The most dominant stock in artificial intelligence (AI), Nvidia (NVDA), is about to become more affordable. At the end of the week, NVDA will undergo a 10-to-1 stock split. Therefore, instead of having to spend more than $1,000 to own a stock, you can buy a share for almost $100.

Theoretically, a stock split has no effect on a company’s value because the lower price is offset by an increase in shares. But it will make the stock – not to mention the options – more affordable for smaller accounts. So, should you add NVDA to your portfolio? This week I look at how stocks have historically performed after prices fell following a stock split.

Stock returns after splits

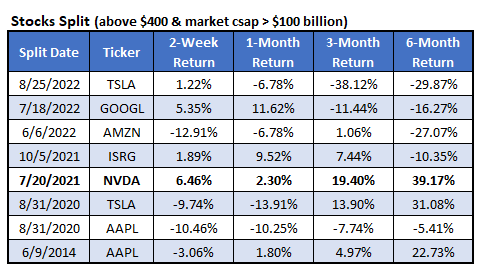

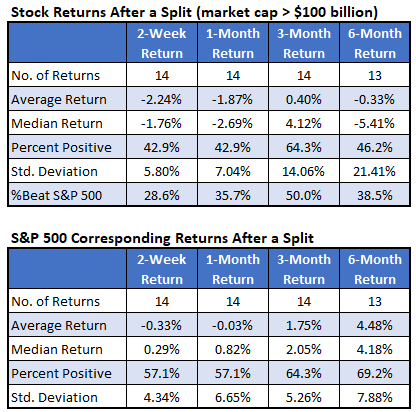

Looking at current optional stocks and going back to 2010, I have data on about 240 splits. The table below summarizes how stocks performed after these splits. The second table is for comparison and shows what the returns would have looked like if instead of buying stocks, you bought the broad market S&P 500 Index (SPX).

Based on these numbers, I’d say a stock split isn’t a reason to buy. Stocks that split performed similarly to the SPX. In the two weeks immediately following a split, shares averaged a gain of 0.44%, with just under half beating the index. The six-month average return slightly outperforms the SPX (6.6% to 5.4%), with again just under half outperforming the index. However, investing in the general market produces much less volatility.

Breaking splits for NVDA

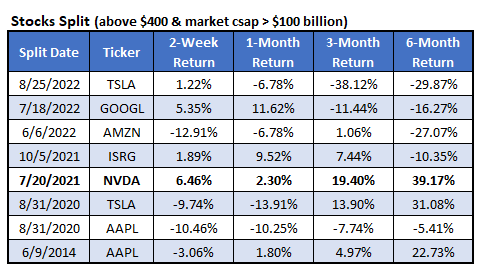

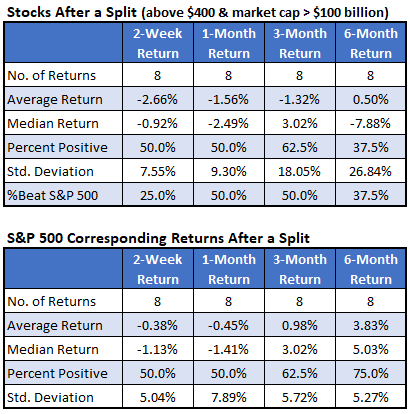

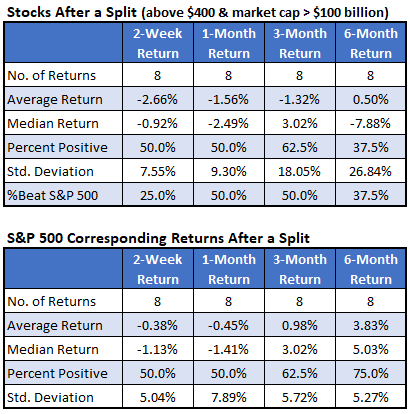

Nvidia shares have risen significantly in price over the past two years and are now over $1,000 per share. The tables below look at splits where the stock was above $400 before the split.

The returns after these 19 stock splits show slight underperformance. Three months after the split, the share is actually at break-even level, while the SPX showed a return of 2.11%. Meanwhile, stocks averaged a gain of 2.3% six months after the splits versus 3.47% for the index, while in the subsequent six months only 44% of returns were better than the index.

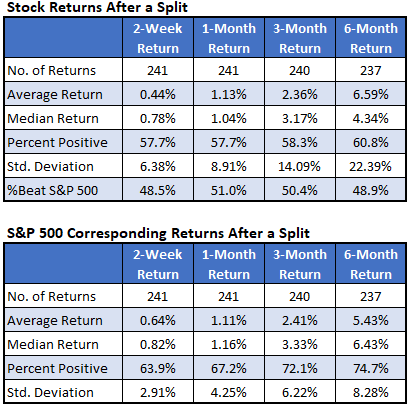

Nvidia is one of just a handful of companies with a market capitalization over $2 trillion. To put this into perspective, there have only been fourteen splits where the company had a market cap of over $100 billion.

Large companies performed significantly less well after the stock split. In the short term, stocks averaged a loss of more than 2% over the next two weeks, with less than 30% beating the SPX. Six-month returns also underperformed, averaging a slight loss of 0.3%, with only 38.5% of returns outperforming the SPX.

Finally, let’s look at expensive stocks with huge market caps that are falling apart. As you might expect from looking at the numbers above, these stocks have generally underperformed the broader market. They averaged a loss of 2.66% over the first two weeks, then rose to just above breakeven after six months.

This means that buying the split shares yielded a 0.5% return over the next six months, 37.5% of which was positive, and the same amount better than the SPX. If you had just bought the SPX instead, the average return was 3.8%, with six out of eight being positive.

As a bonus, here’s a list of the eight companies that were trading above $400 with a market cap of more than $100 billion at the time of their split. The above analysis doesn’t look good for NVDA, but then again, security has been there before. NVDA met the criteria in its last stock split in mid-2021, posting gains of nearly 40% over the next six months. It is now up over 500% since that split.