A new report from the Capgemini Research Institute has detailed where the world’s high net worth individuals (HNWIs) are investing their money – and, just as importantly, how this has changed over the past year.

The report classified high net worth individuals as those with assets of at least $1 million.

Most read from MarketWatch

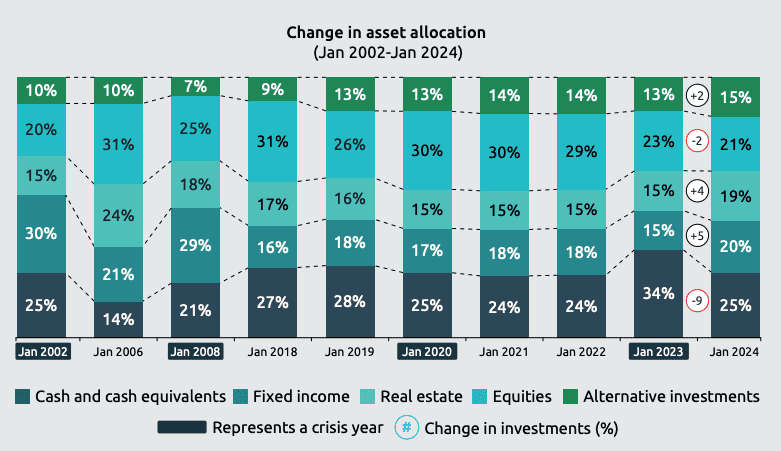

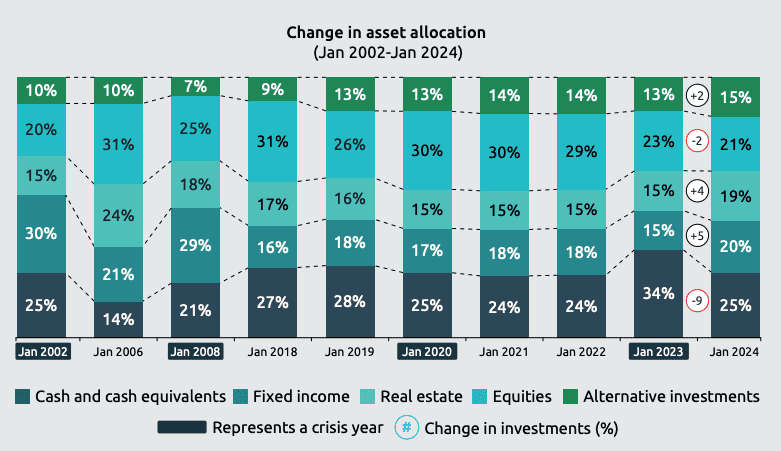

The World Wealth Report 2024 provided a detailed look at the total asset allocation of high-net-worth individuals and how it changed from January 2023 to January 2024.

At the beginning of 2023, high-net-worth individuals held 34% of their assets in cash and cash equivalents (including savings deposits and money market funds), 23% in equities, and 15% in fixed income (including bonds and fixed annuities), 15% in real estate and 13% in alternatives. investments (including commodities, currencies, private equity, hedge funds, structured products and digital assets).

As of January 2024, they had 25% in cash, 21% in equities, 20% in fixed income, 19% in real estate and 15% in alternative assets.

One of the report’s contributors believes that the decline in cash allocation for this group is largely due to an investment strategy that revolves around growth rather than minimizing risk.

“Everyone was concerned with preserving wealth – things were very confusing last year,” Elias Ghanem, the global head of the Capgemini Research Institute, told Yahoo on Friday about the report. “Last year you threw all your money into cash: ‘Let’s just wait and see what happens.’ What we are seeing this year is that cash and cash equivalents have gone down, back to 25%.”

“People are slowly but surely moving away from preserving wealth [and] “Let’s be safe’ for the growth of prosperity,” Ghanem added.

Also see: What investors stashing away $6.5 trillion in cash should do as the Fed scales back interest rate expectations

The level of cash and cash equivalents among total assets of high-net-worth individuals fell from the previous year in early 2024 data, but fell from record highs to levels broadly in line with Capgemini’s historical data, the report showed. report.

“HNWIs, especially those with $10 million or more, are prioritizing the use of fixed income instruments and tax optimization in their wealth management strategies,” Greg Gatesman, head of international client development at UBS, wrote in the report. “They are concerned with bond ladders and seek specialist advice on how to use the tax rules effectively.”

A deeper look at bond ladders – a portfolio of bonds that mature at regular intervals on different dates – can be found here.

The allocation of alternative investments has also increased for high net worth individuals in the past year and has been on an upward trend since Capgemini started tracking these figures in 2002.

“2024 is not expected to be a year of huge growth, although interest rates are expected to fall now that inflation is under control. Bonds and private credit will be attractive for wealth preservation,” said Pierre Ramadier, CEO of BNP Paribas Wealth Management International Markets, in the report. “For growing prosperity, private equity investments will undoubtedly be more attractive than stock markets because of their volatility.”

The June survey details the views of 3,119 high-net-worth individuals with backgrounds in wealth management, banking, brokerage and other fields in North America, Asia and Europe. The report was administered in January 2024.

Also see: ‘Her world is turned upside down’: A friend has hit the jackpot, but her old friends are abandoning her one by one. Is there a cure for jealousy?