One of the biggest temptations for dividend investors is the pursuit of returns. In short, this means making risky investments just to gain a larger income stream. In the long run, you’ll be better off if you’re careful, especially if you have to live off the income you generate. That’s why Partners for business products (NYSE:EPD) is a high-return investment that you’ll wish you had purchased. A quick comparison with Altria (NYSE:MO) will help explain why.

Who wins the high-yield story, Altria or Enterprise?

When it comes to yield, Altria’s 8.1% dividend yield is a full percentage point higher than Enterprise Products Partners’ 7.1% distribution yield. Both have regularly increased their dividends, which may leave many investors defaulting on the higher-yield option. But that’s not necessarily the best plan.

Altria, a consumer packaged goods company, carries more risks than you might think, despite operating in what is widely considered a reliable industry. That’s because the main product is cigarettes. This business has been in a downward spiral for quite some time. In the second quarter of 2024 alone, Altria’s cigarette volume fell 13% year over year. That’s no fluke. In the second quarter of 2023, volumes fell by 8.7%. In the same quarter of 2022, the number of cigarettes decreased by 11.1%. Every recent quarter and every recent full year would have shown the same terrible trend.

The company has offset the volume declines with price increases, allowing it to continue raising its dividend despite the clearly poor performance of its core industry. There’s a very real chance you’ll regret buying this high-yield dividend stock if it can’t stop the bleeding somehow.

Enterprise is a completely different story.

The lower returns of companies are associated with lower risk

It’s easy to say that Enterprise comes with its own set of risks as it operates in the highly volatile energy sector. And midstream activities are directly linked to demand for oil and natural gas, which is under pressure from the shift to cleaner alternatives. Fair enough, but what does Enterprise actually do?

As a midstream provider, Enterprise owns critical infrastructure assets that help move oil and natural gas around the world. The country generally charges fees for the use of its infrastructure, so the price of energy is less important than the demand for energy. Energy demand generally remains robust, regardless of the price of oil and natural gas.

But here’s the big fact: Despite all the hype around clean energy, demand for oil and natural gas is expected to remain robust for decades to come. In fact, demand for these fuels is likely to increase, with much dirtier coal bearing the brunt of the clean energy transition.

In other words, Enterprise’s business is not as risky as it seems. Furthermore, it is one of the largest midstream players in North America with an investment-grade rated balance sheet. Although internal growth opportunities are limited, the country has long functioned as a consolidator for the sector. It just announced plans to buy Pinon Midstream for, say, $950 million. Acquisitions are unwieldy and impossible to predict, but they give Enterprise plenty of room for growth on top of the slow and steady price increases it will be able to extract from customers.

If you want high returns from a growing company, Enterprise is the better option compared to Altria and its declining core business. Sure, you’re giving up a percentage point of return, but as Altria continues to struggle, you can sleep at night with that last point if you buy Enterprise.

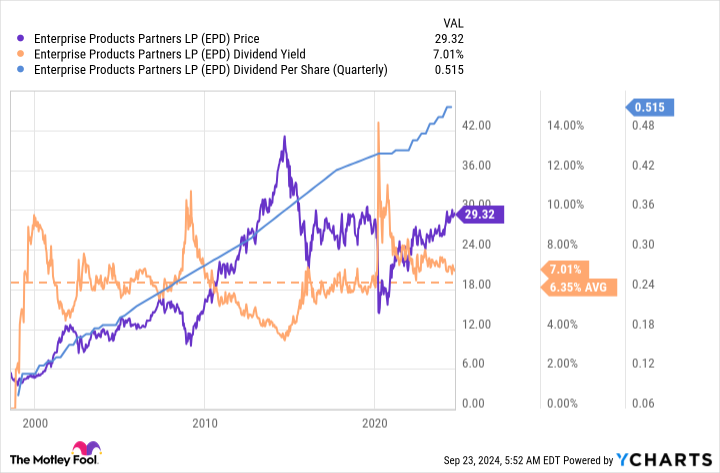

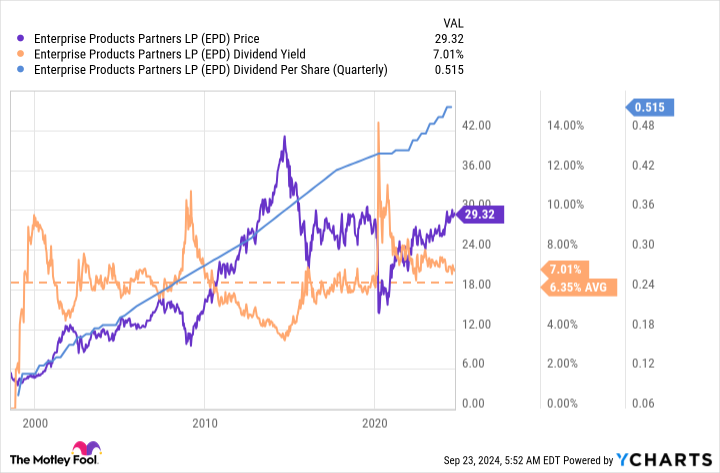

Enterprise’s earnings still look cheap

Here’s the most interesting part: Enterprise’s dividend yield of 7.1% is above the 10-year average yield of 6.3%. So despite the recovery from the pandemic lows, the economy still appears undervalued. A growing company, a financially strong company, and an undervalued price make Enterprise one high-yield stock you’ll regret missing out on. Especially when you compare it to other high-yield choices with similarly high, but much riskier, returns.

Should You Invest $1,000 in Altria Group Now?

Consider the following before purchasing shares in Altria Group:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

In a few years, you’ll wish you had bought these undervalued high-yield stocks. originally published by The Motley Fool