After sharp declines in 2022, capital markets have shown unprecedented resilience over the past 20 months. Since January 2023, the S&P 500 And Nasdaq Composite have delivered total returns of 48% and 66% respectively (at the time of writing). While it may be tempting to let the good times roll, savvy investors know that this can be a good time to take some profits off the table and seek out more reliable opportunities.

Why is that? Well, September is generally a bad month for the stock market, a month marked by heavy selling activity. There are many factors that influence stock sales towards the end of the year, including tax planning or potential changes in the Federal Reserve’s monetary policy. However, 2024 has another variable: the upcoming presidential election. The common theme between these items is that widespread unpredictability on a number of important topics can result in abnormal levels of selling in the market.

For these reasons, investors might consider opting for more predictable opportunities instead of volatile growth stocks. A good example of this would be to allocate a portion of your portfolio to consistent dividend stocks. Below, I share an ultra-high-yielding dividend stock that I think should be on your radar and explain why September might be the perfect time to buy shares in this particular player.

This telecom stock stands out for one big reason

I will readily admit that the telecom industry is not nearly as exciting as other opportunities in the technology world. Telecom companies offer a standardized set of products and services, which ultimately forces the big players to compete for customers on price. This dynamic can take a toll on growth, often leaving investors uninspired.

However, I see things differently with Verizon (NYSE: VZ) — and history shows that September could be the perfect time to buy, especially for those looking for passive income.

