The S&P 500 is just shy of its all-time high of 5,433.74, a record it reached last Thursday. This year, the index is up nearly 14%, a solid gain that supports positive investor sentiment.

Ari Wald, Oppenheimer’s head of technical analysis, looks at the market from a technical perspective and takes a bullish stance on large-cap stocks.

“Looking ahead, we believe the weight of evidence favors higher market highs, and at worst we believe a selective approach is appropriate. For us, this selection includes a core position in large-cap growth. While the bull case is based on catching up in lagging sectors (small caps, value), we believe market leaders (large caps, growth) still offer a more attractive risk-reward balance,” Wald opined.

Some of Oppenheimer’s top analysts are following this line, encouraging investors to go long on two specific large-cap stocks. We ran them both through the TipRanks database to find out if the rest of the Street is comfortable with these choices. Let’s take a closer look at that.

Uber Technologies (UBER)

The first stock on our large cap list is Uber, a leader in the rideshare niche. Uber was one of the first startups to enter that space, and its design – which allowed users to order rides online and drivers to work as and when they wanted – revolutionized the way we see and use taxi services . Uber has expanded over the years and in addition to ride-hailing services, the company also offers courier services, package delivery and light freight, corporate ride plans, and even food delivery services through Uber Eats.

Uber’s market cap currently stands at $144.8 billion, and the company achieved that scale by giving its customers what they want: fast access to transportation services at their fingertips. Some numbers will tell the story. At the end of the first quarter of 24, Uber’s services were available in more than 10,000 cities in 70 countries around the world, and the company had 149 million monthly active platform customers, had 7.1 million monthly active drivers and couriers, and provided 28 million rides every day.

That’s a solid foundation for the rideshare business, and Uber reported some solid profits in the first quarter of this year. The company’s revenue was $10.1 billion, up 15% year over year, and exceeded forecasts by $40 million. The company reported a 21% increase in year-over-year travel, and a 20% increase in gross bookings, to $37.76 billion. However, the latter was slightly below the consensus expectation of $37.97 billion.

We should note that while Uber’s stock is posting strong gains (up 61% in the past year), its growth rate has slowed. For Oppenheimer analyst Jason Helfstein, this stock price slowdown represents a buying opportunity and a chance for investors to establish a solid long-term position. The five-star analyst writes: “We see UBER stock as having the most upside within the big web, thanks to tailwinds from healthy affluent consumers (UBER’s core customer), travel demand and service spending. Meanwhile, the correction from the highs provides an attractive entry point as estimates are now higher than pre-Analyst Day estimates while share prices are lower. Wealthy Consumers Continue to Splurge: Memorial Day Travels Strong; AXP consumer airline spending accelerated; the growth of services exceeds goods; and sales of existing homes indicate significant outperformance at the higher end.”

For Helfstein, this equates to an Outperform (Buy) rating, and his $90 price target suggests a 28.5% upside over the next twelve months. (To view Helfstein’s track record, click here)

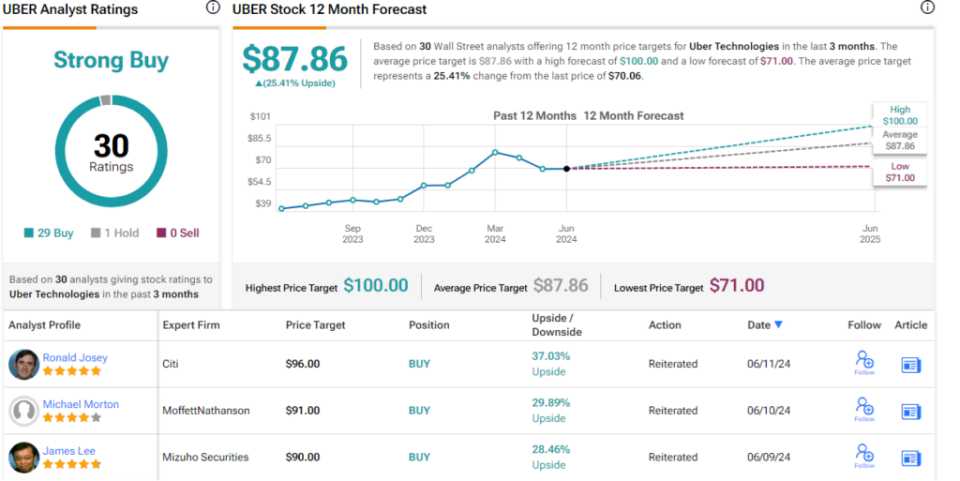

Almost no one disputes this view of Wall Street. The stock’s Strong Buy consensus rating is based on 29 Buy recommendations and one Hold. The shares are priced at $70.06 and their average price target of $87.86 implies a one-year upside potential of 25.5%. (To see UBER stock forecast)

Snowflake (SNOW)

The second stock we’ll look at is Snowflake, a software company that offers a cloud-based data analytics platform and high-quality data capabilities based on its popular subscription model. What Snowflake essentially does is deliver data-as-a-service so that customers at any scale can realize the benefits of a simplified data architecture. The company places all its services on one platform, eliminating silos and providing customers with a more streamlined and efficient experience.

