Data centers house IT architecture such as server racks that house advanced chipsets called graphics processing units (GPU) – a crucial part of the infrastructure for AI development.

However, a disadvantage of data centers is power consumption. Because GPUs run advanced algorithms 24 hours a day, data centers experience a lot of heat and consume a lot of energy. Currently, some of the most common devices that equip data centers are air conditioning units, fans and generators.

While these products work, there are questions about their long-term viability. For this reason, nuclear energy is emerging as an alternative and more efficient solution compared to traditional energy solutions for data centers.

Just a few weeks ago, Microsoft signed a deal Constellation Energyand the two companies want to restart nuclear power plants at Three Mile Island in Pennsylvania. Constellation shares have soared following news of this partnership. Naturally, investors are now looking for the next big opportunity at the intersection of AI and nuclear energy.

Below I will explore a little known nuclear power company called Okay (NYSE:OKLO) and assess whether the stock could be a lucrative opportunity.

What is Oklo?

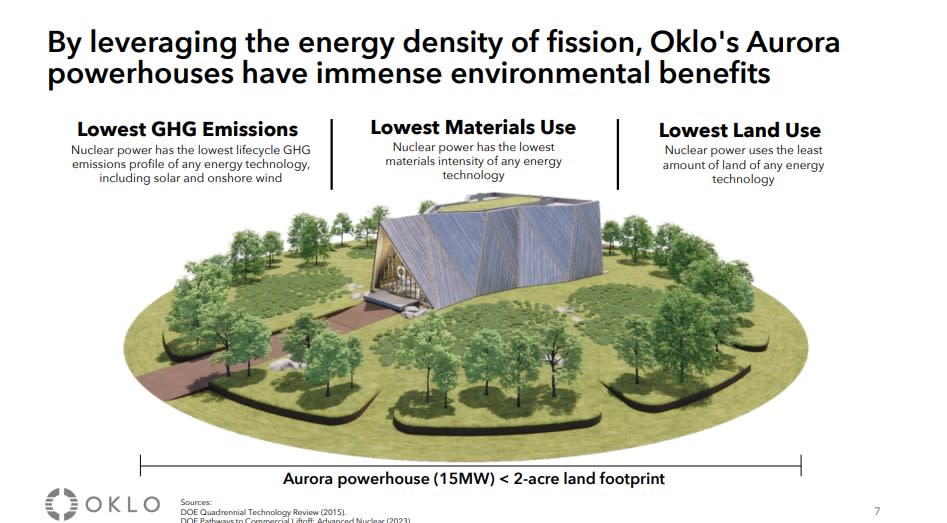

According to its website, Oklo is a “fission technology and nuclear fuel recycling company.” The nuclear project is called the Aurora Power Plant, which is essentially a fission reactor using recycled nuclear waste. This technology could revolutionize the operations of data centers, making them less dependent on traditional electricity grids.

Oklo looks impressive at first glance, but…

Before going public, Oklo received funding from a number of high-profile venture capital firms. Some of the more notable investors include Sam Altman, CEO of OpenAI, and billionaire Silicon Valley legend Peter Thiel. In addition, the company has received interest in its reactors from, among others Diamondback energy, Equinix, Centrus energy and the US Air Force.

At first glance, Oklo looks quite impressive. But smart investors know there’s always more to discover when assessing smaller companies. Oklo is no exception, and I’ve found some important things to keep in mind with this under-the-radar energy stock.

…investors should keep the following in mind

Oklo began trading on the New York Stock Exchange in May after merging with a special purpose acquisition company (SPAC). SPACs are a somewhat unusual way to go public because they bypass traditional underwriting processes at investment banks. SPACs have grown in popularity in recent years.

Here’s the uncomfortable reality of SPAC stocks. Many market themselves as forward-thinking companies but have yet to show tangible results. As a result, after an initial surge fueled by investor euphoria, SPAC shares often sell off as a more sober assessment emerges.

According to a study at the University of Florida, renewable energy SPACs have an average return of negative 84% between 2009 and 2024. It’s too early to tell where Oklo’s stock price will end up, but I see some reasons why the stock could start to fall.

While the Aurora powerhouse has some traction, Oklo’s first factory isn’t expected to be operational until 2027. Until then, the company will likely remain a pre-revenue business requiring continued investment in capital expenditure (capex). As a result, I wouldn’t be surprised if the company pushed for liquidity and possibly diluted shareholders in an attempt to keep the company afloat.

I find Oklo’s nuclear energy solutions intriguing, but I have my doubts about the company’s investment capabilities at its current stage. For now, I see Oklo as quite risky and a speculative opportunity at best.

I think a wiser strategy is to invest in higher quality companies that are already taking steps at the intersection of nuclear energy and AI. In addition to Microsoft and Constellation Energy, Amazon And Vistra are some big names worth keeping an eye on. As for Oklo, I think it’s best to stay on the sidelines and monitor the company’s progress over time.

Should you invest $1,000 in Oklo now?

Consider the following before buying shares in Oklo:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions at Amazon and Microsoft. The Motley Fool holds positions in and recommends Amazon, Constellation Energy, Equinix and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Following Microsoft’s landmark deal with Constellation Energy, could this little-known stock be the next big opportunity in nuclear energy? was originally published by The Motley Fool