Oil prices have been a bit volatile lately, causing stock prices to fall Western petroleum (NYSE:OXY) Down 25% from their 52-week high. The stock’s yield is a mediocre 1.7%, despite the significant price drop. Most energy stock-oriented investors, and especially income-oriented investors, will be better off here Partners for business products (NYSE:EPD) and the strong distribution yield of 7.1%. This is why.

Occidental Petroleum is a great energy company

Most investors have heard the names ExxonMobil And Chevronboth of which are among the largest integrated energy companies in the world. Integrated energy companies have activities that extend from the upstream (energy production) through the midstream (pipelines) to the downstream (chemicals and refining). This diversification of activities helps smooth out the peaks and valleys inherent in the highly volatile energy sector.

Occidental Petroleum wants to compete with these giants.

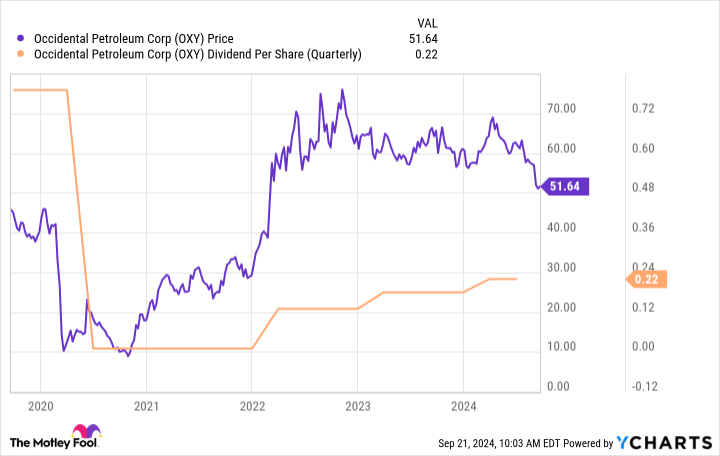

It’s a great plan, but it means that Oxy, as it is more often called, will have to grow through acquisition. That’s where the story gets complicated. In 2019, the company bought Anadarko Petroleum, winning a bidding war with Chevron. Warren Buffetts Berkshire Hathaway even got involved and helped finance Oxy’s bid. However, the deal was very large, requiring the company to exert significant influence. When oil prices fell during the coronavirus pandemic, Oxy’s dividend was eventually cut.

The dividend has recovered somewhat, but is still well below prior levels as Oxy focused on growing its business rather than rewarding investors with dividends. Notably, it recently closed a deal to acquire oil and gas developer CrownRock. It was a smaller deal and should be easier to digest, but it also makes it clear that Oxy’s efforts today are about competing with energy industry giants and not about returning cash to shareholders through dividends.

Enterprise Products Partners pays in good times and bad

If you’re looking for an energy company that focuses on business growth and not dividends, Oxy could be a good option. But if you want an energy investment that is a little more reliable, you should look at Enterprise Products Partners and its strong distribution yield of 7.1%. That return is super important for your total return.

As a Master Limited Partnership (MLP), Enterprise is specifically designed to pass income through to shareholders in a tax-efficient manner. Meanwhile, the company focuses on the mid-market segment of the industry and owns energy infrastructure (such as pipelines) that produces reliable cash flows. It charges fees for the use of these assets. The price of the raw materials flowing through the system is not as important as the volume flowing through it. Even during periods of low energy prices, energy demand is generally robust due to the important economic role that oil and natural gas play in the world.

That division is also strong when you look at financial statistics. For example, Enterprise has an investment-grade rated balance sheet, and its distribution is covered by as much as 1.7 times its distributable cash flow. Distribution has currently been increased for 26 years in a row. The only problem is that growth is likely to be limited in the coming years, so the big yield here will likely account for the lion’s share of returns.

However, if you’re a dividend investor, that probably won’t be much of an issue for you. And all it takes is distribution growth of about 3%, which is perfectly reasonable, to bring the total return profile close to 10%. That’s about what most investors expect from the broader market. And since its highly reliable distribution will make up the majority of your returns, this is the kind of energy stock that can help you sleep well at night, regardless of what happens to oil prices.

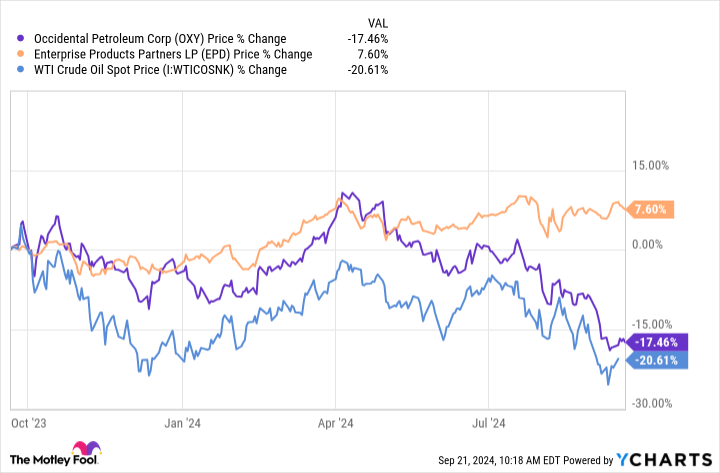

For proof, just take a look at the chart above that compares the price performance of West Texas Intermediate (WTI) crude oil, a key U.S. oil benchmark, with the price performance of Oxy and Enterprise. Oxy coincided with WTI as Enterprise kept moving. Conservative investors and investors who want to live off their dividends will likely be much better served by owning Enterprise.

Oxy is not a bad company, but it is a volatile company

Occidental Petroleum took more from the Anadarko deal than it could handle, but appears to have learned a lesson after being forced to cut its dividend. Yet it is an energy company that focuses on growth in a very volatile sector. It’s not for the faint of heart, even after a 25% share price drop. Most investors will probably be happier owning a boring income stock like Enterprise if they want exposure to the energy sector today.

Should you invest $1,000 in Occidental Petroleum now?

Consider the following before purchasing shares in Occidental Petroleum:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has and recommends positions in Berkshire Hathaway and Chevron. The Motley Fool recommends Enterprise Products Partners and Occidental Petroleum. The Motley Fool has a disclosure policy.

Forget Occidental Petroleum – Buy These Beautiful High-Yield Energy Stocks Instead, originally published by The Motley Fool