If you stuck with it Tesla (NASDAQ: TSLA) Lately you’ve probably seen nothing but negative headlines. With headwinds in the electric vehicle (EV) market, multiple layoffs and some rumors that it might ax its long-awaited sub-$25,000 model, Tesla hasn’t been able to catch a break.

As the bad news piles up and investors are tested, it’s worth asking: Is Tesla still a good long-term option?

Analysis of Tesla’s value

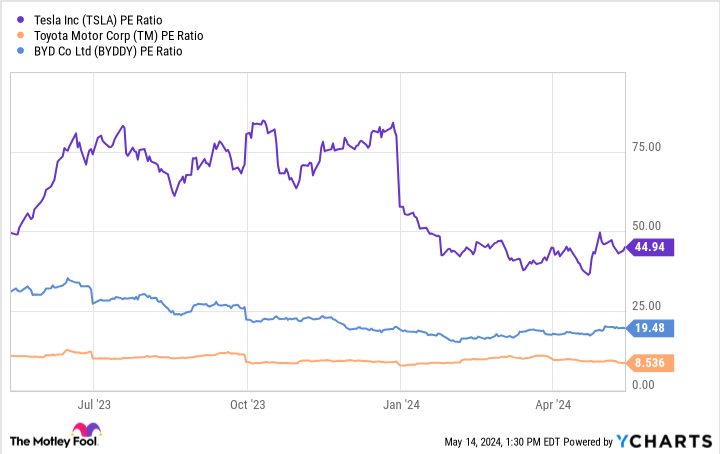

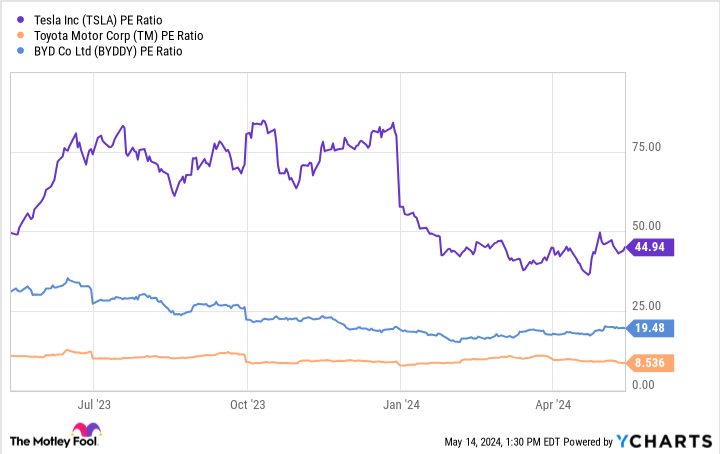

Compared to other automakers, Tesla shares are considered expensive and overvalued. We can see this by comparing companies’ price-to-earnings ratios.

Today, Tesla’s price/earnings ratio is 42. This is five times more expensive than the next most valuable car manufacturer, Toyotaand about twice as expensive as fellow China-based EV manufacturer BYD.

Even with its generous margins and ability to efficiently mass-produce electric vehicles, Tesla stock isn’t worth buying from a purely automotive perspective. However, when we look at Tesla in the context of its future endeavors, its potential begins to become clear and indicates that the company is currently trading at a discount.

Many consider Tesla the best investment opportunity to explore the future potential of artificial intelligence (AI), despite the need for further development before the company can benefit from its labor.

The road ahead is why Tesla is undervalued

CEO Elon Musk’s goal is to one day make Tesla the most valuable company in the world. And it will do so by making its fully self-driving software more capable and increasing the capabilities of its Optimus humanoid robot.

On the self-driving side, Musk’s goal is to eventually launch a robotaxi service. With vehicles that can drive themselves, Musk plans to create a unique taxi company that could change the way we travel. He sees it as an opportunity with “quasi-infinite” demand, and many analysts agree this will be a turning point.

It’s difficult to quantify the true potential of a technology that doesn’t exist anywhere else on the market, but ARK Invest took a stab at it. After running a Monte Carlo simulation, the investment firm found that robotaxis could generate up to $440 billion in revenue, about four times more than its total revenue in 2023.

As for Optimus, the potential is still commendable, albeit not as great as robotaxis. Analysts at Morgan Stanley believe that Optimus could disrupt up to 30% of the global labor market through its ability to perform repetitive and dangerous tasks currently performed by humans. From a revenue perspective, Musk expects Optimus to one day surpass its vehicle production.

Optimus is already in use at Tesla factories performing basic tasks. But Musk believes it will expand its responsibilities by the end of this year and could be shipped to consumers and markets by the end of 2025.

The opportunity available today

From a pure EV perspective, it may be difficult to justify an investment in Tesla. While Tesla will continue to increase its electric vehicle manufacturing capabilities in the coming years and benefit from the increasing adoption of electric vehicles around the world, the true potential for Tesla lies in its AI efforts.

It may not be wise for risk-averse investors to invest in Tesla as it may address short-term challenges, but for those with a long-term horizon and risk appetite, you could say there are few better options than Tesla.

In addition to Tesla’s fundamentals, it is worth keeping in mind the advice of one of the world’s leading investors, Warren Buffett. He famously said, “Be greedy when others are fearful, and fearful when others are greedy.” With a quick search online, it becomes clear that there is fear these days when it comes to investing in Tesla.

While bad press is not a reason enough to invest in a company, given Tesla’s history of success, the progress it has made in developing its AI products, and the transformative potential these technologies can have for society, it seems a solid long-term player. term option for growth investors.

Where you can invest $1,000 now

If our analyst team has a stock tip, it could be worth listening to. The newsletter they have been publishing for twenty years, Motley Fool stock advisorhas more than tripled the market.*

They just revealed what they believe to be the 10 best stocks for investors to buy now… and Tesla made the list — but there are nine other stocks you might be overlooking.

View the 10 stocks

*Stock Advisor returns May 13, 2024

RJ Fulton has positions in Tesla. The Motley Fool holds and recommends positions in BYD and Tesla. The Motley Fool has a disclosure policy.

Everyone is talking about Tesla: is it a good long-term option? was originally published by The Motley Fool