The Artificial Intelligence (AI) revolution is in full swing, and the big winner of that revolution is Nvidia (NASDAQ: NVDA).

Well, maybe it’s the second biggest.

Nvidia is undoubtedly the company that is currently receiving the most attention. Its GPUs are in high demand as companies rush to implement AI. Nvidia is certainly the biggest winner of the popular “Magnificent Seven” stocks.

However, one AI beneficiary outpaced Nvidia in the first half and led the entire S&P 500 Table of contents.

Super Micro Computer capitalizes on Nvidia’s success and leads the market

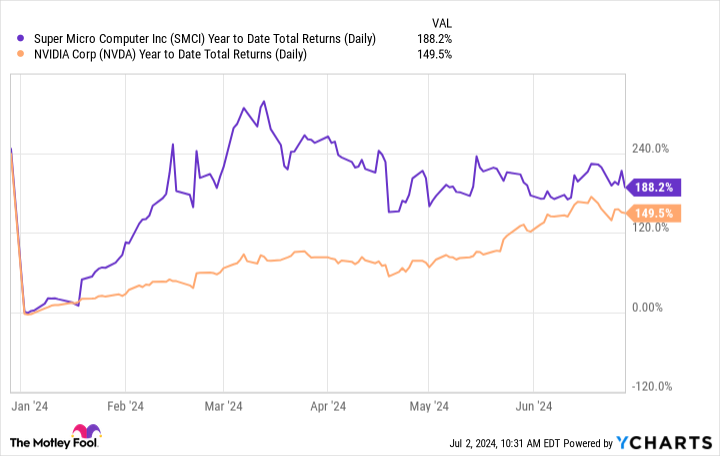

The best-performing stock in the S&P 500 in the first half of the year wasn’t Nvidia, but Supermicrocomputer (NASDAQ: SMCI). Supermicro returned a whopping 188% in the first half of the year, compared to just 150% for Nvidia, including dividends. Not only that, but while Nvidia ended the quarter near its highest values of the year so far, Supermicro was significantly higher earlier in the half, gaining a whopping 331% at one point in mid-March!

How did Supermicro do it? Basically, for the same reasons that Nvidia kept growing: a boom in AI-related growth. In fact, you could say that Supermicro, as a server maker, rode a growth wave from Nvidia, as demand increased for Supermicro’s AI servers, which make up over 50% of revenue and primarily feature Nvidia GPUs. So Supermicro’s AI-driven growth was likely due to essentially reselling Nvidia chips, with a small markup, as indicated by Supermicro’s relatively low gross margins of 15.5% last quarter.

Nvidia even posted higher revenue growth than Supermicro, with 262% growth in the second quarter, compared to ‘only’ 200% growth for Super Micro Computer in the previous quarter.

However, the stock market is not always exactly correlated with financial results, as we have seen. So, has Supermicro’s stock managed to pull off such a feat?

Assuming a lower valuation

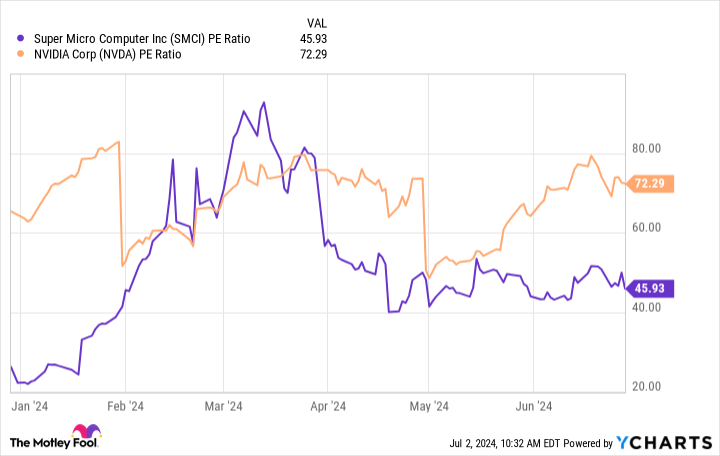

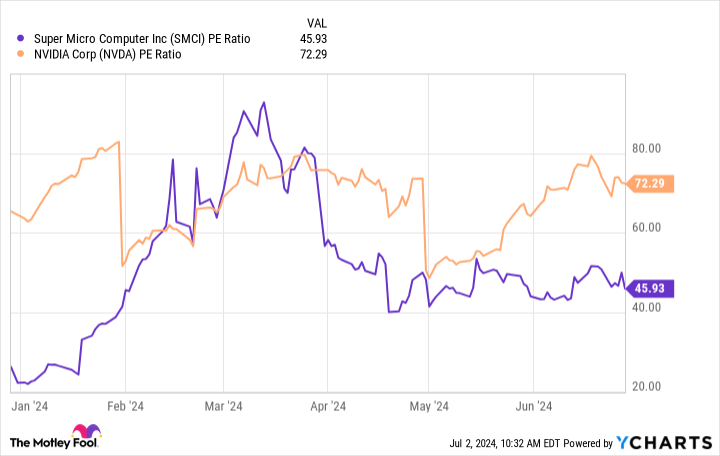

While long-term business performance is the most important determinant of long-term performance, valuation matters too, especially in the short term. And as we can see, Supermicro started this year with a much lower valuation.

