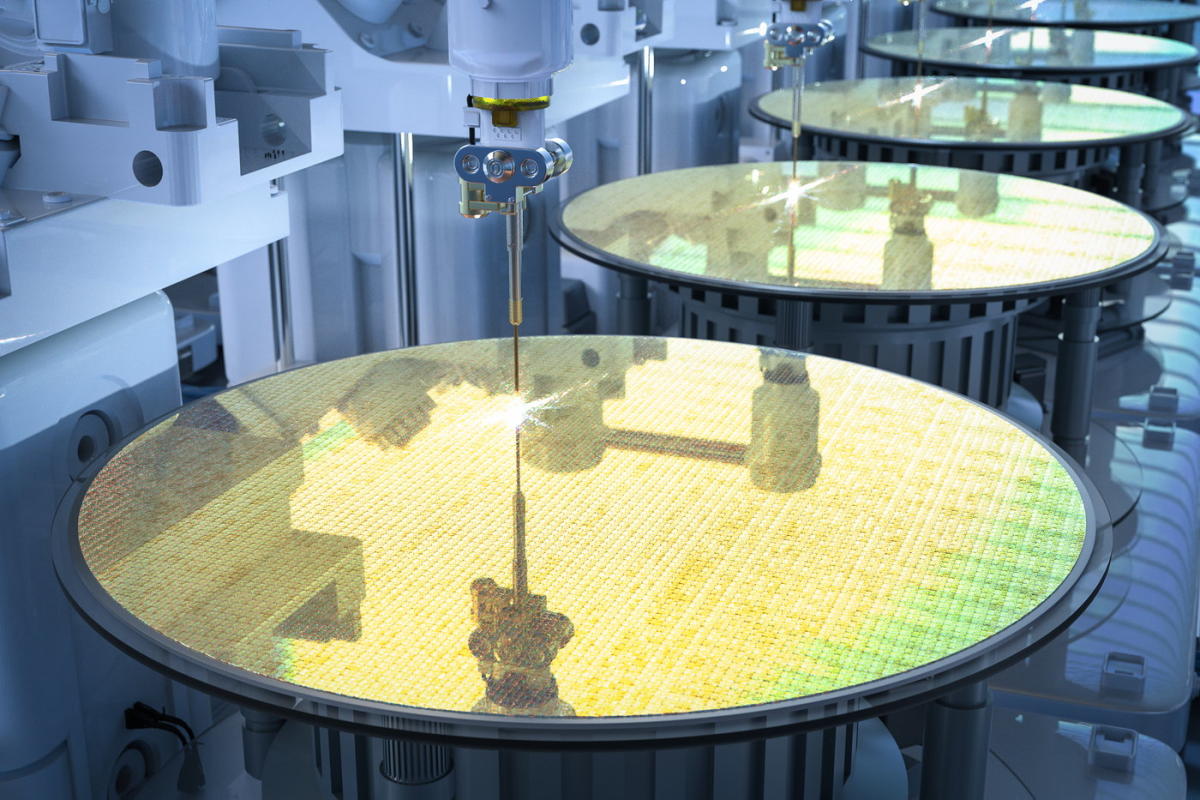

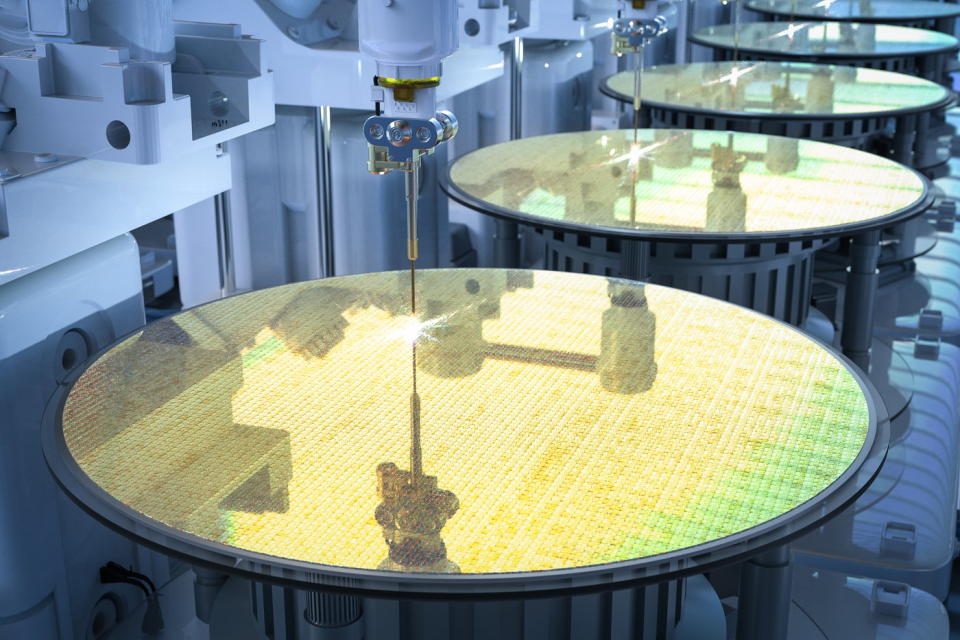

There is probably no better name in the field of artificial intelligence (AI) than Nvidia (NASDAQ: NVDA). From specials 60 minutestalking heads on financial news programs and headlines all over the internet, Nvidia is everywhere.

There is so much discussion about the company that it is difficult to keep track. A recent update from Nvidia is the company’s upcoming 10-for-1 stock split.

Let’s take a look at how stock splits work and how they can impact the decision to invest in a company.

1. How do stock splits work?

During a stock split, a company’s outstanding shares increase by the factor stated in the split ratio. At the same time, the company’s stock price is reduced by the same proportion.

At the time of writing, Nvidia has approximately 2.5 billion shares outstanding and trades at $1,145. If the split were to happen today, Nvidia’s share count would increase tenfold, resulting in roughly 25 billion shares. Furthermore, the stock price would be approximately $114.

Given these dynamics, stock splits do not change a company’s market capitalization.

2. Why is Nvidia splitting its shares?

Overall, capital markets have performed quite strongly over the past eighteen months. Since January 2023, the S&P500 has risen by 37%, while the Nasdaq Composite has returned almost 60%. Much of this performance can be attributed to bullish sentiment around AI.

When it comes to AI, Nvidia is leading the next big wave in the technology sector. Nvidia shares are up more than 680% since January 2023 and are up about 130% so far in 2024.

Given the sharp price increase in a relatively short period of time, Nvidia shares can be perceived as expensive. Stock splits are common when management wants to make shares more accessible to a broader base, especially retail investors.

But like I said, stock splits don’t actually change a company’s market cap. Therefore, the lower share price after the split does not mean that you are actually investing in Nvidia at a more attractive price. In fact, this is rarely the case, and I’ll explain why.

3. How are stock splits handled?

One of the most convenient aspects of a stock split is that investors don’t have to do anything. Investment firms and brokerage firms take care of the details in the background.

