War. Natural disasters. Congressional power. Any of these can devastate public perception of a presidential administration. Presidents are also often judged – fairly or not – by how the stock market performs during their time in office.

By looking at each presidency in numbers, we’ll see what lessons investors can learn, and how this can help them become smarter, happier, and richer.

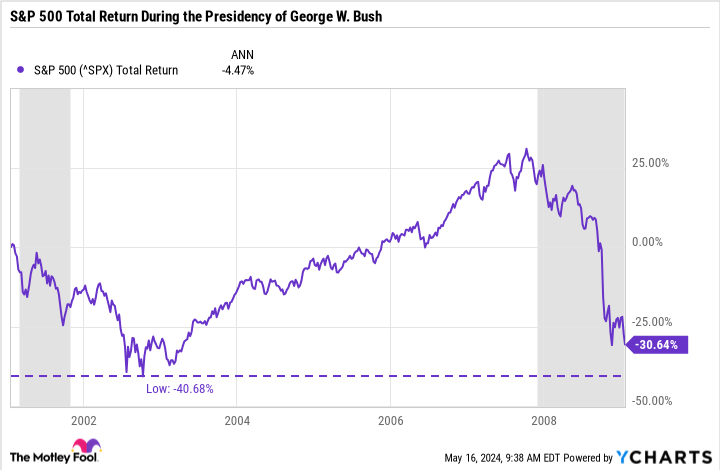

George W. Bush (2001–2009)

George W. Bush was sworn in at noon on Saturday. January 202001 – the day and time set in the constitution – with the S&P500 to have slipped about 12% from its all-time high when the dot-com bubble started to burst. Over the next few months, financial conditions continued to deteriorate, spurred by a series of financial scandals, the beginning of a formal one recessionand the terrorist attacks on September 11, 2001. All told, the S&P 500 would bottom out in late 2002, falling nearly 50%.

The gray bars in the graphs in this article indicate recessions in the US.

Despite this difficult period, the economy recovered and the market recovered all its losses and more. By early 2007, the S&P 500 had risen more than 25% since the start of Bush’s presidency.

Still, storm clouds were gathering. The stock market peaked mid 2007 and investment banks Bear Stearns and Lehman Brothers failed the following year, leading to the Great Recession.

Bush left office at the height of the recession. General, the stock market as measured by the S&P 500 fell almost 31% during his term. So buying on day 1 of his administration and selling on the last day would not have proven to be a profitable move. However, investors who bought shares of the S&P 500 on his first day as president and held on to them until today would have richly rewarded.

A $10,000 investment would now be worth about $60,000, which equates to a compound annual growth rate (CAGR) of 8%.

|

Time frame |

Value of an investment of $10,000 |

Total refund |

Compound annual growth rate |

|---|---|---|---|

|

January 20, 2001 – January 20, 2009 |

$6,936 |

(30.64%) |

(4.5%) |

|

January 20, 2001 – May 17, 2024 |

$61,770 |

517% |

8.2% |

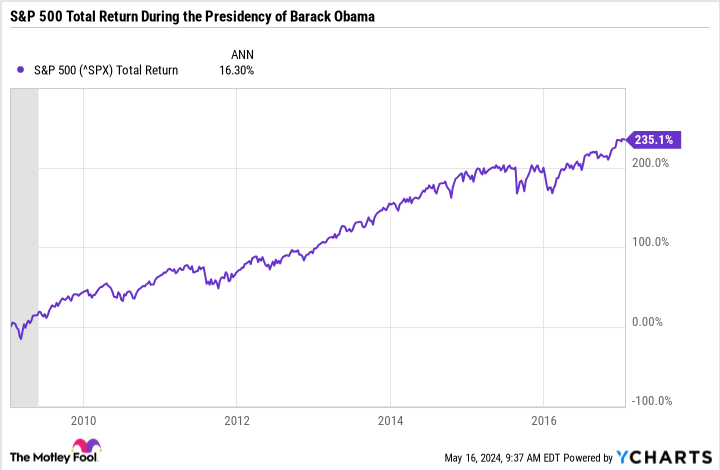

Barack Obama (2009-2017)

Barracks Obama was sworn in as 44th president on Tuesday, January 202009. The stock market was in the middle of it a prolonged bear market, and the country was stuck in a deep recession following the 2008 financial crisis.

However, which would become initial disadvantages positive effects in the longer term. The 2007-2009 bear market bottomed out in March 2009 and a long bull market began. what would take for more than a decade.

