Technology stocks have probably made more than a few millionaires lately Technology sector Nasdaq-100 for example, up 51% since last May. The increased interest in artificial intelligence (AI) has caused numerous stocks to skyrocket. The launch of OpenAI’s ChatGPT highlighted how far the technology has come and its potential to boost many industries.

As a leading chipmaker Advanced micro devices (NASDAQ: AMD) is one of the main beneficiaries of the bull run. The stock is up 61% in the past year. The company has attracted investors with the second-largest market share in graphics processing units (GPUs), the chips needed to train AI models, and with heavy investments in its AI offerings.

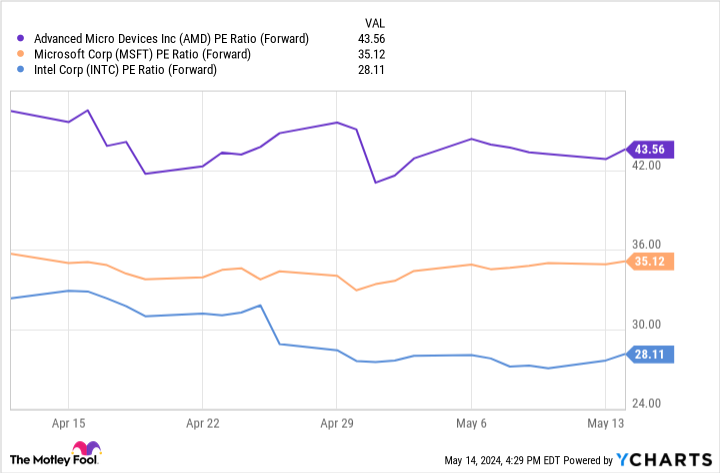

AMD has made many millionaires over the years. But a recent rally means the stock is trading at almost 44 times its earnings, indicating it doesn’t offer much value. The diagram above shows that Microsoft (NASDAQ: MSFT) And Intel (NASDAQ: INTC) are potentially better-regarded alternatives, and both have promising positions in the AI field.

So forget AMD and consider buying one of these two millionaire stocks instead.

1. Intel

Shares of Intel have risen more than 110,000% since the company’s initial public offering in 1971, likely creating many millionaires. But it’s been a while since Intel made anyone rich, with its share price up about 20% in the last decade.

The company has suffered repeated blows to its business since 2014, including reduced market share in central processing units, the end of a lucrative partnership with Appleand an economic downturn. So now could be an excellent time to consider investing in Intel.

The company is taking steps to come back strong over the next decade and could see its stock price rise in the long term. Last year, Intel announced a “fundamental shift” in its manufacturing, with plans to adopt an in-house foundry model that would allow it to compete with companies like Taiwanese semiconductor.

Intel said the move would save the company between $8 billion and $10 billion by 2025 and help it achieve adjusted gross margins of 60%. Production is a costly affair, so it will take some time before the investment yields a return.

But the first quarter earnings numbers indicate that Intel is moving in the right direction. During the quarter, foundry revenues fell 10% year-over-year. Still, operating income in the segment rose from $22 million in 2023 to $482 million this year.

In addition to manufacturing, Intel is investing heavily in AI. The company launched new AI chips this year and posted promising gains in its data center and AI segment in the last quarter. In the first quarter, segment revenue rose 4% year-over-year, while operating income rose from negative $69 million to a profit of $184 million.

The chipmaker still has a lot of work to do, but is on a growth path that could be worth investing in before it’s too late. Meanwhile, Intel’s significantly lower price-to-earnings (P/E) ratio makes it a bargain compared to AMD.

2.Microsoft

Microsoft has reached record highs in the past year. The stock’s 35% rise has pushed its market cap to over $3 trillion, well exceeding Apple as the most valuable company in the world.

The company has attracted investors by taking a lead in AI. It seemingly had the foresight of the century when it invested $1 billion in OpenAI in 2019, an investment that has since grown to around $13 billion. The partnership has given Microsoft exclusive access to some of the most advanced AI models on the market and given the company a competitive edge Amazon And Alphabet.

On April 25, Microsoft announced earnings for the second quarter (ending in March). Revenue rose 18% year over year to $62 billion. Microsoft saw growth across multiple segments, with its productivity and business processes division posting a 12% year-over-year revenue increase and its AI-focused Intelligent Cloud segment delivering a 21% revenue gain.

Over the past year, the company has integrated AI into many of its products and services, including adding generative features to its Office productivity suite, expanding its AI tools on Azure, and basing parts of its search engine Bing on ChatGPT. Recent figures indicate that the expansion is paying off.

Microsoft has made a lot of millionaires over the years, with its stock up about 950% over the past decade. And recent growth and a powerful position in AI suggest that this is not done yet. So at a better value than AMD, the stock is a screaming buy right now.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel, long January 2026 $395 calls to Microsoft, short January 2026 $405 calls to Microsoft, and short May 2024 $47 calls to Intel. The Motley Fool has a disclosure policy.

Forget AMD: Consider These 2 Millionaire Maker Stocks Instead was originally published by The Motley Fool