Cathie Woods ARK Invest rose to prominence during the unprofitable growth stock boom of 2020 and 2021, helped by a high concentration in Tesla (NASDAQ: TSLA) – which rose as much as 743% in 2020.

But over the past five years, all of Ark’s major exchange-traded funds (ETFs) have underperformed S&P500 and the Nasdaq Composite. Here’s how Ark Invest lost its lead in the market, why the funds have largely missed the boat on artificial intelligence (AI) and how you can avoid making the same mistake.

ARK’s strategy

Each year, ARK publishes a 100+ page research report on the best and biggest ideas and the companies it invests in to capitalize on these trends. What made ARK get a lot of attention is that it heavily weighted relatively small companies and excluded most of the mega-cap names (except Tesla).

ARK has six actively managed ETFs. I have ruled out the one ARK Space Exploration & Innovation ETF (NYSEMKT: ARKX) in this article because the fund was launched just a few years ago and has only $236 million in net assets.

-

ARK Innovation ETF (NYSEMKT: ARKK)

-

ARK Next Generation Internet ETF (NYSEMKT: ARKW)

-

ARK Fintech Innovation ETF (NYSEMKT: ARKF)

-

ARK Autonomous Technology & Robotics ETF (NYSEMKT: ARKQ)

-

ARK Genomic Revolution ETF (NYSEMKT: ARKG)

Here’s a look at the top 10 holdings in each of the other five actively managed ETFs.

|

Top 10 largest holding companies (in order) |

ARK Innovation ETF |

ARK Next Generation Internet ETF |

ARK Fintech Innovation ETF |

ARK Autonomous Technology & Robotics ETF |

ARK Genomic Revolution ETF |

|---|---|---|---|---|---|

|

1 |

Tesla |

ARK Bitcoin ETF HoldCo |

Coinbase worldwide |

Tesla |

Twist Biosciences |

|

2 |

Coinbase worldwide |

Tesla |

Shopify |

Teradyne |

CRISPR therapies |

|

3 |

Roku |

Roku |

Block |

Kratos Defense and Security |

CareDx |

|

4 |

Block |

Coinbase worldwide |

DesignKings |

UiPath |

Recursion pharmaceutical products |

|

5 |

UiPath |

Block |

UiPath |

Iridium Communications |

Modern |

|

6 |

CRISPR therapies |

Roblox |

Robinhood Markets |

Trimble |

Intellia Therapeutica |

|

7 |

Roblox |

Robinhood Markets |

Toast |

AeroVironment |

Arcturus Therapeutics Holdings |

|

8 |

Robinhood Markets |

UiPath |

ARK Bitcoin ETF HoldCo |

Komatsu |

Schrodinger |

|

9 |

Zoom video communication |

Metaplatforms |

Adyen |

Deere |

Ionis pharmaceutical products |

|

10 |

Palantir Technologies |

Unity software |

|

Taiwanese semiconductor |

Beam therapies |

Data source: ARK Invest.

There are several duplicate investments in multiple funds. For example, UiPath is in four out of five funds, and Tesla, Robinhood, Block and Coinbase are in three out of five. There is a lot of overlap between the ARK Innovation ETF, Next Generation Internet ETF and the Fintech Innovation ETF.

What has led to ARK’s underperformance is a high concentration in a few fairly niche companies within its ETFs. Many of these stocks have cooled off since their rise in 2020 and 2021 and are down significantly from those highs.

