While nothing will be more popular among the investing community than artificial intelligence (AI) in 2024, the euphoria surrounding stock splits could give AI a run for its money.

A stock split is a tool at the disposal of listed companies that allows them to adjust their share price and the number of shares outstanding by the same factor. Keep in mind that stock splits are merely superficial and have no impact on a company’s market capitalization or operating performance.

Most investors tend to focus on companies that announce forward stock splits. A forward split is intended to reduce a company’s share price so that it becomes nominally more affordable to retail investors and/or employees who do not have access to purchasing fractional shares from their broker. This type of split is almost always announced by companies that outsmart their competition and innovate better.

On the other hand, investors typically avoid companies completing a reverse stock split. A reverse split aims to increase the share price of a publicly traded company, often with the aim of ensuring its continued listing on a major stock exchange. The lion’s share of companies that execute a reverse split do so from a position of operational weakness.

By 2024, just over a dozen leading companies have announced or completed a stock split. Only one of these leading companies has completed a reverse split – and it’s the stock in which I’ve increased my stake more than fivefold since mid-April.

Introducing Wall Street’s Most Anticipated Reverse Stock Split of 2024

While reverse stock splits happen all the time, nothing better expected on Wall Street in 2024 than the satellite radio operator’s recent split Sirius XM Holdings (NASDAQ: SIRI).

In mid-December, Sirius XM announced it would merge with Liberty Media’s Sirius Before their combination, which became effective after the close of trading on September 9, shares of Liberty Sirius XM Group easily outperformed shares of Sirius XM over the past year.

But in addition to this merger, Sirius 339 million.

Unlike the countless companies that conduct reverse splits each year to maintain minimum stock listing standards and avoid delisting, Sirius risk of delisting.

Instead, the company’s board wanted to increase its share price to make it more attractive to institutional investors. Stocks trading below $5 per share are considered prohibited or too risky by some fund managers. Splitting the company’s shares and cosmetically raising the stock price to the mid-$20s should make it more attractive to large investors.

However, it’s not just institutional investors who have been lured by Sirius XM.

Since mid-April, I have increased my position in this legal monopoly by 463%

Long before the Sirius XM board announced plans to implement a reverse split, I was busy adding what started the year as a symbolic stake in Sirius XM. Since mid-April, I have increased the number of shares I own by a whopping 463%.

Let me preface this discussion by stating clearly that Sirius XM is far from perfect. Total subscribers have fallen over the past two quarters as concerns grow about the health of the U.S. economy and auto market.

Regarding the latter, new car buyers are sometimes offered promotional subscriptions to Sirius XM services for a period of three months. The company is counting on these promotional listeners to become paying subscribers themselves. If fewer cars are sold, it means fewer opportunities for Sirius to convert promotional users into paying subscribers.

There are also a number of predictive measures, such as the first notable decline in the US M2 money supply since the Great Depression, as well as the longest yield curve inversion in history, which suggest that economic weakness is in the not-too-great position of the American economy. distant future. Most radio operators rely heavily on advertising revenue to keep the lights on, and advertising expenditures usually are very cyclical.

Despite these headwinds, I view Sirius XM as historically cheap and worth investing in.

A phenomenal aspect of the business model is that it is a true legal monopoly. Although Sirius XM still faces competition for listeners with terrestrial and online radio providers, it is the only legally licensed satellite radio operator. This gives the company some level of pricing power with its subscriptions, and should help it stay ahead of the inflation curve.

Another reason I’m attracted to Wall Street’s most anticipated reverse stock split of 2024 is because How it generates revenue. While traditional radio companies rely almost exclusively on advertising to keep the lights on, Sirius

The positive for the radio industry as a whole is that the U.S. economy is experiencing extended periods of expansion. But when inevitable downturns occur, it’s completely normal for advertising revenue to decline significantly. Because Sirius

I’ve also come to appreciate Sirius XM’s somewhat predictable cost structure over the years. Line items such as equipment costs and transmission costs won’t change much, if at all, no matter how many subscribers Sirius XM signs up.

But the main attraction, at least for now, has to be Sirius XM’s historically cheap valuation. Even with revenue growth currently stagnant, shares are valued at a next-year earnings multiple of less than 8, which is near a low since the company went public in September 1994.

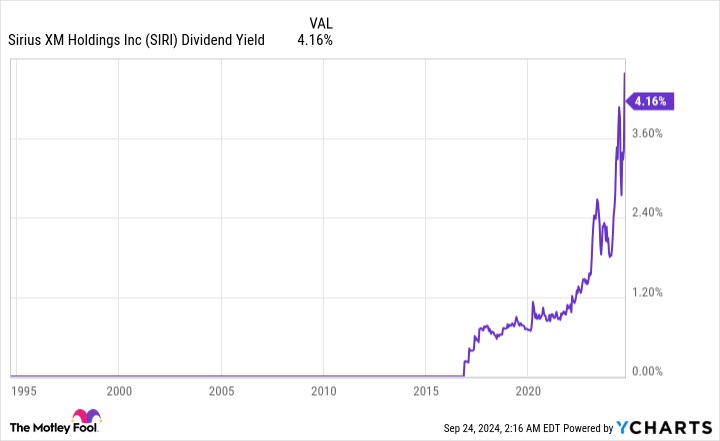

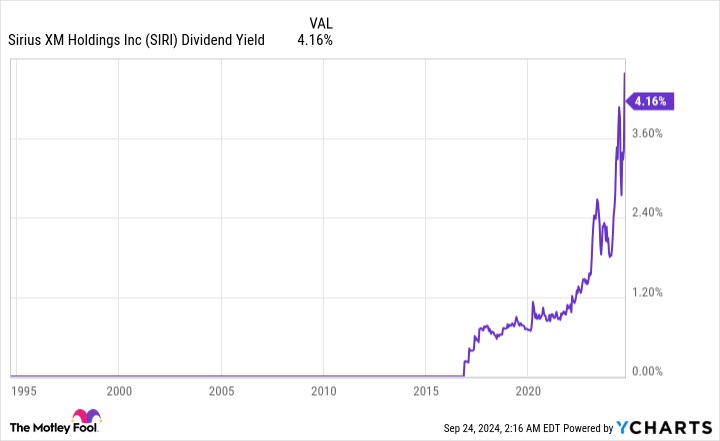

Furthermore, recent stock weakness has pushed the company’s annualized return to 4.2%. Sirius XM’s board is committed to maintaining the company’s annual payout above $1 per share.

Sirius

Should You Invest $1,000 in Sirius XM Now?

Before you buy shares in Sirius XM, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

I have more than quintupled my stake in this historically cheap legal monopoly that just caused a reverse stock split. originally published by The Motley Fool