Sometimes politicians seem to have an uncanny ability to beat the market. In recognition of this, many investors outside the Beltway are paying particular attention to the dealings of our Senators and Representatives – such as those of Rep. Marjorie Taylor Greene, R-Ga.

Last week, Greene filed a regulatory filing that revealed six recent stock purchases: Advanced Micro Devices (NASDAQ: AMD), Apple (NASDAQ: AAPL), Caterpillar (NYSE: KAT), Karel Schwab (NYSE: SCHW), Friendlier Morgan (NYSE: KMI)And Southern Company (NYSE: DUS). It is not clear how much Greene invested in each of the stocks, although each trade was worth between $1,001 and $15,000. Greene serves on the Oversight and Reform Committee and the Homeland Security Committee.

What you need to know about Greene’s recent purchases

While Greene hasn’t explained the motivation behind her recent stock purchases, there are some likely reasons why she’s hit the buy button on some of these names. First, Advanced Micro Devices and Apple are leading tech stocks that offer exposure to artificial intelligence (AI) – something that is red hot right now.

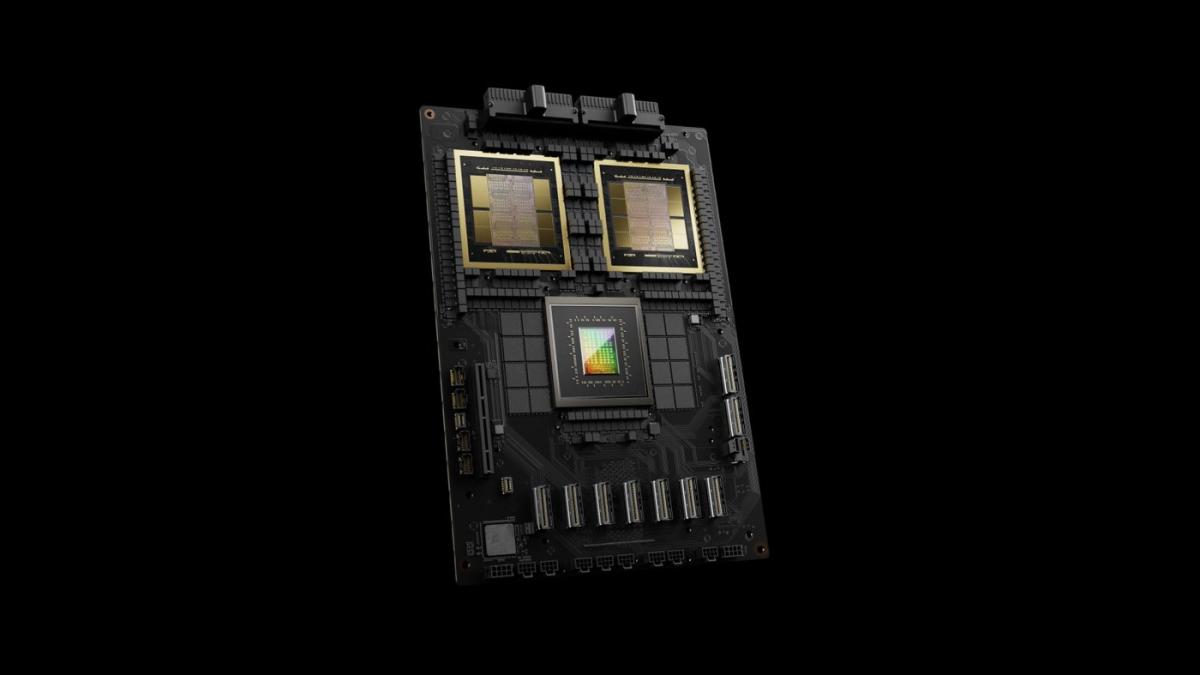

Semiconductor stock AMD is taking a bigger step toward AI with its new graphics processing units (GPUs), an area where Nvidia is currently the reigning champion. Apple is trying to expand its AI reach in several ways, including developing a new large language model advancement system called ReALM that could significantly improve Siri’s functionality.

Three infrastructure stocks also found their way onto Greene’s buying screen. There are a number of reasons why she may have been motivated to acquire these household names. First, many projects are taking shape in response to the bipartisan infrastructure bill passed in 2021. This will provide a strong tailwind for Caterpillar, a heavy machinery powerhouse, in the coming years. The company reported a $400 million quarter-over-quarter increase in order book during its first-quarter 2024 financial results presentation. In addition, Caterpillar has demonstrated a long-standing commitment to shareholders. After increasing its dividend for the past 30 consecutive years, Caterpillar also began a $3.5 billion stock buyback plan.

As a leading pipeline stock, Kinder Morgan is also poised for growth from infrastructure spending. The company expects natural gas demand to grow approximately 19% between 2023 and 2030, and has approximately $2.5 billion in natural gas projects in inventory – a figure that is expected to continue to grow. Like Caterpillar, Kinder Morgan is also an attractive income stock, with a dividend yield of 5.8%.

Southern Company is yet another infrastructure stock Greene is banking on to build a better portfolio. A familiar name for the Georgia representative, the utility is headquartered in Atlanta. Southern Company recently began operations at its new Plant Vogtle Unit 3 nuclear power plant, providing electric service in the Southeast and natural gas service to 4.4 million customers in 10 states. Southern Company has paid a dividend for 77 consecutive years and increased it for the last 23 consecutive years.

Retail heavyweight Charles Schwab rounds out Greene’s latest purchases. After a strong start to 2024, Greene financial stocks offer some diversification, as well as more passive income, with a forward dividend of 1.3%.

Should you emulate Greene’s purchases?

While it is worth checking which stocks politicians add to their holdings, it is foolhardy to blindly follow their stock choices. There are certainly bull cases to be made for all the stocks Greene recently purchased, but there are also skeptics who can present bear cases for the stocks. Consequently, investors must do their own due diligence and decide whether the individual stocks are right for them.

Should You Invest $1,000 in Apple Right Now?

Before you buy shares in Apple, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. Scott Levine has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Apple, Charles Schwab, Kinder Morgan, and Nvidia. The Motley Fool recommends the following options: Short June 2024 puts $65 on Charles Schwab. The Motley Fool has a disclosure policy.

Marjorie Taylor Greene Just Loaded Stock: Here Are the 6 She Bought was originally published by The Motley Fool