(Bloomberg) — Banks are dumping assets, and many of them are turning to a booming sector of the bond market to do so.

Most read from Bloomberg

The latest round of global capital rules, known as the Basel III endgame, is expected to make a slew of loans more expensive for banks to hold on to. In response, lenders are increasingly bundling auto loans, equipment leasing and other types of debt into asset-backed securities.

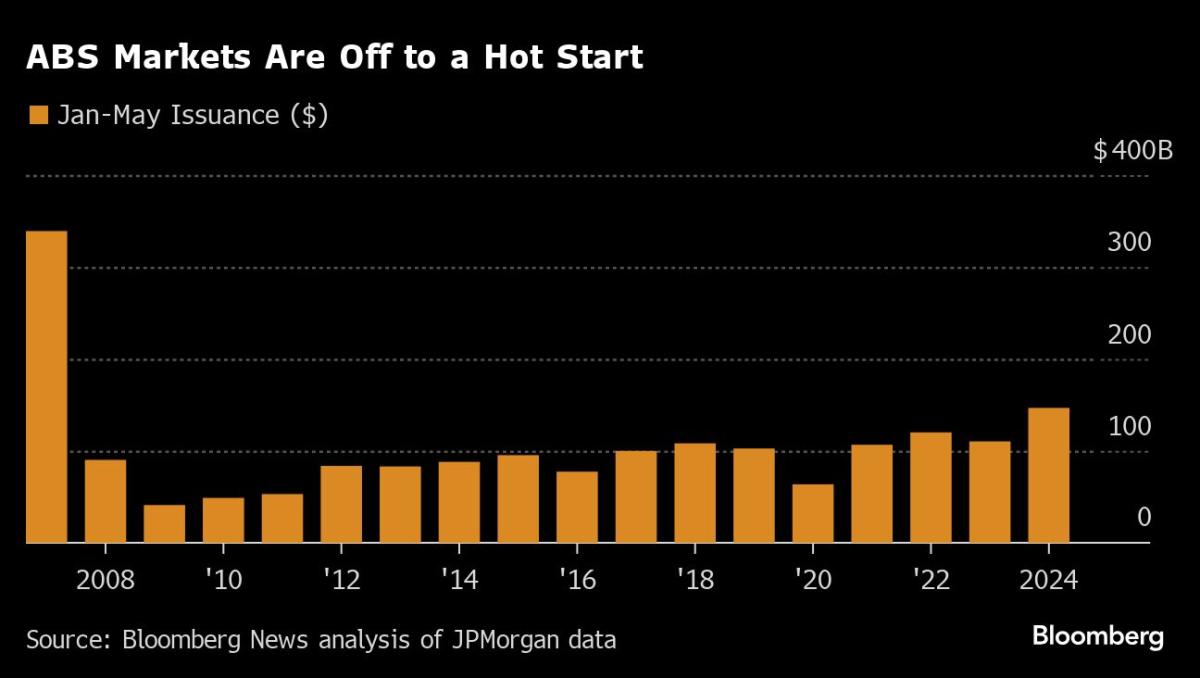

In the U.S. alone, ABS sales have topped $170 billion this year, up about 38% from 2023, according to data compiled by Bloomberg News. Europe has made similar gains, with issuance reaching about €21 billion ($22.9 billion) this year, up about 35% from the same point last year, according to data compiled by Bloomberg that excludes mortgage bonds.

And the tide of issuance shows no sign of abating. Bank of America strategists on May 31 raised their full-year U.S. sales forecasts for the bonds to about $310 billion from the previous $270 billion, mainly due to auto loan securitizations. The bonds are finding buyers among credit investors, with participants at a global ABS conference in Barcelona this week expressing cautious optimism about the market.

“We see attractive opportunities in asset-backed securities,” especially those tied to U.S. households, Kay Herr, JPMorgan Asset Management’s chief investment officer for U.S. fixed income, said on the Credit Edge podcast. “We definitely see opportunities there for higher yields.”

Banks’ use of significant risk transfers, which are akin to ABS, is also fueling issuance, which is happening at the fastest pace since the 2008 financial crisis crushed the market.

