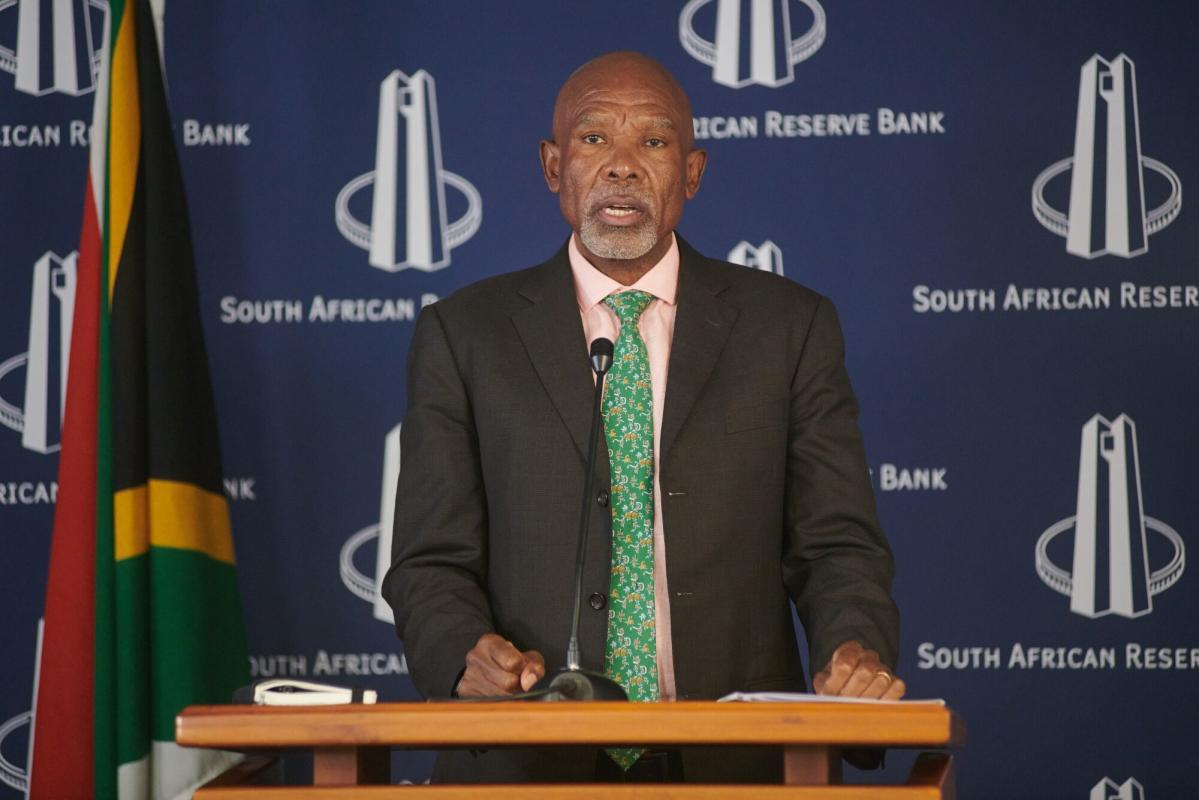

(Bloomberg) — Lesetja Kganyago, governor of the South African Reserve Bank, said he and his fellow monetary policymakers will remain committed to their task of ensuring price stability regardless of the political uncertainty caused by last week’s elections.

Most read from Bloomberg

“We will continue to deliver on that mandate, regardless of how our post-election politics plays out, regardless of the outcome in the next two weeks,” he told an audience at the Soweto Theater, southwest of Johannesburg, on Tuesday. “We will continue to be accountable to Parliament and work for the economic betterment of all South Africans.”

The African National Congress lost its parliamentary majority in the May 29 elections for the first time since it took power in 1994 and is now talking to its smaller rivals about a power-sharing pact.

Possible combinations include a coalition with the centrist Democratic Alliance, or a partnership with the left-wing Economic Freedom Fighters, or the uMkhonto weSizwe Party, led by former ANC and national president Jacob Zuma.

The talks must be completed within two weeks of the election results being announced on Sunday.

“The only impact is what kind of policies a coalition will come up with and whether those policies are sustainable,” Kganyago said. “If the policies are not sustainable, we may not have investments; if it is sustainable, we will talk about a different future.”

The central bank held interest rates steady at a 15-year high of 8.25% last week, warning that while price pressures have eased in recent months, they are still too high. The decision was widely anticipated, with economists expecting the central bank to keep a low profile when it delivered its verdict a day after South Africans voted.

South African inflation fell for the second month in a row to 5.2% in April. But the central bank is focused on bringing rates back to the middle of its target range of 3% to 6%, where it prefers to anchor expectations.

Officials nodded to the recent improvement and updated their May 30 policy statement to say inflation risks are now broadly balanced, a shift from March when they saw risks tilted to the upside. They also revised their forecast to predict price pressures will stabilize at 4.5% in the second quarter of next year, compared to March end of 2025.

However, officials were careful not to give the impression that they were leaning in a dovish direction, which could indicate interest rate cuts would happen soon, noting that the task of achieving our inflation target is not yet complete.

Kganyago struck a similar tone in Soweto, warning that while officials expect price pressures to ease to 4.5% in the first half of next year, “achieving that target is likely to be a bumpy and difficult path.”

(Updates with more Kganyago commentary in the sixth and final paragraph.)

Most read from Bloomberg Businessweek

©2024 BloombergLP