Certainly, there were gradual corrections in the stock markets, caused by numerous events, including several Greek debt crises, the 2011 US debt ceiling crisis and the Brexit referendum vote.

Nevertheless, by the end of Obama’s term in 2017, the S&P 500 had generated a total return of 235%, for an annualized return of 16%. A $10,000 investment in the S&P 500 on Day 1 of his presidency would have been worth $33,500 on the last day, and would be worth $89,000 today.

Among presidents dating back to 1900, Obama’s stock market record is near the top of the list. Only Calvin Coolidge (1923-1929) and Bill Clinton (1993-2001) can claim a taller percentage gain in the stock market during their term.

|

Time frame |

Value of an investment of $10,000 |

Total refund |

Compound annual growth rate |

|---|---|---|---|

|

January 20, 2009 – January 20, 2017 |

$33,510 |

235% |

16.3% |

|

January 20, 2009 – May 17, 2024 |

$89,050 |

790% |

15.7% |

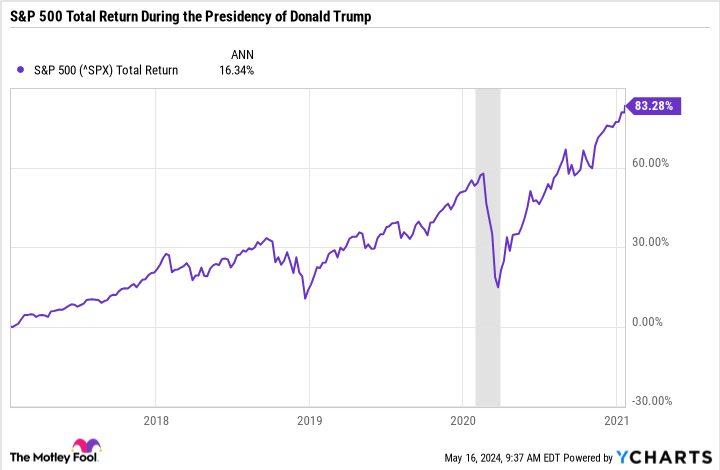

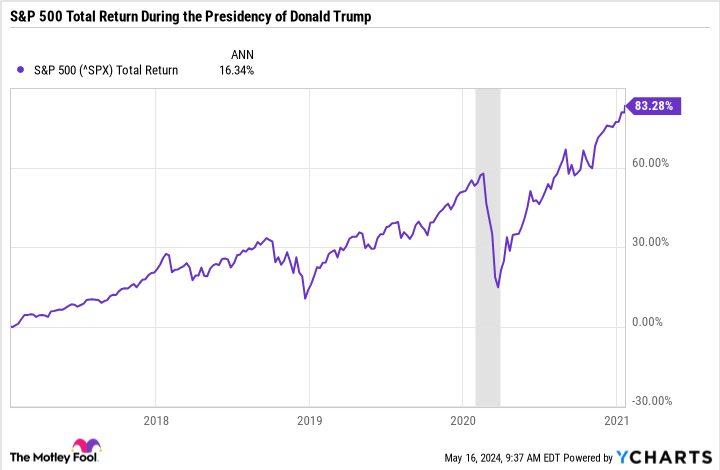

Donald Trump (2017-2021)

Donald Trump was sworn in as chairman on Friday, January 202017. During his time office, the stock market experienced enormous highs and lows. However, the timing of the recessions could surprise some investors.

For example, during the Trump presidency, the stock market had three great years and one bad year – assuming you’re at the beginning of the crisis. year on January 20 (in line with Inauguration Day). The positive years were 2017, 2019 and, surprisingly, 2020 – despite the steep sell-off at the start of the COVID pandemic. It was 2018 – when the Federal Reserve began tightening monetary policy – that was the worst year of Trump’s presidency. In that twelve-month period, the S&P 500 fell 3.1%.

