Unusually high inflation and an environment of rising interest rates have played a crucial role in affecting the macroeconomy in recent years. But despite these economic pressures, the stock market is generally showing some signs of strength.

Although the technology is tough Nasdaq Composite The index fell 33% in 2022 and showed significant resilience last year, rising 43%, thanks to the evolving euphoria around artificial intelligence (AI). This momentum has continued into 2024; the Nasdaq has already returned about 13% so far this year.

Since its inception in 1971, the Nasdaq has posted negative returns only twice in a row. The last time this happened was between 2000 and 2002.

Given the long-term tailwinds that AI is currently fueling, I see further gains on the horizon for the tech sector. Below, I’ll break down five stocks that operate at the intersection of software and AI, and assess why each is an attractive buy for long-term investors.

1. Palantir

Palantir Technologies (NYSE:PLTR) is an enterprise software platform used by the US military and its Western allies, as well as major private sector companies. AI-powered software is an intense market dominated by big tech. Nevertheless, Palantir has done a respectable job of making a name for itself.

Over the past year, the company resorted to an unorthodox lead generation strategy to bring its latest product, the Palantir Artificial Intelligence Platform (AIP), to market. Specifically, the company hosts immersive seminars called “boot camps” in which potential customers can demonstrate the company’s software and identify a use case.

This approach seems to be paying off. For the quarter ended March 31, Palantir’s customer base grew 42% year over year. But more importantly, the company is rapidly expanding beyond its existing government contracting business. The number of commercial customers in the US increased 69% year over year in the first quarter.

In addition to accelerating revenue, Palantir’s operating margins are also increasing. This flows directly to the bottom line as the company generates positive net income and free cash flow.

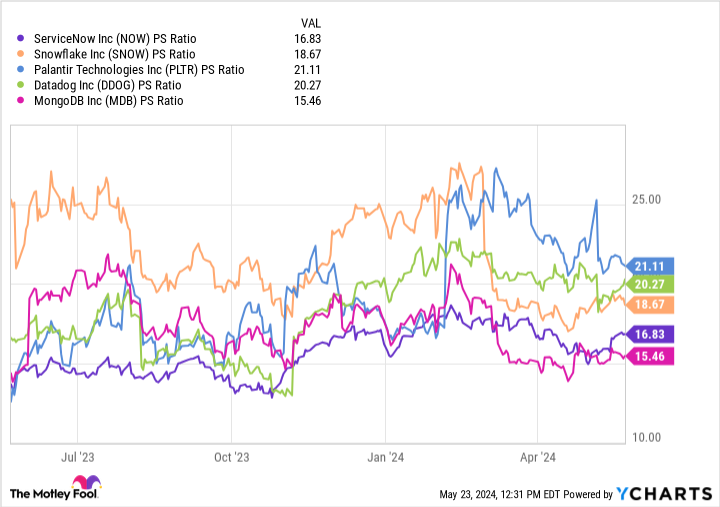

Its price-to-sales ratio (P/S) of 21 isn’t necessarily dirt cheap, but the chart below helps put things into perspective. Considering Palantir’s current P/S is well below previous highs, this could be an interesting time to buy the dip.

2. Shopify

Shopify (NYSE: STORE) is an e-commerce platform for small and medium-sized enterprises (SMEs), but also for large companies.

