Artificial intelligence (AI) will transform multiple industries ranging from smartphones to personal computers, automotive, digital advertising and cloud computing. Investors should look for potential AI winners in these niches as they could deliver healthy gains in the stock market.

For example, according to Mordor Intelligence, the cloud AI market is expected to achieve annual growth of more than 32% through 2029, generating $274 billion in annual revenue by the end of the forecast period. Major cloud computing providers such as Microsoft And Amazon are some of the names that can help investors capitalize on this huge opportunity.

However, I would like to take a closer look DigitalOcean (NYSE: DOCN), a cloud company that recently announced its quarterly results and suggests that AI-related demand will exceed supply. Let’s take a look at the reasons why DigitalOcean could become a top AI stock in the long term.

Demand for DigitalOcean’s AI-focused services is growing

DigitalOcean announced its first-quarter results on May 10, and revenue and profit were well above analyst expectations. The company’s revenue rose 12% year over year to $185 million, ahead of the consensus estimate of $182.6 million. DigitalOcean’s adjusted earnings, meanwhile, shot up just over 50% to $0.43 per share, beating the consensus estimate of $0.38 per share.

Additionally, DigitalOcean management raised the lower end of its full-year guidance to $760 million from $755 million. On the higher end, the company expects to achieve $775 million in revenue this year. The midpoint of the current guidance range would translate into an 11% increase in sales this year.

Of that, AI is expected to contribute 3 percentage points to DigitalOcean’s growth this year. However, don’t be surprised if you see AI making a greater contribution to business growth in the future thanks to the market it targets. During the company’s latest earnings conference call, CEO Paddy Srinivasan noted: “We are seeing strong revenue growth for our early-stage AI solutions as we continue to ramp up our initial GPU capacity through the first part of this year. And our expectations are that demand will continue to exceed supply for the foreseeable future.”

DigitalOcean targets customers who want to deploy a variety of smaller AI models instead of using just one large language model (LLM), which can be expensive to train and deploy. Demand for this service is high, with DocuSign’s annual recurring revenue from its AI platform-as-a-service (Paas) offering increasing an impressive 128% from the first quarter quarter.

Demand for DigitalOcean’s AI GPU-as-a-service is also increasing at a nice pace. The company launched this service in January this year and witnessed a 67% increase in consumption from March to April. Both markets offer enormous growth opportunities for DigitalOcean.

According to third-party estimates, the AI PaaS market is expected to grow at nearly 21% annually through 2028 and generate nearly $15 billion in revenue by the end of the forecast period. Meanwhile, the global GPU-as-a-service market could achieve annual growth of nearly 36% through 2032 and generate nearly $50 billion in annual revenue.

DigitalOcean could therefore generate more spend from its customer base in the long run, leading to higher average revenue per user (ARPU). The company’s ARPU rose 8% year-over-year to $95.13 in the first quarter, while its total customer base increased 3%. While these numbers don’t seem very attractive right now, increasing adoption of AI services could help accelerate growth. Therefore, analysts expect it to grow at a faster pace.

Stronger growth and an attractive valuation make it worth buying

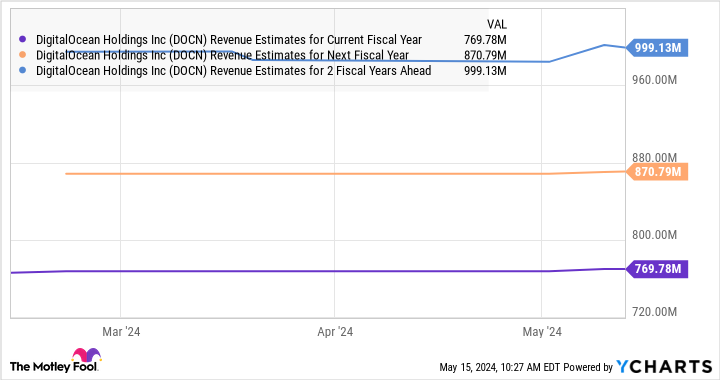

We’ve already seen that Digital Ocean is expected to achieve 11% revenue growth by 2024. However, as the following chart indicates, the company’s revenue growth will improve from 2025 onwards.

Furthermore, investors can currently buy this AI stock at just 5.3 times sales. That’s lower than the 7.2 sales multiple for the US technology sector. Assuming that DigitalOcean is rewarded with a higher sales multiple after three years thanks to its AI-driven growth, and that it trades at the tech sector average and reaches nearly $999 million in revenue by 2026 according to the chart above, its market cap could rise to $7.2 billion.

That would be double DigitalOcean’s current market capitalization. Investors would do well to buy this potential AI winner while it is still cheap.

Should You Invest $1,000 in DigitalOcean Now?

Consider the following before purchasing shares in DigitalOcean:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and DigitalOcean wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, DigitalOcean, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Here’s My Top Artificial Intelligence (AI) Stock to Buy and Hold was originally published by The Motley Fool