(Bloomberg) — For Filicia Porter, the insurance bills were the final straw. They were on a steep rise for her assisted living business as Florida was battered by increasingly powerful storms, and eventually the numbers kept adding up.

Most read from Bloomberg

So she finally decided to call it quits in March, closing the Palm Beach area location she opened just two years ago. That came four months after she closed an older Port St. Lucie location that opened in 2017. Together they sent a dozen residents to look for another place to live.

“Every year you see an increase. Why pay more?” said Porter, who first founded The House of Cares to capitalize on the growing demand for senior care as baby boomers flooded into the Sunshine State. But with her premiums skyrocketing on top of all her other costs, she just couldn’t “keep wearing herself out.”

Porter is just one small example among many in Florida, where two major generational forces are colliding: the toll of climate change and the challenge of caring for an aging society. Attracted by the state’s warm weather and low taxes, baby boomers have been piling into the retirement paradise for years, leaving it one of the oldest demographics in the US. That makes it a harbinger for other states as the effects of rising temperatures ripple through the economy in ways few could have imagined.

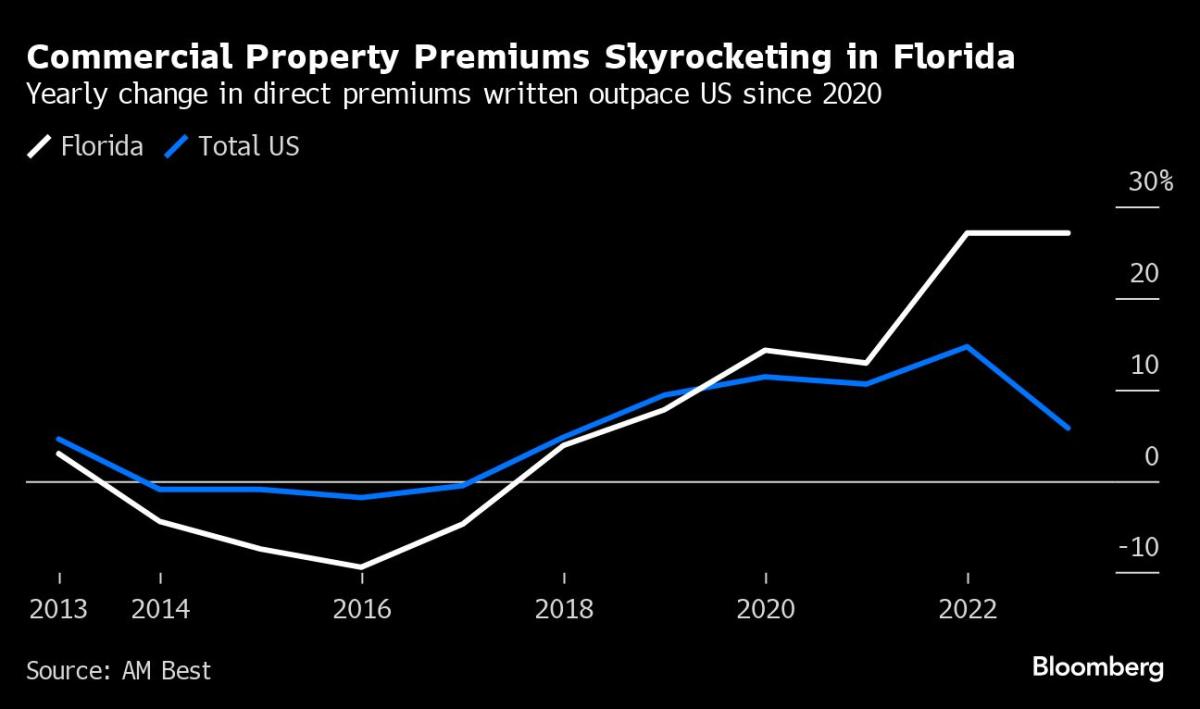

With Florida threatened by more powerful hurricanes, commercial property insurance costs rose at nearly five times the national rate last year, according to credit rating agency AM Best Co. Inc. – taxing an industry already struggling with labor shortages, rising wages and rising supply costs.

The result? Every year more and more nursing homes close their doors, while others are unable to pay off their debts. At the same time, the costs of elderly care – at all levels, from independent living to 24-hour nursing – are rising, threatening to become unaffordable for a growing number of retirees.

