Most investors will probably find Children’s Morgan‘S (NYSE: KMI) 5.5% dividend yield is the company’s most attractive investment feature. That’s especially true considering the meager 1.2% available from the S&P 500 and the average return of 3.2% for the energy sector.

But don’t start and stop with the proceeds of Kinder Morgan. There’s a lot more to think about when you make the decision to buy, sell or hold.

Want to buy Kinder Morgan shares?

Let’s start with the good stuff up front: Kinder Morgan is one of the largest midstream companies in North America. Its portfolio of critical energy infrastructure, including pipelines, storage and transportation assets, would be nearly impossible to replace or relocate.

The vast majority of the company’s assets generate reliable cash flow, driven by contracts. While energy prices are important, Kinder Morgan’s business is typically much less volatile than that of an energy producer or refiner.

There is a solid business to support the dividend. Notably, the company’s distributable cash flow covers its distribution at a strong 1.7x. Furthermore, Kinder Morgan has an investment-grade balance sheet. All in all, the dividend appears to be on solid ground.

Looking ahead, Kinder Morgan has $5.2 billion in capital expenditure projects lined up that should boost earnings. Through 2024, the company is forecasting 14% earnings growth with 8% distributable cash flow growth. That’s not a bad story if you’re looking for a dividend stock.

Do you want to own shares in Kinder Morgan?

If you own Kinder Morgan, the reason to buy it is essentially the same reason you would want to hold it. That said, there is one small wrinkle.

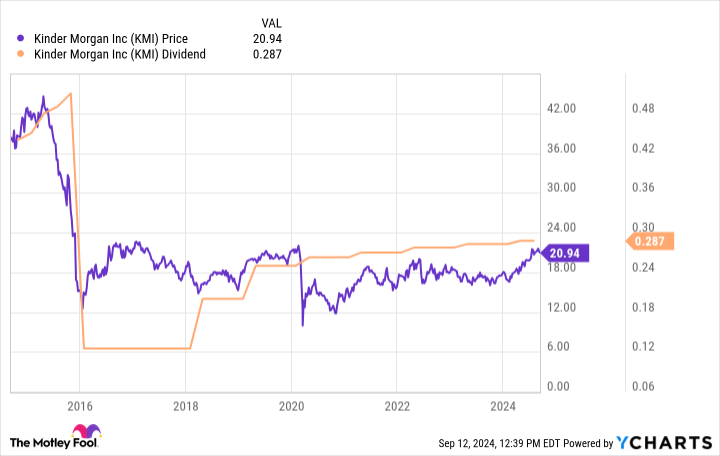

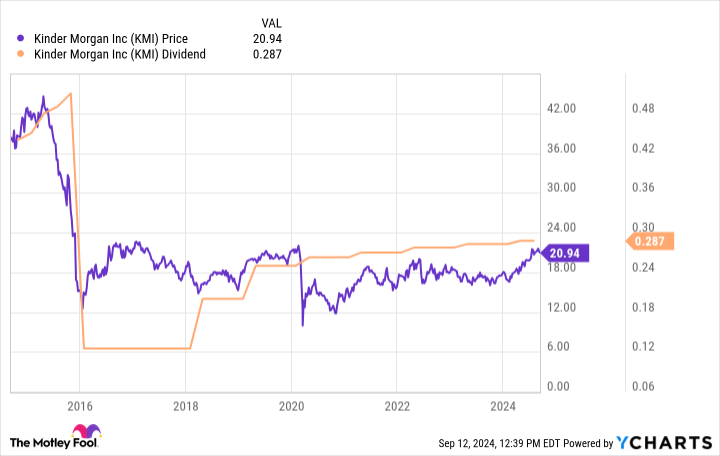

Shares remain well below their 2015 highs. That’s a significant period for the company, as it was around that time that Kinder Morgan cut its dividend by 75%. If you’ve owned it since then, you’re probably still underwater.

Right now, it doesn’t look like you’re going to break even anytime soon. Why? Because the dividend is only up 2% year-on-year.

That’s pretty poor dividend growth for a company that expects 8% distributable cash flow growth. If you have losses that you can absorb to offset gains elsewhere in your portfolio, you might consider selling Kinder Morgan for portfolio reasons.

Selling Kinder Morgan shares?

You have to remember that dividend cut, because it was a shocking development. Why? Because management told investors a few months before the cut that they could expect a maximum increase of 10%.

To be fair, 2016 was a tough year for the energy sector, so cutting the dividend was probably the right decision. Or at least it was the right decision for Kinder Morgan.

But there is a problem with the 2% increase above. That is because Kinder Morgan had a huge dividend growth plan in the run-up to the turn of the century. The goal was very clearly to regain confidence on Wall Street.

The plan was to culminate in 2020 with a dividend hike to $1.25 per share. But the pandemic hit and management backed away from that plan (again, probably the right move for the company), telling investors it would still go to $1.25, but at a slower pace.

The most recent dividend was $1.15 per share annually. So four years later, Kinder Morgan still hasn’t delivered on the bold dividend promise it made.

The big takeaway here is that it wouldn’t be shocking if you looked at these events and wondered if you could trust management. If trust is important to you, then you should probably sell Kinder Morgan or not buy it in the first place. There are other midstream options, such as Business Product Partnerswith higher yields and better histories of delivering on their promises. For reference, Enterprise has grown its distribution for 26 consecutive years.

What to do with Kinder Morgan?

Wall Street is forward-looking, so it would be understandable if investors would invest in high-yield Kinder Morgan and its growth prospects. However, for conservative, long-term income investors, you can’t just look to the future, because a company’s past tells a lot about how it operates.

In the case of Kinder Morgan, it appears that income-focused shareholders have borne the brunt of the burden if things don’t go as planned for the company. That’s likely to scare off more than a few potential investors (and perhaps even a few current shareholders).

Should You Invest $1,000 in Kinder Morgan Now?

Before you buy shares in Kinder Morgan, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $729,857!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

High-Yield Kinder Morgan: Buy, Sell or Hold? was originally published by The Motley Fool