About thirty years ago, the advent of the Internet changed the growth trajectory of corporate America. Since then, countless new technologies, innovations and next-big-thing trends have emerged that promise to be the best thing since sliced bread. However, none of them have come close to the game-changing potential that connecting the world via the Internet brings… until now.

The advent of artificial intelligence (AI) opens an unlimited number of doors in virtually every sector and industry. When I discuss “AI,” I am talking about the use of software and systems to perform tasks that would normally be performed or controlled by humans. Giving software and systems the ability to learn and evolve over time without human intervention is what gives AI such a broad reach.

Based on a report published last year by PwC analysts, AI could add an estimated $15.7 trillion to the global economy by the turn of the century. That’s a huge amount of money and a pie big enough to allow for multiple winners.

But right now, no company is a bigger AI winner than the semiconductor company Nvidia (NASDAQ: NVDA).

Nvidia has parlayed its competitive advantages into a much-needed stock split

In a short time, Nvidia graphics processing units (GPUs) have become the standard in high-performance data centers. According to a study by semiconductor analytics firm TechInsights, Nvidia was responsible for supplying 3.76 million of the 3.85 million GPUs for AI-accelerated data centers in 2023. That’s a nice 98% market share and is effectively bordering on a monopoly.

There’s absolutely no doubt that AI-driven companies will want Nvidia’s GPUs in their data centers to train large language models (LLMs) and oversee generative AI solutions. This is clearly evident when you consider that approximately 40% of Nvidia’s net revenue comes from “Magnificent Seven” members Microsoft, Metaplatforms, AmazonAnd Alphabet. During Meta’s first quarter, the company announced plans to increase its capital expenditures, with the express idea of boosting its AI ambitions.

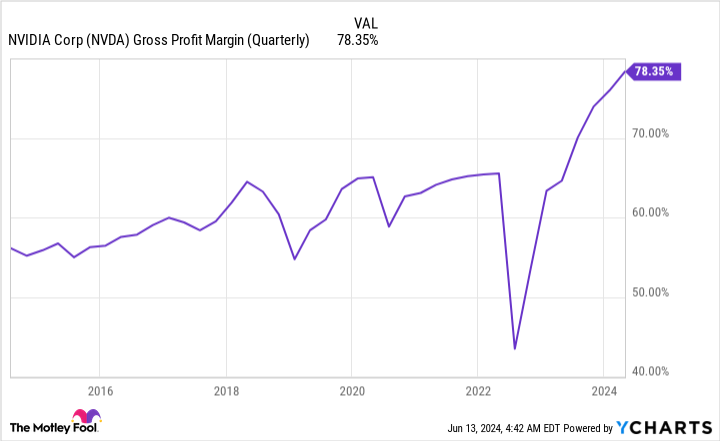

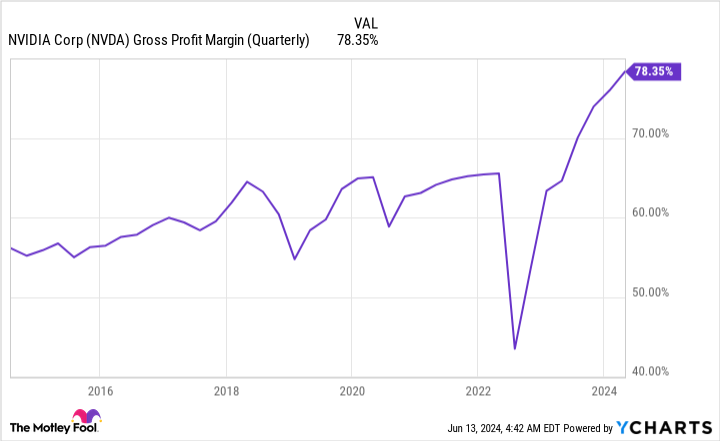

First-mover advantage has also fueled Nvidia’s pricing power. Demand for the company’s H100 GPU has completely overwhelmed its ability to fulfill orders. Even with Taiwanese semiconductor manufacturing By expanding its chip-on-wafer-on-substrate capacity, Nvidia cannot satisfy all its customers. As a result, it worked dramatic increased the selling price of its GPUs, leading to a scorching 78.4% gross margin during its fiscal first quarter (ended April 28).

Nvidia’s pioneering advantages in AI-accelerated data centers, combined with the mountain of cash flow it generates from its expensive H100 GPUs, also help support continued innovation. In March, the company unveiled its Blackwell GPU architecture, which is designed to further accelerate computing capabilities in data processing, quantum computing and generative AI.