On January 1, Supermicro traded at about 25 times earnings, while Nvidia traded at 65 times earnings. Still, Supermicro’s valuation grew to about 45 times earnings during the quarter — an 80% increase — while Nvidia’s price-to-earnings multiple grew to 72 — an increase of just 8%.

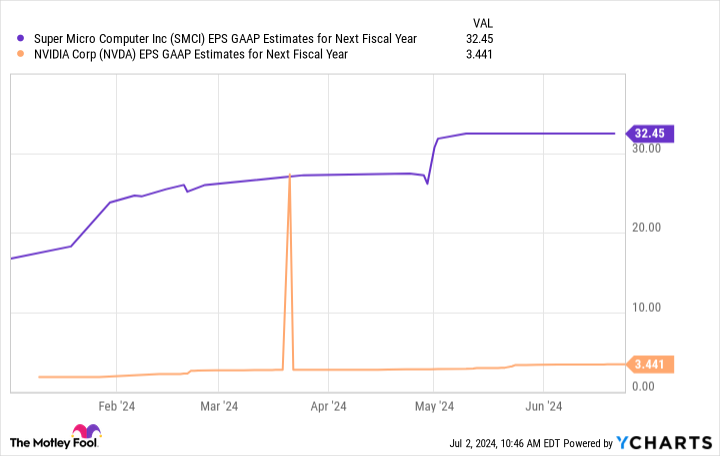

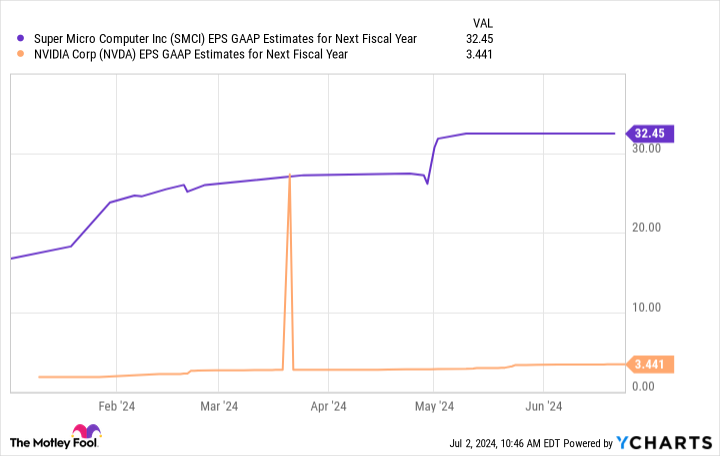

Meanwhile, both companies saw their forward earnings estimates rise, by about the same percentage over the first half of the year. Wall Street analysts’ earnings estimates for both stocks rose by about 80% to 90% over the year.

The earnings estimates were driven by strong earnings and guidance from both companies during the quarter. Supermicro’s estimates got a big boost early in the year when it significantly raised its forward guidance during its February earnings call. And while earnings estimates continued to rise even after the May 1 earnings report, the stock was sold off. This was perhaps because the previous quarter had such high expectations.

Meanwhile, Nvidia continued to climb as the meteoric growth it posted in February and May continued to defy skeptics. However, with the company already battling high expectations at the start of the year, it didn’t bounce back as strongly following February’s earnings, leaving “room” for surprises following May’s earnings.

So Supermicro’s outperformance is largely due to initial expectations.

Valuation issues

Trying to draw a lesson from this is really splitting hairs, as both stocks have outperformed handily, and for the same reasons. One lesson we can learn from this, however, is that valuation matters. If a company is a great company but is already trading at a high valuation, it may not rise as much as a company that may not be as great but is still able to beat initial expectations by a greater amount.

Think of it as a point spread in football. Market valuations are essentially point spreads on stocks. You only win a bet if your team wins the game. And beats the point spread. Likewise, if your team loses but by less than others think, you still win the bet.

Phil Fisher, one of the greatest growth investors of all time, once said, “Every significant price movement of an individual common stock relative to stocks as a whole occurs because of a change in the valuation of that stock by the financial community.”

With enthusiasm for AI growing and many tech stocks reaching very high valuations, this is something to keep in mind, as expectations for AI winners look set to continue to rise this year.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy Super Micro Computer stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $761,658!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Billy Duberstein and/or his clients have positions in Super Micro Computer and have the following options: short January 2025 $1,840 calls on Super Micro Computer, short January 2025 $110 puts on Super Micro Computer, short January 2025 $125 puts on Super Micro Computer, short January 2025 $130 puts on Super Micro Computer, short January 2025 $280 calls on Super Micro Computer, and short January 2025 $85 puts on Super Micro Computer. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

How This Chip Company Outperformed Nvidia in the First Half of the Year was originally published by The Motley Fool