Social Security is an essential source of income for many of the approximately 53.5 million recipients. For retirees who have worked for years and paid taxes into the program, it is a well-deserved financial safety net.

Regardless of when you plan to retire or the role Social Security will play in your retirement finances, having an idea of the monthly benefit you can expect is essential for financial planning.

According to the latest data from the Social Security Administration, the average monthly benefit for someone filing a claim at age 62 is $1,275. If you look at the averages by gender, there is a difference because of the difference in average lifetime earnings. The average benefit for men is $1,421, while for women it is $1,141.

While any income in retirement is useful, the hard truth is that the average monthly benefit at that age will not be enough to cover living expenses for many retirees.

How your benefits will be affected if you file a claim at age 62

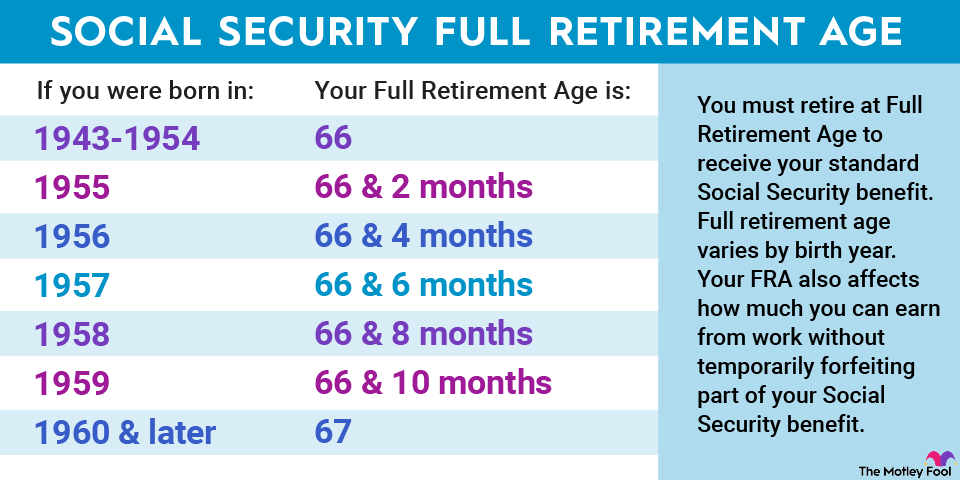

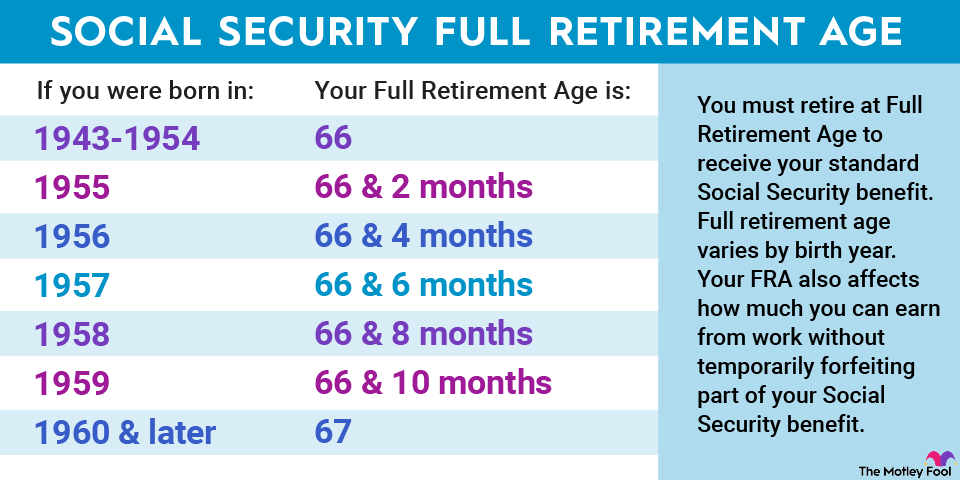

Your full retirement age (FRA) is one of the most important numbers you need to know about Social Security and retirement in general. It is the age at which you become eligible for the Primary Insurance Amount (PIA), which you can consider your standard benefit. From there, monthly benefits are reduced or increased based on when you file a claim against your FRA.

You can claim social security benefits from the age of 62 at the earliest. If you file for benefits before your FRA, they will typically be reduced by 5/9 of 1% per month within 36 months after the FRA. After 36 months, Social Security further reduces benefits by 5/12 of 1% each month.

For someone whose FRA is 67, claiming benefits at 62 will reduce their monthly payout by 30%. For example, if you received $2,000 at your FRA of 67, claiming at 62 would reduce the amount to $1,400.

Use the 80% rule to put your monthly benefit into perspective

There is no one-size-fits-all approach to how much you will need in retirement. Different plans, locations and lifestyles all require different amounts of savings. However, there are rules of thumb you can use to help you.

One of these is the 80% rule, which means that you should aim to generate 80% of the income of your last year of work each year when you retire. Following those guidelines, here are examples of how much someone should aim for in annual retirement income:

|

Income in last year of employment |

Annual income goal after retirement |

|---|---|

|

$40,000 |

$32,000 |

|

$60,000 |

$48,000 |

|

$80,000 |

$64,000 |

|

$100,000 |

$80,000 |

Calculations by author.

An average Social Security benefit of $1,275 amounts to $15,300 per year. If we assume the 80% rule, this amount would only work for those whose income in their last year of work was $19,125.

For many people, that amount of money alone won’t get the job done. It helps if you live in a house that is paid off or if you don’t have a car payment, but many retirees aren’t so lucky. With rising prices and higher healthcare costs, meeting your financial needs with Social Security benefits alone is a challenge, even with regular cost-of-living adjustments.

A reminder of the importance of multiple sources of retirement income

The 80% rule is just one example of high-level guidance. If you plan to reduce your lifestyle after retirement, you can reduce the percentage. If you plan to improve your lifestyle, you should probably stay at 80% or increase it slightly.

In either case, the more important point is how important it is to aim for multiple sources of retirement income. A 401(k) may not be available to you because it is dependent on your employer, but a retirement account such as an IRA may also be a good option.

You can open your own IRA, similar to a bank account, and it often offers great tax benefits, flexibility in investment choices, and early withdrawal exceptions that can come in handy for life events like purchasing your first home or paying for an IRA. for higher education.

You can also rely on investments through an investment account. History has shown that dollar cost averaging over time, no matter how small the investments, can actually add up to significant amounts. You won’t get IRA-like tax benefits in an investment account, but it can still be a great place to park your savings.

There’s no such thing as being over-prepared for retirement, but you definitely can’t be under-prepared. As valuable as Social Security may be to retirees, it should not be their only source of income.

The $22,924 Social Security bonuses that most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could give your retirement income a boost. For example, one simple trick can earn you as much as $022,924 more… every year! Once you learn how to maximize your Social Security benefits, we think you can retire confidently, with the peace of mind we’re all looking for. Click here to find out how you can learn more about these strategies.

View the “Social Security Secrets” ›

The Motley Fool has a disclosure policy.

Here’s the Average Social Security Benefit at Age 62 — and Why It’s Not the Best News for Retirees was originally published by The Motley Fool