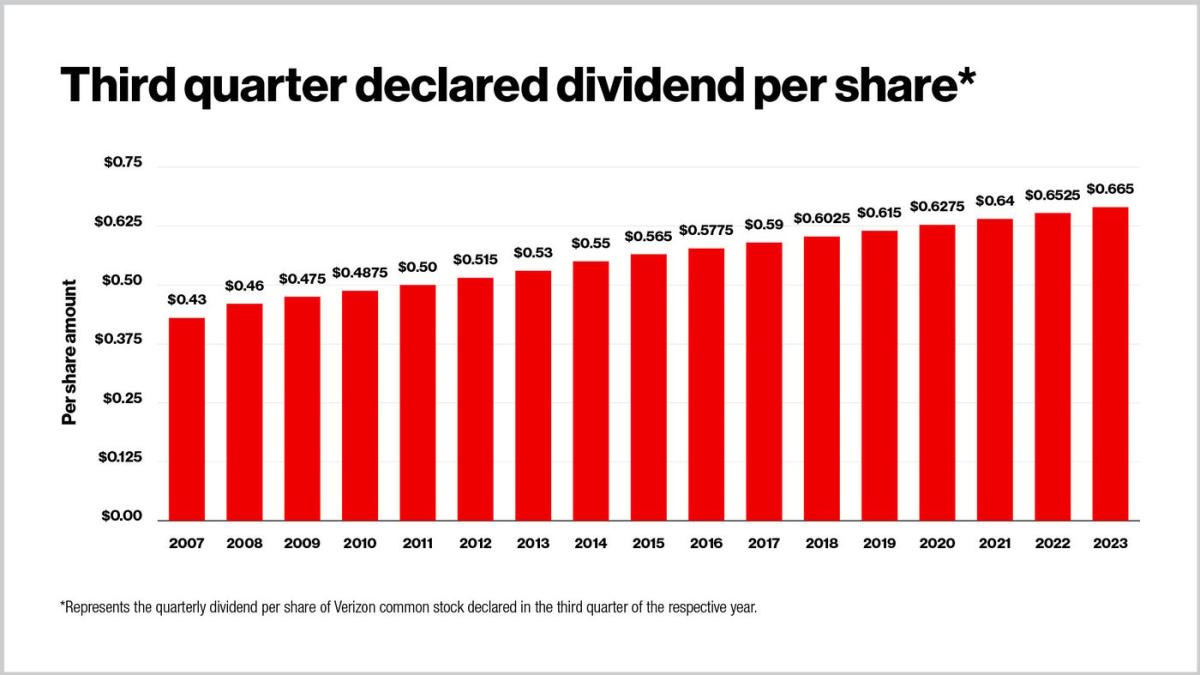

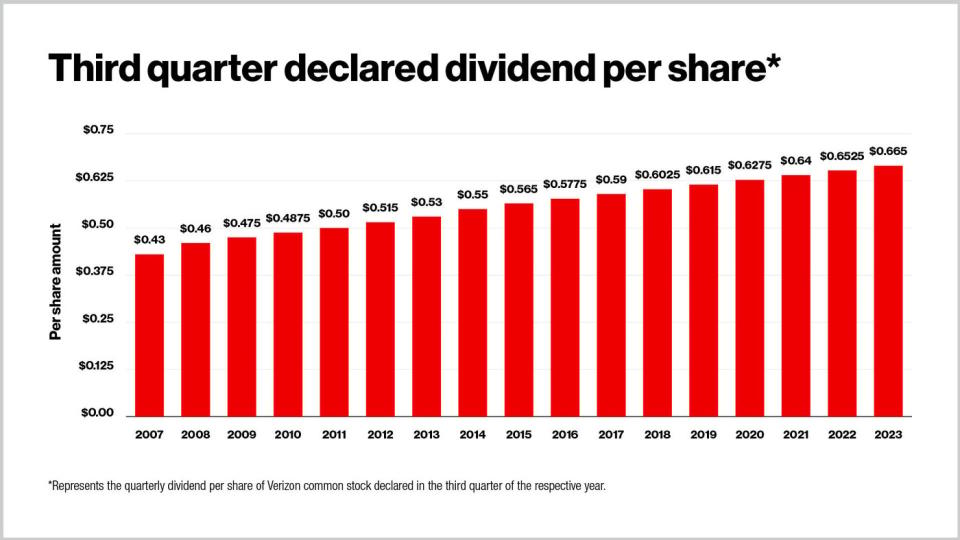

The chart below shows that Verizon has increased its dividend for 17 years in a row. But so what? Many other companies increase their dividends every year.

That’s true, but Verizon typically announces quarterly dividend increases in September.

Why Verizon Could Raise Its Dividend Again

It is interesting to note a pattern regarding the timing of Verizon’s dividend increases. However, astute investors know that historical performance is no guarantee of future results. A close look at Verizon’s recent stock trading activity, combined with a thorough analysis of its financial position, will help us determine whether an upcoming dividend increase seems likely or not.

The table below summarizes Verizon’s revenue and free cash flow growth over the past few years. There are clearly some inconsistencies in Verizon’s growth.

|

Growth measure (year-on-year) |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|

|

Gain |

(3%) |

4% |

(2.4%) |

(2%) |

|

Free cash flow |

32.4% |

(18.3%) |

(27%) |

33.1% |

Data Source: Verizon Investor Relations

While the above trends may make you nervous, it’s important to zoom out and look at the bigger picture. The company has consistently generated strong cash flow, and even in years where growth slowed, it has maintained and increased its dividend.

Through the first six months of 2024, Verizon generated a total of $65.8 billion in total revenue. Considering that this represents only a roughly 0.5% increase year over year, you might be forgiven for thinking that the rest of Verizon’s financial profile would be similarly uninspiring. But despite this run-of-the-mill acceleration at the top line, Verizon has done a respectable job of growing its profitability. For the six months ended June 30, Verizon generated $8.5 billion in free cash flow — up 6.9% year over year.

In my opinion, Verizon’s dividend seems safe at this point.

Should You Buy Verizon Stock Now?

Currently, Verizon stock has an ultra-high dividend yield of 6.2%. For comparison, the SPDR S&P 500 ETF Confidence has a dividend yield of just 1.2%. Furthermore, Verizon’s forward price to earnings (P/E) multiple of 9.4 significantly lags the S&P 500’s forward P/E of 22.4. While an impending dividend increase is speculation on my part, recent gains in Verizon stock suggest that I’m not alone in expecting the company to continue rewarding shareholders and announce a dividend increase soon.

Historical trends suggest that prolonged, heavy market sell-offs are imminent, so I encourage investors to look for more isolated opportunities. Given Verizon’s consistent ability to generate cash flow, combined with its historical tendency to announce dividend increases in September and its notable valuation discount to the broader market, I think now is a good time to swoop in and buy shares.

Should You Invest $1,000 in Verizon Communications Now?

Before you buy Verizon Communications stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $661,779!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

History says September could be the perfect time to jump on this ultra-high yielding dividend stock. Originally published by The Motley Fool