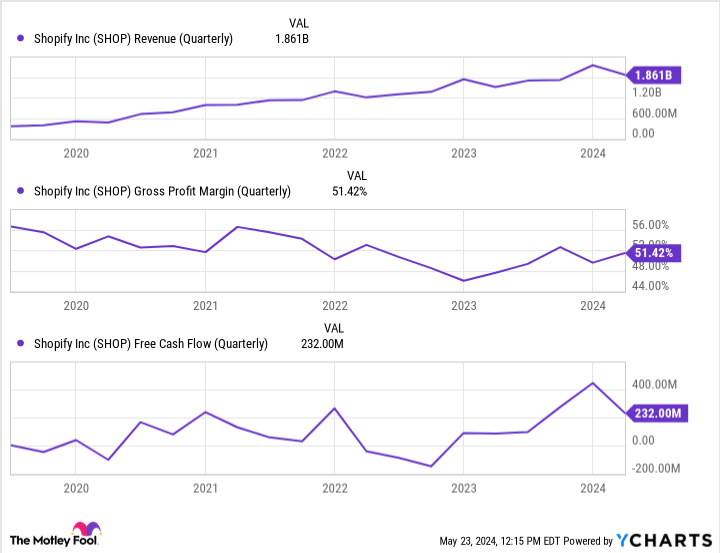

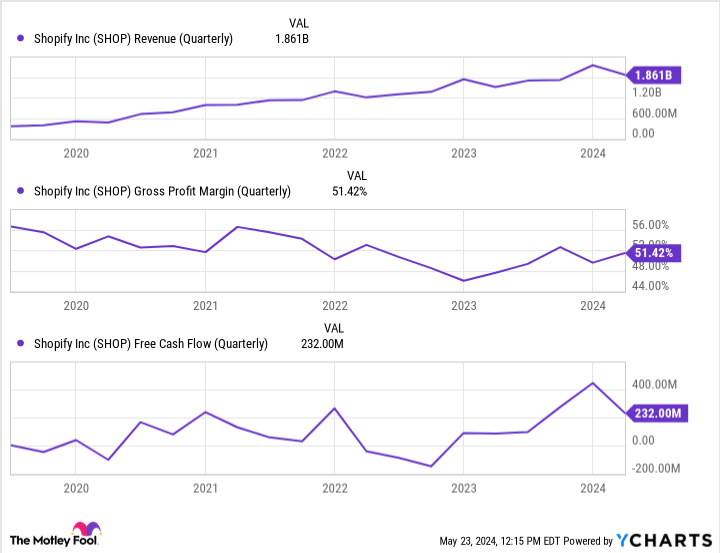

The charts below illustrate some key financial metrics for Shopify. Overall, I’d say the company’s revenue, margins and cash flow are all moving in the right direction. However, there are a few important points to note.

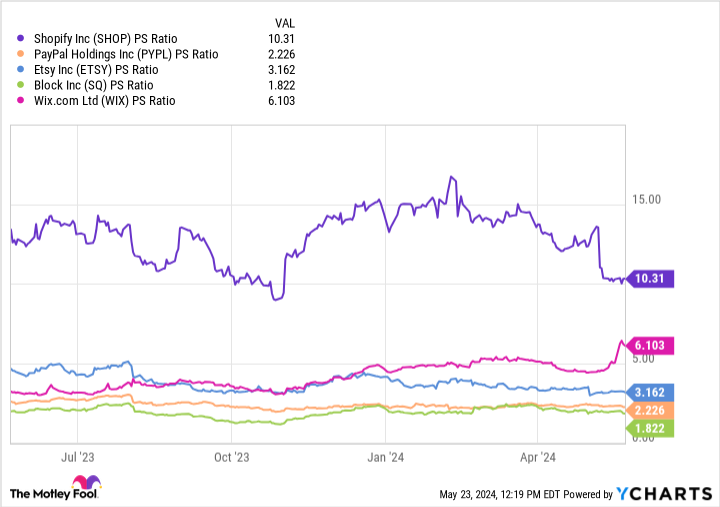

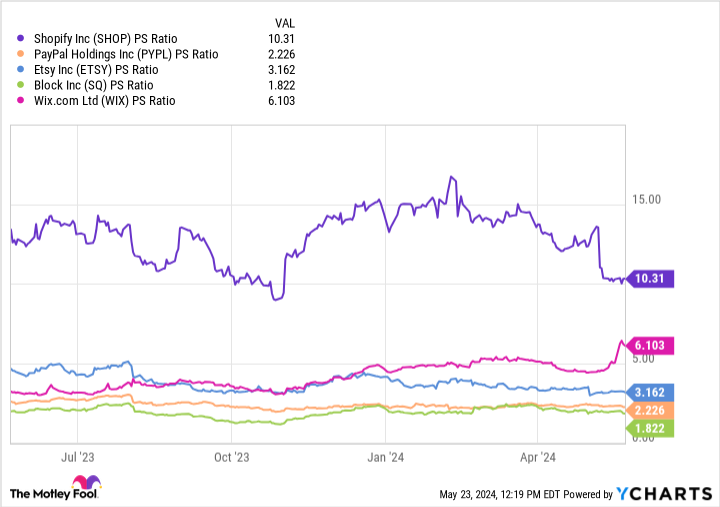

Shopify’s operating performance has been inconsistent in recent years. Much of this can be attributed to a failed acquisition of a logistics company called Flexport, as well as a series of layoffs to help reduce costs. Plus, Shopify stock trades at a noticeable premium when you compare it to a cohort of e-commerce peers.

Shopify represents something of a turnaround story. I suspect the company will invest aggressively in new products and services, an effort that will take a toll on short-term profits. However, these steps are a compelling strategy to build a long-term growth story.

