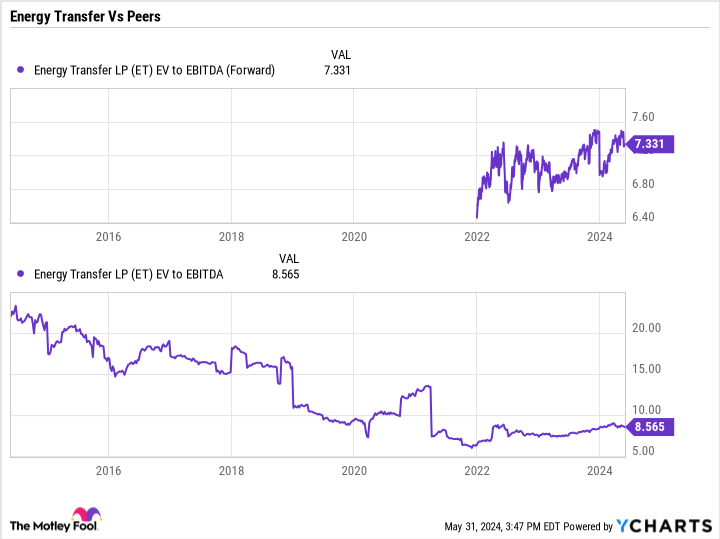

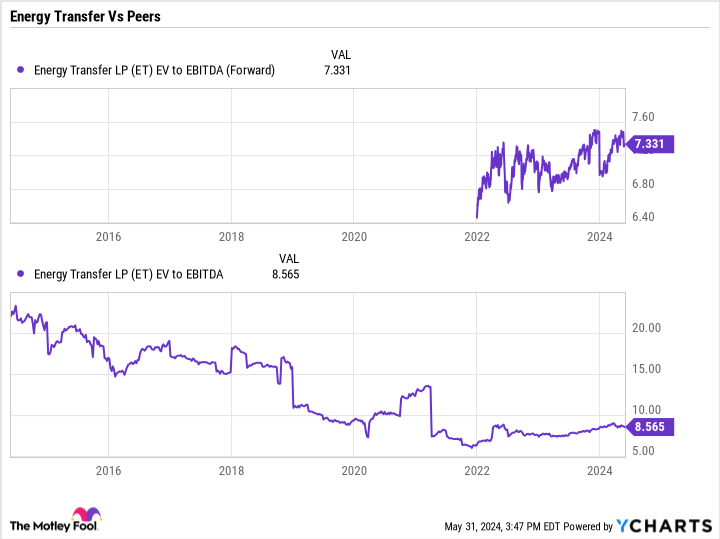

The stock trades at 7.3 times on an enterprise value (EV) to forward EBITDA basis and is cheap compared to where it typically traded pre-pandemic, although it is a much healthier company financially with a better balance sheet and a generates surplus cash. power after growth investments and distribution payouts.

The Master Limited Partnership (MLP) carries a robust yield of 8.2% based on the most recent quarterly distribution, with the aim of increasing this by 3% to 5% per annum going forward. As such, the stock appears to be an attractive investment given its valuation, well-covered distribution and growth prospects.

Energy Transfer may be building a pipeline empire, but that’s a good thing for long-term investors as long as it continues to do so in its current prudent manner.

Do you now have to invest € 1,000 in energy transfer?

Consider the following before purchasing shares in Energy Transfer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Geoffrey Seiler has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Energy Transfer is expanding its pipeline empire with a new acquisition. Why that’s a good thing for these 8.2% yielding stocks. was originally published by The Motley Fool