“We are headed for a train wreck,” said Pilar Carvajal, founder and CEO of Innovation Senior Living, a Winter Park-based 339-person nursing home chain. Operator insurance costs have increased by at least 50% over the past five years. “We need help to solve this social problem,” she said.

While climate change has caused commercial property insurance premiums to rise across the country, few places have been hit harder than Florida. In the five-year period ending in 2023, costs increased by 125%. Last year, annual premiums in the state rose by about 27% — for the second year in a row — while the rate of growth nationally slowed from about 15% to nearly 6%, according to AM Best.

“We have a lot of customers who can’t afford the coverage,” said Patrick McConachie, senior vice president at Marsh McLennan Agency in Tampa, who helps senior residents negotiate policies. “In many cases in Florida lately, the operator will simply return the keys to the landlord.”

Read more: A new financial crisis looms in uninsurable American homes

Palm Garden Healthcare closed its assisted living facility earlier this year due to skyrocketing costs, according to president and CEO Rob Greene. The property insurance bill for his 14-location nursing home chain more than doubled in two years to $2.2 million. And while Greene pays more to be insured, he said the coverage for $75 million in damages is far below the at least $200 million he needs.

So far, Palm Garden has not experienced any major storm damage since it opened in the late 1980s, but “in June we get a little nervous,” Greene said.

‘The feeling of a bottleneck’

According to the National Centers for Environmental Information, damage from natural disasters such as tropical cyclones and severe storms has at least doubled to as much as $200 billion between 2019 and 2023 compared to the previous decade. That five-year overview also includes Hurricane Ian – the third costliest hurricane in American history.

The increasing claims led to a number of property insurers going bankrupt, causing rates to rise. But this year, seven new companies are expected to enter the market, said Mark Friedlander, director of corporate communications at the Insurance Information Institute. And negotiations with reinsurers have gone well, which could mean a flat or smaller premium increase this year, said Jack Walker, senior sales executive at AssuredPartners, an Orlando-based insurer specializing in senior housing.

But until that happens, operators like Innovation and Palm Garden must find ways to pay the rising bills. Palm Garden’s elders qualify for Medicaid, but Greene says the benefits are never enough. “We don’t have the luxury of being able to pass on costs like we do at McDonald’s,” he said.

For operators serving affluent retirees who can mark up and pass on the price, even they will become “unaffordable” at some point, says Margaret Johnson, senior director at Fitch Ratings.

“Residents are feeling the pressure,” said Raoul Nowitz, senior managing director at SOLIC Capital Advisors, which specializes in restructuring for distressed companies and investment banking. And operators are struggling to have enough cash flow to cover their debts, he added.

While the spike in insurance costs is a major problem for all groups in Florida – from homeowners to hotels – it is especially crippling for this sector. Fitch’s Johnson has a negative credit outlook on the sector.

According to Municipal Market Analytics, the majority of first defaults on debt issued to retirement communities in Florida since 2009 occurred after the pandemic – 21 out of 34. Florida’s senior housing default rate is 18% – more than twice the national rate of nearly 8%, according to data compiled by Bloomberg.

Read more: More defaults for seniors in the future as debt matures

Supply and demand

That tension has led to dozens of facilities closing. An average of 146 nursing homes or assisted living facilities have closed each year in the five years ending in 2023, according to data from the Florida Agency for Health Care Administration. Within that period, 2022 saw the most closures – coinciding with the landfall of Hurricane Ian and the winding down of federal pandemic aid.

The steady closures are happening as demand grows and prospects for new facilities diminish. Florida is the nation’s second-fastest growing state by population, after Texas, according to the U.S. Census Bureau, and ranks second among U.S. states in terms of oldest, with about 22% aged 65 and older, compared with only 17% for the entire US. .

New facilities need to open at a faster pace to keep up with the growing demographic, said Lisa Washburn, chief credit officer at Municipal Market Analytics, adding that “construction has slowed significantly” in the US. There must be some form of government involvement to subsidize or facilitate construction, she said.

“In Florida you may not have an income tax,” but insurance is a tax, Washburn said.

After Hurricane Ian, Carvajal had to install a new $200,000 roof on one of its six facilities to stay insured.

“How do you make things like property insurance so difficult and unpredictable?” she said. “Looking into the future, if things get worse, I don’t know what we’re going to do.”

Most read from Bloomberg Businessweek

©2024 BloombergLP