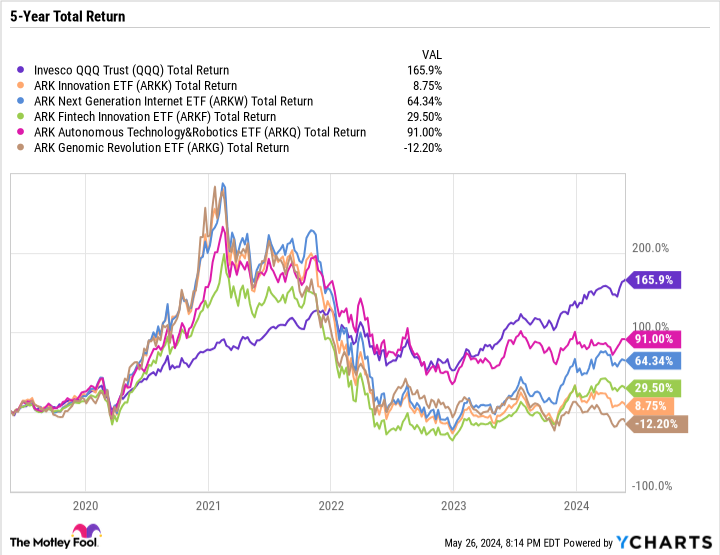

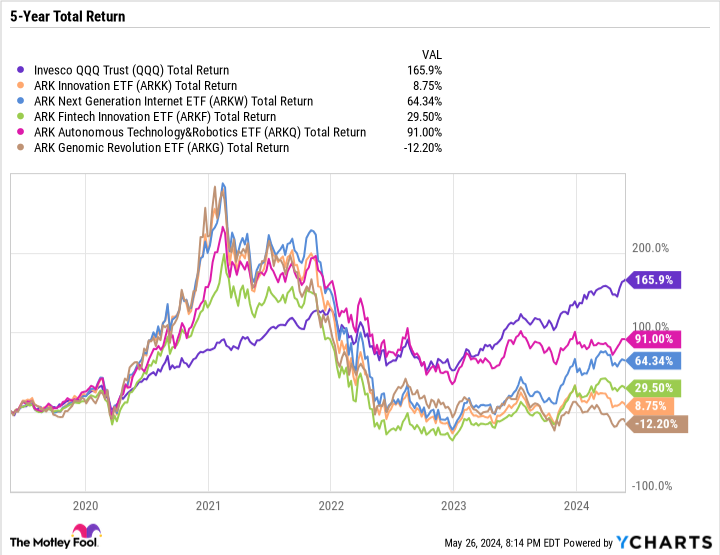

The Invesco QQQ Trust (NASDAQ: QQQ) reflects the performance of the Nasdaq-100 – including the 100 largest non-financial companies in the Nasdaq Composite. Given their fast-growing nature, we’ll use this as a benchmark instead of the S&P 500 to see how these funds fare.

Year to date, the Invesco QQQ is up 12%, and the best-performing ARK ETF, the Next Generation Internet ETF, is up just 2%. The disparity widens over a three-year horizon, with Invesco QQQ rising more than 40%, compared to a decline of 28% or more across all five major ARK ETFs. Even looking back over the past five years, including the run-up to 2020 in many of ARK’s top holdings, all five ETFs still tracks the Invesco QQQ, which indicates the severity of the selloff in many of ARK’s favorite companies compared to the gains of top growth stocks.

The dangers of underweight market leaders

ARK’s underperformance is highlighted by two major misses in recent years. The first and most important is that mega-cap stocks, not small-cap stocks, have led the market to new highs in most sectors. ARK’s active ETFs do not focus on mega-cap stocks, so they have missed this trend. The mega-cap stock that ARK is a big fan of, which again is Tesla, is down about 24% since the start of 2021.

The second and more glaring miss is that ARK didn’t have enough exposure to AI, which was led by mega-cap growth companies like Nvidia and other chip supplies, Microsoft, Alphabet, Amazon, Metaplatforms, and others. It has some small positions in AI-focused companies and even some big tech names, but not enough to move the price of an ETF.

Index funds and sector-based ETFs are market-cap weighted to include high exposure to these massive giants. But ARK’s allocation is based on best ideas, not market capitalization. And unfortunately, these ideas haven’t been very good in the medium term. It could still work out, but for now the shortcomings of ARK’s strategy are on full display.

While there’s no perfect formula for ensuring you have “enough” mega-cap growth stocks in your portfolio, there are certain thresholds to keep in mind. The technology sector represents 29.2% of the S&P 500. The ‘Magnificient Seven’ – including Microsoft, Apple, Nvidia, Amazon, Alphabet, Meta Platforms and Tesla – represent 31.4% of the S&P 500, but there are names outside these there are plenty of mega-cap growth stocks that have a high weight in the index. It’s also worth noting that Amazon and Tesla are in the consumer discretionary sector, not the technology sector. And Alphabet and Meta Platforms are in the communications sector.

All told, I’d say any portfolio with sub-40% to 50% growth in mega-caps has probably underperformed the major indices in recent years. If you are primarily invested in companies outside of mega-cap growth and have the risk tolerance to approach this space, but don’t know where to start, it may be a good idea to Vanguard Mega Cap Growth ETF (NYSEMKT: MGK).

That ETF has crushed the Nasdaq Composite and S&P 500 in recent years, has huge exposure to technology and the consumer discretionary sector, and has 55% of its weighting in Microsoft. Apple, Nvidia, Alphabet, Amazon and Meta platforms. It also only has an annual fee of 0.07% – or $7 for every $10,000 invested.

Due to the high concentration in a few names and themes, the fund is likely to be extremely volatile based on the earnings performance of the top companies and investor sentiment. But it’s a great way to fill a hole in your portfolio if you’re underweight some of the largest and most important companies on the market.

Use ETFs to your advantage

In the stock market, anything can go up in the short term, which often happens for the wrong reasons. But in the long run, fundamentals win.

ARK Invest gained popularity because its strategy perfectly aligned with what was popular at the moment and because it stood behind Tesla when there was widespread doubt that it could ever reach the mass market. ARK deserves a lot of credit for making this bold call to Tesla, but that doesn’t mean it’s worth repeating every move made by Cathie Wood and her team.

As an individual, you can choose which funds or celebrity investors you look up to, while also understanding their weaknesses and the context of their investments. The fun of investing in individual stocks comes from understanding a company well and believing in the long term. And if you want to invest in a particular sector or theme but don’t have high-conviction ideas, an ETF is a good way to fill a gap and achieve diversification at the same time.

Should you invest $1,000 in Ark ETF Trust – Ark Innovation ETF now?

Consider the following before purchasing shares in Ark ETF Trust – Ark Innovation ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Ark ETF Trust – Ark Innovation ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Adyen, AeroVironment, Alphabet, Amazon, Apple, Beam Therapeutics, Block, CRISPR Therapeutics, Coinbase Global, Intellia Therapeutics, Ionis Pharmaceuticals, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, Pinterest, Roblox, Roku to , Shopify, Taiwan Semiconductor Manufacturing, Tesla, Toast, Twist Bioscience, UiPath, Unity Software and Zoom Video Communications. The Motley Fool recommends Deere & Company, Moderna, Teradyne and Trimble and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Here’s how Cathie Wood (almost) completely missed the boat on artificial intelligence (AI) – and the easiest way you can avoid making the same mistake, originally published by The Motley Fool