In a sweeping change that could improve the ability of millions of Americans to own a home or buy a car, the Biden administration on Tuesday proposed a rule to ban medical debt from credit reports.

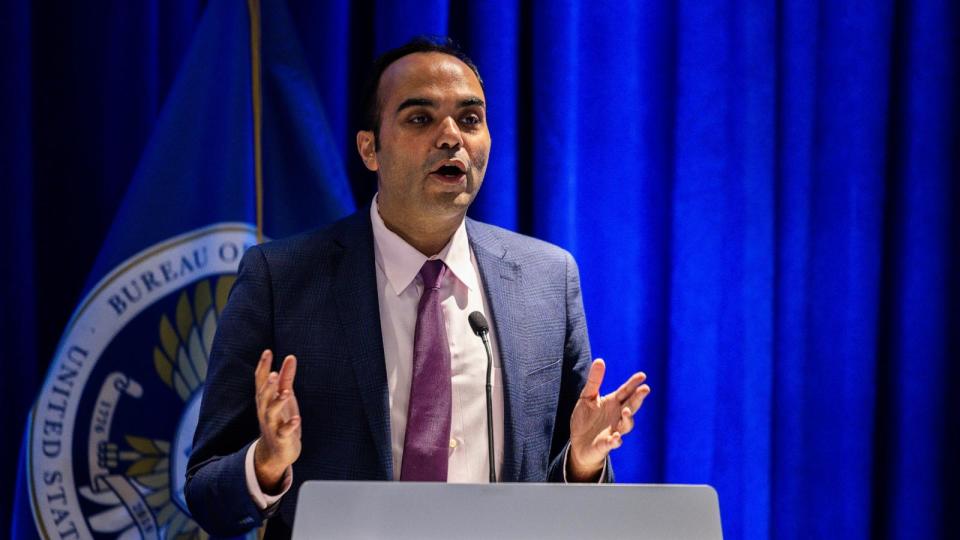

The rule, announced by Vice President Kamala Harris and Consumer Financial Protection Bureau Director Rohit Chopra, comes as President Joe Biden steps up efforts to convince Americans that his administration is cutting costs, a top concern for voters in the coming elections.

“This will be a huge relief for so many people who are struggling with bills when it comes to hospital visits,” Chopra told ABC News in an exclusive interview ahead of the policy announcement.

The rule, which has been in the works since September, could come into effect early next year.

“Our research shows that medical bills on your credit report are not even predictive of whether you will repay another type of loan. That means people’s credit scores are being unfairly and inappropriately harmed by this practice,” Chopra said.

The CFPB study estimates that the new rule will allow an additional 22,000 people to obtain a secure mortgage each year – meaning lenders can also benefit from the positive impact on people’s credit scores by being able to approve more borrowers.

Some major credit reporting companies have already taken steps to stop using certain medical debt to calculate people’s creditworthiness, including Equifax, TransUnion and Experian. FICO also recently started including medical debt less heavily in its scores, and VantageScore does not use this in its newer models.

But 15 million Americans still have $49 billion in medical debt that is hampering their scores, the CFPB found. This rule would expand the practice to all credit reporting in the US

Medical debt is high in the US. According to healthcare policy research organization KFF, two in five Americans are affected, and a large majority are in thousands of debt.

Once those debts are collected, credit scores take a hit, meaning auto and home loans become harder to obtain or are only offered at high interest rates — leading to a slippery slope for people already struggling with their bills.

“Medical debt makes it harder for millions of Americans to get approved for a car loan, a home loan, or a small business loan, all of which in turn makes it harder to make ends meet, let alone get ahead. And that is simply not fair,” Harris said on a call with reporters on Tuesday.

Lexi Coburn, 33, first encountered this problem almost a decade ago. She incurred medical debt in 2013, when she was 23 years old and uninsured.

Her feet were too swollen to walk, so she went to the emergency room, unsure where else she could go for medical care without insurance. She was told she had early arthritis.

The $425 bill from that visit wasn’t in Coburn’s budget, so she left it unpaid. Growing up, her family often didn’t have the income to cover medical costs, she said, and she felt ill-equipped to deal with the medical system differently as a young adult.

