Buying and holding solid companies with shares trading at attractive valuations for the long term is one of the best ways to make money in the stock market. By applying this strategy, investors can take advantage of long-term growth trends and disruptive technologies. This is part of why buying shares of Nvidia (NASDAQ: NVDA) right now could be a smart move for the long term.

The company is in large, addressable markets and appears undervalued by some measures. Of course, the share has also more than tripled in value over the past year. That leaves some wondering whether Nvidia stock is currently overvalued. A closer look at Nvidia’s growth rate reveals that the company is more undervalued overall. Investors may regret not buying this semiconductor giant before it soars higher. Let me explain.

This is why Nvidia stock is undervalued

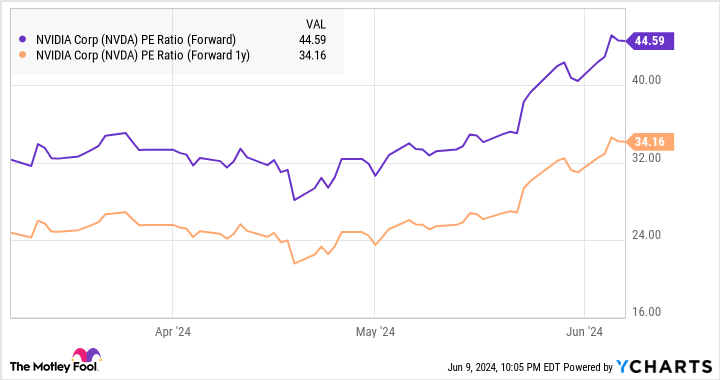

Nvidia’s price-to-earnings (P/E) ratio of 70 is admittedly rich and could indicate that the company is overvalued, especially when compared to the average P/E ratio of 44.5 in the US tech sector. But with a forward earnings multiple of 46, there are strong indications that there is a big jump in operating profit. That future price-earnings ratio is almost in line with the average of the American technology sector.

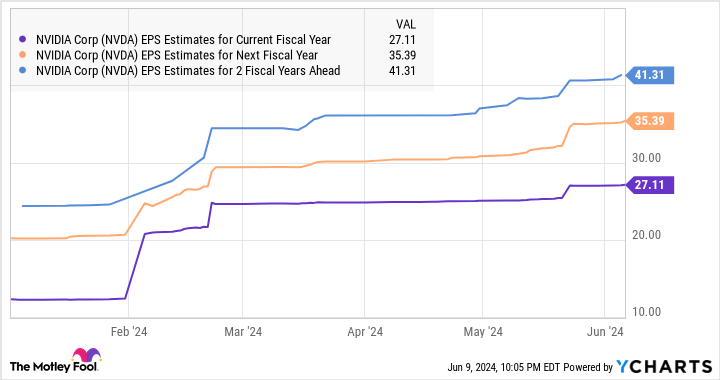

Looking beyond next year, Nvidia’s forward price-to-earnings ratio falls even lower.

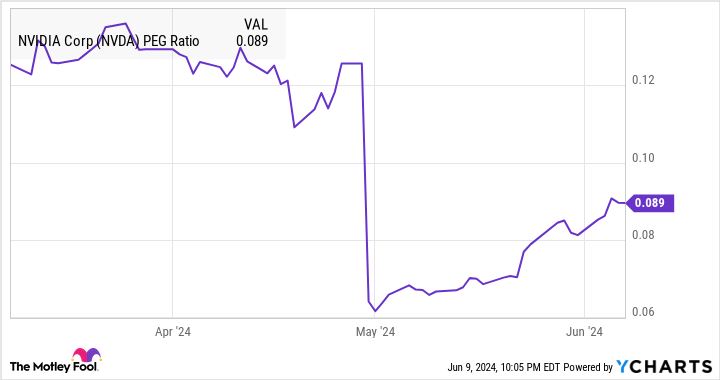

Nvidia is also quite cheap when you analyze its price-to-earnings-growth (PEG) ratio, a valuation metric that takes into account a company’s potential growth.