Earlier this month, CEO Jensen Huang unveiled Nvidia’s latest AI architecture, called ‘Rubin’. Rubin will help train LLMs and will work on a new central processor known as ‘Vera’. While Blackwell is expected to hit customer hands later this year, Rubin won’t make its official commercial debut until 2026.

This combination of innovation, first-mover advantages, and otherworldly pricing power has helped Nvidia’s share price rise more than 700% since the start of 2023. With the company’s stock recently rising well above $1,000 per share, the board of directors approved and executed a 10-for-1 stock split. Nvidia joined more than half a dozen other high-flying companies in executing a stock split in 2024.

On paper, you can’t ask for a more perfect sales increase than what Nvidia has offered. But when things on Wall Street seem too good to be true, they almost always are.

Even if Nvidia keeps its computing advantages, shareholders could still lose

As an investor, you should look for companies with clearly defined competitive advantages, if not impenetrable moats. At the very least, Nvidia, which will account for 98% of AI GPUs shipped in 2023, ends up in the former category.

But even if Nvidia maintains its competitive GPU advantages, it may not be enough to prevent its stock from eventually collapsing.

For example, it is well documented that Nvidia is about to face its first real bout of external competition from the likes of Nvidia Intel (NASDAQ: INTC) And Advanced micro devices (NASDAQ: AMD). Intel’s AI-accelerating Gaudi 3 chip will begin shipping widely to customers in the third quarter. Intel claims that Gaudi 3 has inference and power efficiency advantages over Nvidia’s H100.

Meanwhile, AMD is ramping up production of its MI300X AI GPU, which is designed as a direct competitor to Nvidia’s highly successful H100. The MI300X is superior to the Nvidia H100 in memory-intensive tasks, such as simulations.

Even if Blackwell and Rubin ultimately blow Intel and AMD’s chips out of the proverbial water on the basis of computing power, the scarcity of GPUs suggests that Intel and AMD could still be big winners. A significant backlog in Nvidia chips should see the red carpet rolled out to outside competitors like Intel and AMD.

And it’s not just external competitors that pose a potential problem for Nvidia. The company’s aforementioned top customers, which make up about 40% of revenue, are all developing AI GPUs in-house for their data centers. This includes Microsoft’s Azure Maia 100 chip, Alphabet’s Trillium chip, Amazon’s Trainium2 chip, and social media giant Meta Platforms’ Meta Training and Inference Accelerator (MTIA).

Do these AI chips currently pose a threat to Nvidia’s computing advantage? No. But their mere presence to complement the H100 GPU removes valuable data center “real estate” and signals that Nvidia’s top customers are purposefully reducing their dependence on the AI queen.

With more AI GPUs becoming available from Intel and AMD, and many of the Magnificent Seven developing AI chips in-house, the GPU scarcity that has lifted Nvidia’s pricing power into the stratosphere will ease. The company’s adjusted gross margin forecast of 75.5% (+/- 50 basis points) for the second fiscal quarter – down 235 to 335 basis points from the subsequent quarter – is likely a signal that these pressures are continuing.

Furthermore, every subsequent major technology, innovation, or trend of the past thirty years has fallen prey to a bubble that burst early on. Investors have consistently overestimated how quickly a new technology, innovation or trend would be adopted by companies and/or consumers.

While AI may seem like the second coming of the internet when it comes to changing the growth curve for corporate America, most companies don’t have well-defined plans for how they will leverage the technology to improve revenue and profits. We see this overzealousness repeated cycle after cycle with the next big investments.

Mind you, this doesn’t mean that Nvidia won’t be hugely successful in the long term or that its shares can’t continue to appreciate in value when we look back 10 or 20 years from now. But it does suggest that even as Nvidia maintains its competitive advantage in GPUs, the immaturity of the technology in its early stages has left Wall Street facing another bubble.

The leader of every next-big-thing innovation for three decades has ultimately seen its stock price fall by at least 50%. I think Nvidia shareholders are on track to suffer the same disappointment.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, Intel and Meta Platforms. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 calls of $45 on Intel, long January 2026 calls of $395 on Microsoft, short August 2024 calls of $35 on Intel, and short calls in January 2026 from $405 on Microsoft. The Motley Fool has a disclosure policy.

Even if stock-splitting Nvidia retains its competitive GPU advantages, shareholders could be in for an unpleasant surprise, originally published by The Motley Fool