The activities of billionaire investors usually attract the attention of individual investors. When it comes to the investing moves of Warren Buffett and others, many investors sift through billionaires’ quarterly 13-F filings with the Securities and Exchange Commission (SEC), looking for investment ideas and potential insights.

Granted, billionaires often make such decisions for reasons that would not help or interest the average investor. However, some of their investments do indeed have growth potential, three Motley Fool contributors believe Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Uber Technologies (NYSE:UBER)And Texas Instruments (NASDAQ: TXN) could serve their shareholders well.

Bridgewater founder Ray Dalio switches to Alphabet shares

Jake Lerch (alphabet): It’s true: billionaires love tech stocks. And one of their favorites is Alphabet. According to Motley Fool Research, Alphabet (along with another digital advertising giant Meta Platforms) tops the list as tech stocks with the most shares at the end of 2023 among billionaire-run hedge funds.

In particular, Bridgewater Associates, founded by billionaire Ray Dalio, owned more than $285 million in Alphabet shares at the end of 2023, making Company Bridgewater’s largest holding company. However, Bridgewater has added more Alphabet shares this year. Since the fund’s last filing in mid-May, Bridgewater now owns 5,368,853 shares, which amounts to approximately $951 million worth of Alphabet stock.

Why is Bridgewater buying Alphabet stock? The answer is simple: Dalio thinks Alphabet shares are cheap. He even said as much in a report released to investors earlier this year.

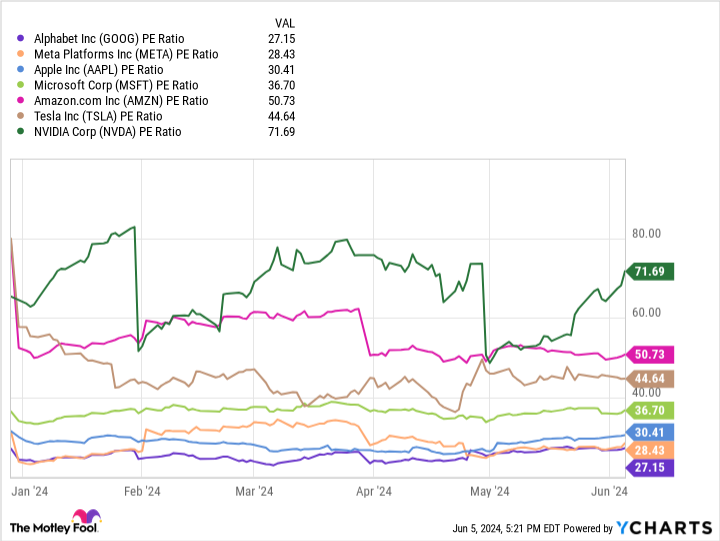

Dalio specifically highlighted that Alphabet’s shares are more affordable than several other stocks in the ‘Magnificent Seven’ category – which is true. Looking at a simple price-to-earnings (P/E) ratio, Alphabet emerges as the most reasonably priced stock among the Magnificent Seven.

A rolling price-to-earnings ratio is a proven measure that helps investors understand the value of a stock. The lower the ratio, the less investors pay for their share of the company’s profits. Conversely, the higher the ratio, the more investors pay for a company’s profits.

For a successful portfolio manager like Dalio, who wants to balance growth and value, Alphabet offers the best of both worlds: a relatively modest price-to-earnings ratio and revenue growth of around 15%.

So for those looking for an affordable growth stock loved by billionaires, it’s time to consider Alphabet.

Uber’s future earnings growth makes the stock a buy today

Justin Pope (Uber Technologies): According to hedge fund research by The Motley Fool, Uber Technologies has become a popular choice among the wealthiest players on Wall Street. The ride-hailing leader ranks in the top 10 holdings for four of the 16 hedge funds analyzed. When the study was published, the top technology holding company was Renaissance Technology, the late billionaire fund manager Jim Simons.

What makes Uber so special? It has become the de facto leader in ride-hailing in the United States and has established a footprint worldwide. Uber has an estimated 76% market share in America, making the company large enough to achieve remarkable operating leverage in recent years. That means revenues are growing faster than expenses, leading to rapid profit growth.