The PEG ratio is calculated by dividing a company’s remaining price-to-earnings ratio by the expected growth it could achieve in the future. This is a forward-looking valuation metric that gives investors a better idea of how Wall Street values a stock based on its future earnings growth. Investors should keep in mind that a PEG ratio of less than 1 means a stock is undervalued. So, based on the chart above, Nvidia’s PEG ratio of just 0.09 makes it incredibly undervalued.

Buying Nvidia at this valuation seems like a no-brainer, as the company sees a potential $1 trillion revenue opportunity in several markets.

The chip giant’s phenomenal growth shows no signs of slowing down

Nvidia generated just under $80 billion in revenue over the next twelve months. Lately, the company has seen phenomenal growth thanks to the huge demand for its artificial intelligence (AI) chips.

For example, in the first quarter of fiscal 2025, Nvidia’s revenue rose 262% year over year to $26 billion. This solid increase was driven by a 427% year-over-year increase in data center revenue to $22.6 billion. In 2022, Nvidia estimated its revenue opportunity in the hyperscale data center and AI chip market at $300 billion.

The company generated $47.5 billion in data center revenue last fiscal year. The segment’s revenue in the first quarter of FY2025 is evidence that it is on track to witness another major leap in this segment.

So Nvidia is making solid progress with the $300 billion data center opportunity, and it won’t be surprising to see it capture a large share of this market in the future. That’s because Nvidia dominates the hyperscale and AI graphics card market with a share of over 90%, which is why data center revenue is expected to grow at a staggering pace in the coming years.

Markets such as digital twins and automotive are other components of Nvidia’s potential $1 trillion revenue opportunity. Nvidia, for example, sees a $300 billion revenue opportunity in automotive chips. The good part is that the company is gaining ground in the automotive sector, with sales from this segment growing 17% to $329 million over the previous quarter.

There’s no doubt that the automotive industry currently makes up a small portion of Nvidia’s overall business, but a solid ecosystem of automotive customers and parts suppliers could help accelerate the company’s growth in this segment.

Meanwhile, Nvidia’s Omniverse software solutions are also gaining tremendous popularity thanks to increasing adoption of digital twins, driving revenue from the company’s professional visualization segment up 45% to $427 million last quarter. Investors should not forget that Nvidia also has huge growth opportunities in the gaming market, where it can benefit from the growing adoption of AI-enabled personal computers (PCs).

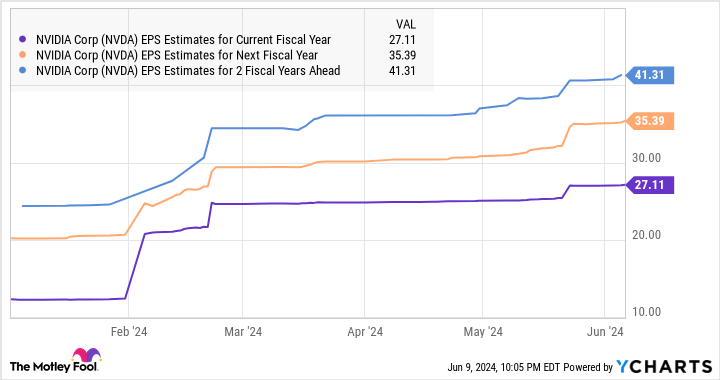

All in all, it will come as no surprise that Nvidia will become a much bigger company in a few years thanks to the multitude of catalysts it sits on and the dominant position it enjoys in key markets such as AI chips. The company ended the previous fiscal year with earnings of $12.96 per share, and you can see in the following chart that operating income will increase over the next three years.

As such, there are plenty of reasons for investors looking to buy a growth stock to add Nvidia to their portfolios. And now that you’ve seen how attractively valued Nvidia is right now in light of the potential growth it’s expected to deliver, it seems like a no-brainer to buy it as it can continue to deliver healthy profits for a long time to come.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

In a few years, you’ll wish you had bought this undervalued stock. originally published by The Motley Fool