Additionally, I wouldn’t discount Shopify’s potential as it relates to AI and fintech more broadly. While the company’s valuation may be high right now, I would still consider picking up some shares of Shopify to hold for the long term.

3. ServiceNow

The next company on my list is Service now (NYSE: NOW)an enterprise software platform for IT management.

What makes ServiceNow unique is its ability to cross-sell. Over the past two years, ServiceNow has grown the number of customers paying at least $1 million per year from 1,405 to 1,933. With a renewal rate of 98%, the company has an extremely close customer base.

Even better, as of March 31, ServiceNow had $17.7 billion in remaining performance obligations (RPO), representing 27% year-over-year growth. ServiceNow not only expands and renews existing customers at a rapid pace, but also realizes a high degree of net new revenue.

With a P/S of 16.8, ServiceNow appears undervalued compared to many of its peer software-as-a-service businesses.

4. monday.com

monday.com (NASDAQ: MNDY) is building customer relationship management (CRM) and automation tools for the workplace productivity market – an opportunity expected to reach $13 trillion by 2030, according to Cathie Wood, CEO of Ark Invest. While there are many workplace automation software tools available, Monday.com has shown impressive growth.

For the first quarter ended March 31, the company increased revenue 34% year over year to $217 million. Additionally, net dollar retention was 110%, implying that the company is expanding its existing customers while generating strong new revenue.

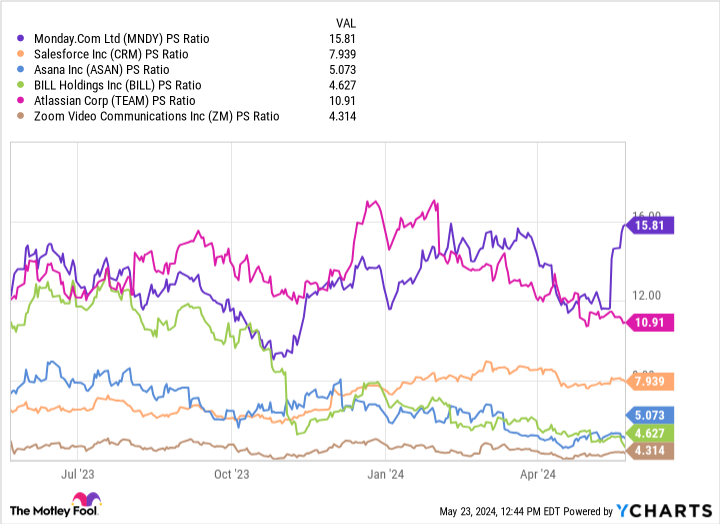

Like Shopify, Monday.com trades at a noticeable premium to its peers. The company generates positive free cash flow and operating losses are approaching breakeven levels. This has a lot to do with the impressive sales growth, which management believes will continue.

I think Monday.com’s premium is valid and consider the stock a good buy right now.

5. CrowdStrike

CrowdStrike (NASDAQ: CRWD) provides cloud-based identity management and endpoint cybersecurity solutions.

Cybersecurity is a huge market with many different use cases. Furthermore, the proliferation of AI only adds to new use cases that could help fuel the cybersecurity domain in the long run. CrowdStrike management believes the total addressable market is currently $100 billion. However, management believes the market opportunity will more than double to $225 billion by 2028.

Considering that CrowdStrike’s revenue is only $3 billion, the company appears to have a greenfield opportunity. In addition, revenues are growing by over 30% year over year, while operating margins are increasing and contributing to consistent profitability.

Although shares are up 136% in the past year, the company’s price-to-earnings ratio of 27.7 is well below its five-year average of 30.5. This could be a great opportunity to pick up some stocks and enjoy the tailwinds driving cybersecurity and AI.

Should You Invest $1,000 in Palantir Technologies Now?

Before you buy shares in Palantir Technologies, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Adam Spatacco holds positions at Block, CrowdStrike, Palantir Technologies and Shopify. The Motley Fool holds and recommends Asana, Atlassian, Bill Holdings, Block, CrowdStrike, Datadog, Etsy, Monday.com, MongoDB, Palantir Technologies, PayPal, Salesforce, ServiceNow, Shopify, Snowflake, Wix.com, and Zoom Video Communications . The Motley Fool recommends the following options: June 2024 short calls of $67.50 on PayPal. The Motley Fool has a disclosure policy.

History says the Nasdaq will boom in 2024: Here are my top 5 software growth stocks to buy now. originally published by The Motley Fool