“Many of the SRT deals to date have taken place in the US,” Andrew South, head of structured finance research at S&P Ratings, said at a conference this week. “With many regulatory changes on the Basel 3.1 side, there could be more incentives for banks to use securitization for capital relief,” he added.

One sign of robust demand is that investors seeking securities with relatively strong ratings and high yields have snapped up asset-backed assets, backed by increasingly exotic assets, including art by Rembrandt van Rijn and Andy Warhol, and internet protocol addresses.

“We get a lot of questions about esoteric securitizations,” says South, citing data center and solar panel securitizations as two examples.

To be fair, strategists say issuers may be pulling out their sales to avoid any volatility from the US presidential election or a reversal in Federal Reserve monetary policy. That dynamic could result in a much slower second half of the year.

Wall Street CEOs have been vocal in their complaints about Basel III’s endgame rules. Jamie Dimon of JPMorgan Chase & Co. said hedge funds and other companies outside the banking system were excited about the revenue they would get from the regulations.

“They dance in the streets,” Dimon said last year.

Supervisors appear to be listening. In March, Federal Reserve Chairman Jerome Powell said the central bank was planning “broad and material changes” to the central bank’s implementation of the rules, and that a full overhaul was possible.

Yet banks’ preparations for stricter new capital rules are evident from the increasing issuance of ABS. Lenders have put a raft of new deals on sale in recent days, including car bonds from Santander and Toyota.

Weekly overview

-

Private credit is a taste of what happens when things get ugly. Higher interest rates make it harder for many businesses to pay off their debts, while lenders undercut each other on prices and offer unusually borrower-friendly terms. Some warn that this is laying the groundwork for more pain to come.

-

A group of investors in Credit Suisse Group AG bonds that went bankrupt when UBS Group AG bailed out the bank in a Swiss government-brokered deal are suing the country in New York as they take their battle abroad.

-

Asian borrowers are returning to global debt markets in greater force, joining others worldwide in contributing to near-record levels of activity this year.

-

Banks are ramping up their investments in a complex part of the mortgage bond market that offers shorter-term securities as they tackle the growing risk of losing deposits due to high interest rates.

-

Deutsche Bank AG plans to sell a credit-linked note known as a significant risk transfer tied to a pool of about $2 billion in leveraged loans.

-

Gym chain Planet Fitness sold $800 million in bonds backed by franchise agreements, intellectual property and equipment sales to refinance some of its debt.

-

Coastal GasLink LP, a pipeline project in Western Canada, sold US$7.15 billion ($5.22 billion) worth of notes in the largest Loonie-denominated corporate bond deal ever.

-

Pipeline manager Energy Transfer LP sold $3.95 billion of investment-grade and high-yield bonds to finance its acquisition of WTG Midstream.

-

Thoma Bravo has reached out to private lenders as it looks to raise about $3.5 billion in new financing for its automated professional services company ConnectWise.

-

HSBC Holdings Plc explored the possibility of offloading at least some of its debt position in beleaguered utility Thames Water before deciding against going ahead.

-

Suntory Holdings Ltd.’s $500 million bond sale makes the whiskey maker an outlier among Japanese companies, which are cutting back on dollar debt sales as they rush to raise money in the yen.

-

A group of lenders asked a court to impose bankruptcy supervision on multiple units linked to struggling Indian education technology company Byju’s, claiming millions of dollars are being “syphoned” out of the companies.

-

Dealmaking is poised to accelerate this year as private equity and private credit funds face renewed pressure to return money to their investors, participants at the SuperReturn International conference in Berlin said.

-

The European Central Bank is investigating how the region’s biggest banks are lending to the private equity sector amid a growing threat of corporate bankruptcies.

En route

-

Toronto-Dominion Bank has hired Goldman Sachs Group Inc. veteran Paul Mutter to lead global sales for its fixed income business.

-

Millennium Management has hired Steven Sasson, co-head of structured credit at Silver Point Capital.

-

BlackRock Inc. has appointed Yik Ley Chan to lead the company’s private lending efforts in Southeast Asia.

-

Arini, an alternative asset manager, has hired Nabil Aquedim, a former managing director of Goldman Sachs Group Inc., as head of real estate and asset-backed strategies.

–With assistance from James Crombie.

Most read from Bloomberg Businessweek

©2024 BloombergLP