With the advent of generative AI in recent years, Snowflake has seen – and seized – an opportunity to expand its business. The company quickly understood that AI is highly data-dependent and that the Snowflake data cloud is uniquely positioned to provide a solid foundational service to AI customers. The company’s scalable, flexible platform architecture delivers optimized data storage, easy access and management, and a workable combination of adaptability and interoperability. In March this year, Snowflake announced a partnership with Nvidia to bring together Snowflake’s secure AI data cloud with the chipmaker’s full-stack accelerator capabilities.

Snowflake currently has more than 9,800 customers who rely on the company to unify their data sources. In total, these customers generate more than 5 billion data queries in the data cloud every day and run more than 515 million workloads every day. The company has 485 customers each generating more than $1 million in revenue and has recorded $5 billion in remaining performance obligations, or work backlog, as of April 30 this year. The company has a market capitalization of $42.5 billion.

Turning to financial results, we note that Snowflake reported total revenue of $828.7 million for fiscal 1Q25, up 33% year over year and beating guidance by $42.8 million. The company’s total revenue included $789.6 million in product revenue, up 34% year over year. Ultimately, Snowflake generated 14 cents per share in non-GAAP revenue; this was one cent less than the previous year and 3 cents per share below expectations.

This stock is part of the coverage universe of Ittai Kidron, another five-star Oppenheimer analyst. Despite the recent mixed earnings report, Kidron, who is rated in the top 3% of Wall Street analysts by TipRanks, is bullish on SNOW, especially its AI potential. He says of the company: “The AI landscape is rapidly evolving, accounting for a larger share of workloads/apps and is highly competitive. Snowflake views AI as a foundational capability and is positioning itself as the data backplane for AI to maintain its position as a leading Cloud DBMS provider… We see the growing product capabilities as a testament to the company’s innovation and believe this can encourage customers to build apps on Snowflake in the longer term.”

Kidron gives an Outperform (Buy) rating to this stock, and he supplements that with a $220 price target, which indicates a 73% upside over one year. (To view Kidron’s track record, click here)

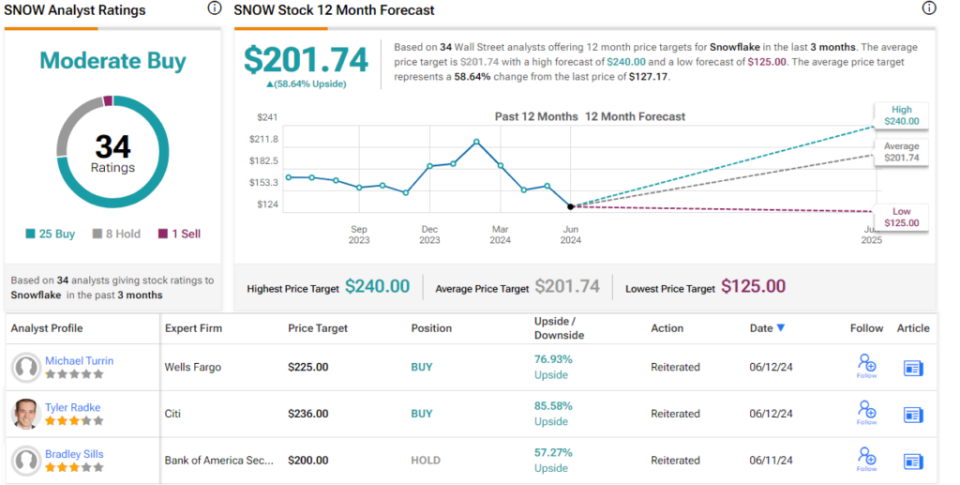

Oppenheimer’s view is very bullish, even more so than the consensus among analysts. The 35 recent reviews include 25 Buys, 8 Holds, and 1 Sell, for a consensus rating of Moderate Buy. Nevertheless, good profits are expected here; The average price target of $201.74 for the stock suggests an upside potential of 58.5% for the year ahead. (To see Snowflake Stock Forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.