Let’s say you own 10 shares of Nvidia at an average price of $1,000. After the stock split, your trading account shows that you now own 100 shares of Nvidia, each at a cost of $100.

4. Has Nvidia ever split its stock before?

Nvidia has split its shares five times in the past; the most recent was a 4-for-1 split in July 2021.

Since Nvidia’s last split about three years ago, its shares have risen sixfold.

5. Should you buy Nvidia stock before or after the split?

Investors spend a lot of time wrestling with the question of when to buy a stock and when to sell. The uncomfortable answer is that there is never a perfect time to do this either. However, there are some things to be aware of when it comes to stock splits.

In general, stock split stocks experience some volatility in the days following a split. Investors view the split-adjusted price as cheaper, so they start pouring in.

This psychological tendency often opens the door to day traders, who ride the momentum and dump stocks quickly for quick profits. Additionally, this increase in buying activity pushes the valuation higher, meaning you are purchasing the stock at a more expensive price compared to before the split.

This dynamic can be seen in the graph from the previous section. You can see that the stock price rose briefly for a short period after the split, then dropped.

So, should you invest in Nvidia before the split? In my opinion, the exact timing of your investment is not that important. Spending time in the market is more important than trying to time the market.

Investors should maintain a long-term horizon when it comes to growth opportunities like AI and Nvidia specifically. Monitoring a company’s progress, both from a sales and profitability perspective, over many years is the key to generating outsized returns for your portfolio.

Considering AI is still in its infancy and Nvidia’s potential in technology in general, I see the stock as an attractive opportunity regardless of whether investments are made before or after the split.

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Adam Spatacco has positions at Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Here are 5 things smart investors need to know about Nvidia’s 10-for-1 stock split, originally published by The Motley Fool