All things considered, tThe stock market has returned 83.3% in Trump’s four years, for a CAGR of 16.4% – the highest annualized rate of the four most recent presidents.

|

Time frame |

Value of an investment of $10,000 |

Total refund |

Compound annual growth rate |

|---|---|---|---|

|

January 20, 2017 – January 20, 2021 |

$18,330 |

83.28% |

16.4% |

|

January 20, 2017 – May 17, 2024 |

$26,580 |

166% |

15% |

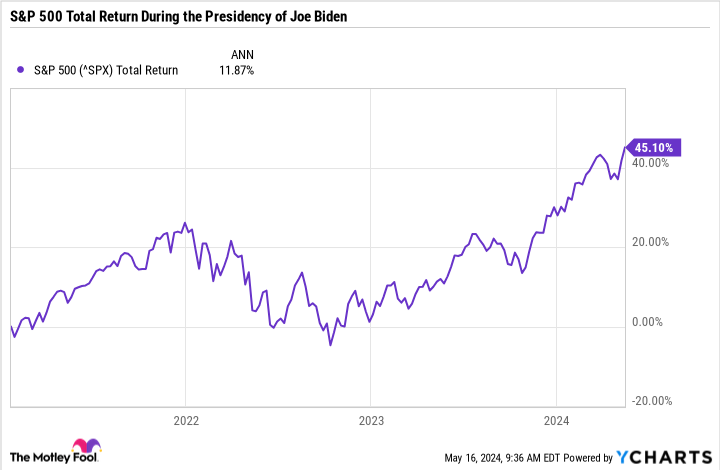

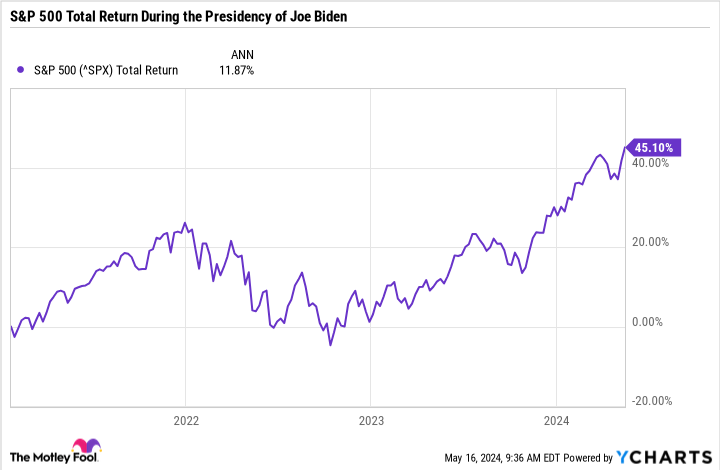

Joe Biden (2021-)

President Joe Biden took office on Wednesday January 202021. During his roughly three and a half years as president, the stock market has put on something like a three-act play. It went up; it went down; then it recovered.

When you count Once you have everything in order, you will notice that the result is above average — an annualized return of 12% and a total return of 45%. A $10,000 investment made on Day 1 of his presidency would now be worth $14,500.

Yet the Biden administration’s big economic story is something you won’t see reflected in stock market returns: inflation. Unlike the other administrations mentioned above, the Biden presidency has seen persistently high inflation. In response, the Federal Reserve quickly raised interest rates with a bid to stabilize prices.

In other words: the stock market Is on under the Biden administration. But for many investors, that may not be the case feel this wayand inflation, combined with higher interest rates, are the biggest reasons for this.

|

Time frame |

Value of an investment of $10,000 |

Total refund |

Compound annual growth rate |

|---|---|---|---|

|

January 20, 2021 – Present |

$14,500 |

45% |

11.9% |

The final count

When you zoom out to the big picture, one thing becomes clear: it’s never a bad time to invest, no matter who the president is.

|

President |

Compound annual growth rate |

Compound annual growth rate |

Value of $10,000 Investment on Day 1 at end of term |

Value of $10,000 day 1 investment now |

|---|---|---|---|---|

|

George W Bush |

(4.5%) |

8.2% |

$6,936 |

$61,770 |

|

Barack Obama |

16.3% |

15.7% |

$33,510 |

$89,050 |

|

Donald Trump |

16.4% |

15% |

$18,330 |

$26,580 |

|

Joe Biden* |

11.9% |

11.9% |

$14,500* |

$14,500 |

*Term not complete.

As the table above shows (the top results are in bold), investors on Day 1 in the S&P 500 in three of the last four administrations would have made money if they had sold on the last day of the administration. In all cases, buying on day 1 and holding would have resulted in a positive return.

There’s clearly a lesson here: the longer you stay invested in the stock market, the greater your chances of success. And that’s a lesson investors can take to the bank — regardless of who’s in the White House.

Should You Invest $1,000 in the S&P 500 Index Now?

Consider the following before purchasing shares in the S&P 500 Index:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and the S&P 500 Index wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $584,435!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Bush, Obama, Trump or Biden: Here’s How Much Money You’d Have If You Invested $10,000 in the S&P 500 on Day 1 of the Last Four Administrations originally published by The Motley Fool