No financial goal applies to everyone. Financial situations vary so much that what one person strives for can be completely different from someone else’s priorities.

That said, $1 million has long been a recognized sign of financial success. I have to admit, there’s something about seeing a second decimal point in a number that feels affirming and reassuring.

The good news is that it doesn’t take major effort or generational returns to make a million-dollar portfolio a reality. In many cases, all it takes is consistent investment in an exchange-traded fund (ETF) like the Vanguard S&P 500 ETF (NYSEMKT:VOO).

If there’s one ETF we can lean on on our way to a million-dollar portfolio, it’s this one. This is why.

A history of impressive and encouraging returns

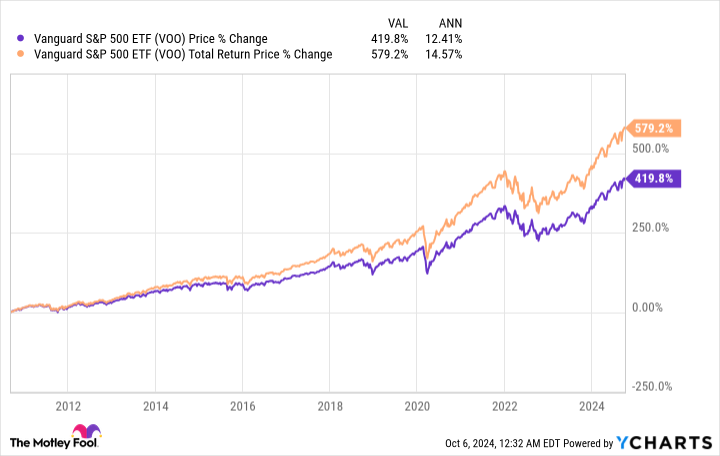

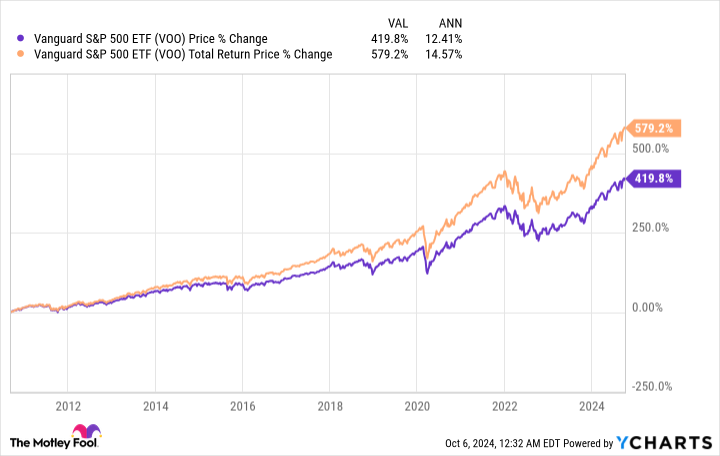

This ETF was created in September 2010 and has since had an impressive run of success, with an average annual return of over 12.4% and an annual total return of over 14.5%.

It is often repeated that “past performance is no guarantee of future performance.” However, if this trend continues, you’ll see how long it would take to reach the million dollar mark, with an average annual return of 12% with varying monthly contributions.

|

Monthly contributions |

Years up to $1 million |

|---|---|

|

$500 |

27 |

|

$750 |

24 |

|

$1,000 |

22 |

|

$1,500 |

18 |

|

$2,000 |

16 |

Calculations by author. Years rounded to the nearest whole year.

You don’t need a lump sum of money to invest to get a million dollar portfolio; you need consistent investments over time.

Get exposure to some of the world’s best companies

I always like to say that investing in an S&P 500 ETF is similar to investing in the US economy. Of course, the US economy depends on more than just 500 companies, but their influence is undeniable given the size and scope of businesses in the US. S&P500 index. Here are the top 10 holdings in this ETF (as of August 31):

-

Apple: 6.97%

-

Microsoft: 6.54%

-

Nvidia: 6.20%

-

Amazon: 3.45%

-

Metaplatforms: 2.41%

-

Alphabet (Class A): 2.03%

-

Berkshire Hathaway (Class B): 1.82%

-

Alphabet (Class C): 1.70%

-

Eli Lilly: 1.62%

-

Broadcom: 1.50%

When you’re trying to build a million dollar portfolio, all you need is consistency. There will inevitably be ups and downs along the way (no stock or ETF is exempt from volatility), but you want companies with a history of long-term growth to lead the way – and that’s what these have proven.

Don’t forget how much money you can save on costs

An underrated part of this ETF is its low expense ratio of 0.03%. That works out to $0.30 per $1,000 invested annually, and it’s one of the cheapest ETFs in the stock market regardless of type. Even another S&P 500 ETF, the SPDR S&P 500 Trust ETFis more than three times more expensive at 0.0945%.

To give you some perspective, here’s how much you’d pay in fees over 20 years if you invest different amounts and earn an average annual return of 10% in both ETFs.

|

Monthly contributions |

Fees paid with Vanguard S&P 500 ETF |

Fees paid with SPDR S&P 500 ETF |

|---|---|---|

|

$500 |

$1,160 |

$3,660 |

|

$750 |

$1,750 |

$5,500 |

|

$1,000 |

$2,330 |

$7,330 |

|

$1,500 |

$3,500 |

$10,990 |

|

$2,000 |

$4,670 |

$14,660 |

Calculations by author. Costs rounded to the nearest ten.

The seemingly smallest difference on paper can save you thousands of dollars in costs over time. Don’t overlook it.

Should you invest $1,000 in the Vanguard S&P 500 ETF now?

Consider the following before buying shares in Vanguard S&P 500 ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple, Microsoft and Vanguard S&P 500 ETF. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

History Says This Vanguard ETF Could Be Your Ticket to a Million-Dollar Portfolio Originally published by The Motley Fool