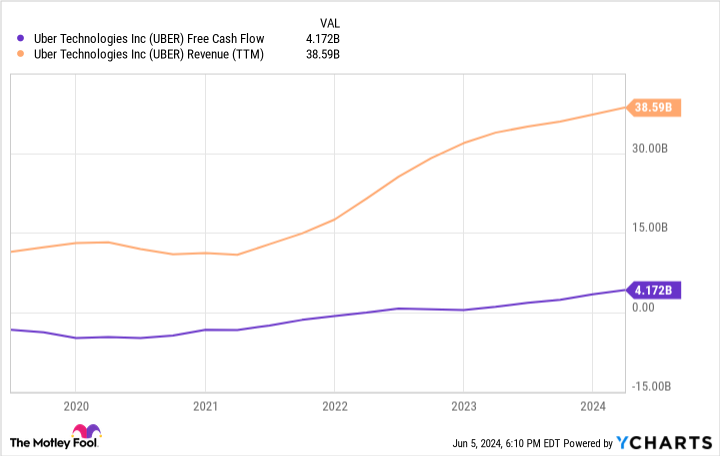

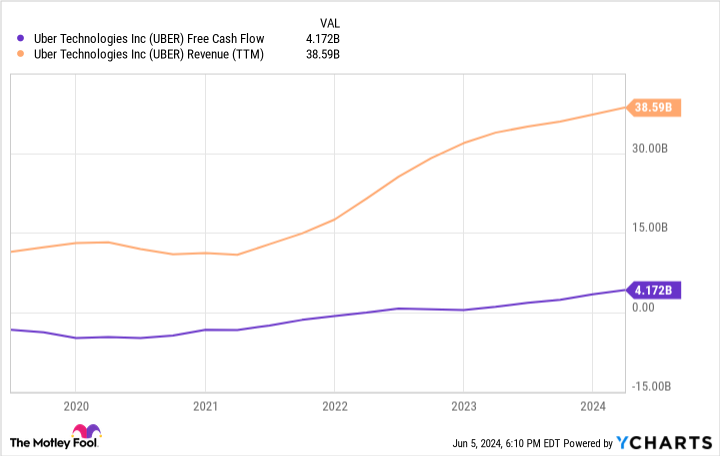

You can see that Uber’s free cash flow started to increase when its revenue exceeded $30 billion at the end of 2022:

Operating results generally follow cash flow. Analysts believe Uber’s earnings per share will grow at an average annual rate of more than 50% over the next three to five years. This seems feasible because Uber is experiencing strong growth and generating new revenue streams. Uber is monetizing its platform traffic in new ways, such as through advertising.

The stock trades at a price-to-earnings ratio of 76. That normally seems expensive, but not if the company is growing profits as quickly as analysts think Uber will. The current PEG ratio of 1.4 indicates that the stock is attractive given Uber’s expected growth. Wall Street’s wealthiest seem to agree.

Active involvement from billionaires could lead to the purchase of Texas Instruments stock

Will Healy (Texas Instruments): Perhaps one of the more unexpected billionaire investments is Elliott Management’s $2.5 billion purchase of Texas Instruments stock. Texas Instruments specializes in analog and embedded chips. It is best known for the invention of the integrated circuit in 1958 and today for its industrial and automotive chips. It has 100,000 customers.

Under its previous CEO, Rich Templeton, it also became known for a dividend that grew at a compound annual growth rate of 24% between 2004 and 2023. Since then, Templeton retired and Haviv Ilan took over as CEO.

It could be Ilan’s leadership that caught the attention of billionaire Paul Singer’s fund. In 2024, the payout increase was only 5%, while the industry collapsed. Moreover, a $5 billion commitment to build additional factories helped push free cash flow over the past twelve months down 79% in a year to $940 million, well below the annual dividend cost of $4.7 billion.

In his letter to Texas Instruments’ board, Elliott noted declining free cash flows and the belief that capacity expansion ambitions far exceed expected demand. To that end, Elliott wants the company to increase its free cash flow above $9 per share by 2026, well above the current annual payout of $5.20 per share.

For now, investors may want to wait and see the company’s response to Elliott’s shareholder activism before adding shares. Texas Instruments consistently outperformed the S&P500 until about a year ago, implying that semiconductor stocks responded well to Templeton’s management philosophy. If Elliott can convince the company to reprioritize free cash flow, the shares could become a buy again, especially for income investors.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, Nvidia and Tesla. Justin Pope has no position in any of the stocks mentioned. Will Healy has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, Texas Instruments and Uber Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Have you heard? Billionaires are buying up shares of these three stocks. was originally published by The Motley Fool