Although she was later able to sign up for health insurance through the Affordable Care Act, Coburn’s medical debt still grew to more than $2,300, including another $1,532 in dental work and a separate emergency room visit, both in 2019.

The consequences became clear when she tried to get a car.

“Immediately my medical debt got in the way of qualifying for a good loan without an excessive monthly payment,” Coburn said.

“The most frustrating part for me was in my mid-20s, when I wasn’t making much money, I needed transportation to get to work,” Coburn said.

She saw a dangerous financial cycle building up. Coburn’s bills and subsequent low credit score got in the way of “being able to prosper enough to pay off the debts,” she said. “So it just felt like a domino effect.”

The new CFPB rule also aims to address the problem of incorrect, confusing and complicated medical billing, which often leads to protracted, protracted disputes between patients and billing departments – a complaint that the CFPB, as the agency charged with consumer empowerment, is receiving in large numbers, Chopra said.

“Too often we see people receiving bills that are inaccurate. Many patients fight over these bills for months, only to find out they appear on their credit report,” he said.

Experts supporting the CFPB’s proposed rule also point to the already low success rate in collecting medical bills.

“We know empirically that repayment rates for medical debt are incredibly low, and so it’s already the case that people aren’t really paying it off. So I don’t think this policy change is going to change behavior that dramatically,” said Matt Notowidigdo, a professor at the University of Chicago Booth School of Business, which studies health economics.

Linda Davis, a 61-year-old resident of Grand Rapids, Michigan, has chronic obstructive pulmonary disease, a type of lung disease, and uses a power wheelchair due to a lower back injury. She said she doesn’t think she will ever be able to pay her medical bills, which she estimates are between $45,000 and $50,000.

“People can be mistaken and think, oh, well, she has Medicare, she’s all set. That’s not the case at all, and it can ruin your whole life. It takes control of your whole life,” said Davis.

She said her monthly income covers rent, electricity, her cell phone bill and groceries, but she has no room in her budget for her medical bills.

“You’ll find out [after the procedure], you have all these medical bills, and what should you do with them? You know, on God’s green earth, I can’t possibly pay all those medical bills. Even if I paid a small amount every month, I wouldn’t live long enough to pay them all,” Davis said.

According to Notowidigdo and many other health economists, addressing the root cause of America’s medical debt problem would mean getting more people adequate health care coverage up front, “rather than having to deal with unpaid medical bills due to lack of insurance or inadequate insurance.” on the front side’. the back,” he said.

Of course, those high bills and low reimbursement rates are already a challenge for hospitals and healthcare systems for the time being.

If the CFPB rule means fewer people pay the bills, it could be the patients who suffer, some experts warned.

Ge Bai, a professor who studies health policy accounting at Johns Hopkins University, predicted that hospitals will have to make up that loss in other ways. Stricter payment efforts, such as requiring payment before patients receive medical care, could leave low-income patients worse off.

“I think in the short term it will be great news for patients, and we’ll probably see patient advocacy groups pushing for this. But I think in the long term, as the long-term negative effects become apparent, we’ll probably also “We will see even more resistance,” Bai said.

Industry groups, such as the Association of Credit and Collection Professionals, have echoed Bai’s concerns.

“The CFPB’s proposal will have a broad negative impact on businesses, healthcare providers, patients and consumers because suppressing information about a consumer’s debt will increase the cost of medical care and force more prepayments. If finalized, the rule would “The U.S. credit-based economy as it is today will fundamentally change in terms of reduced consequences for not paying your bills, which in turn will reduce access to credit and health care for those who need it most,” Scott Purcell, ACA CEO, said in a statement. to ABC News after the rule was proposed Tuesday.

Chopra rejected the idea that more people will be unable to pay their health care debts as a result of the rule, saying they will still face other penalties that come with debt.

“These individuals will continue to be subject to collection actions, lawsuits and more. There are plenty of ways people are punished for not paying their bills. I just don’t want the credit reporting system to be weaponized against people who have already paid them. Chopra said.

In a dramatic change, the Biden administration’s decision to ban medical debt on credit reports originally appeared on abcnews.go.com