(Bloomberg) — Shares of Intel Corp. rose for a second straight day after the troubled chipmaker made a series of announcements, raising optimism that its recovery plan is starting to bear fruit.

Most read from Bloomberg

In its most notable move, the company struck a multibillion-dollar deal with Amazon.com Inc.’s Amazon Web Services cloud unit to invest in a custom AI semiconductor. Intel also could receive up to $3 billion in U.S. government funding to make chips for the military. And it’s turning its ailing manufacturing business, or foundry, into a wholly owned subsidiary.

But the chipmaker is also pulling back in some areas. Intel said it would shelve plans for new factories in Germany and Poland — at least for now.

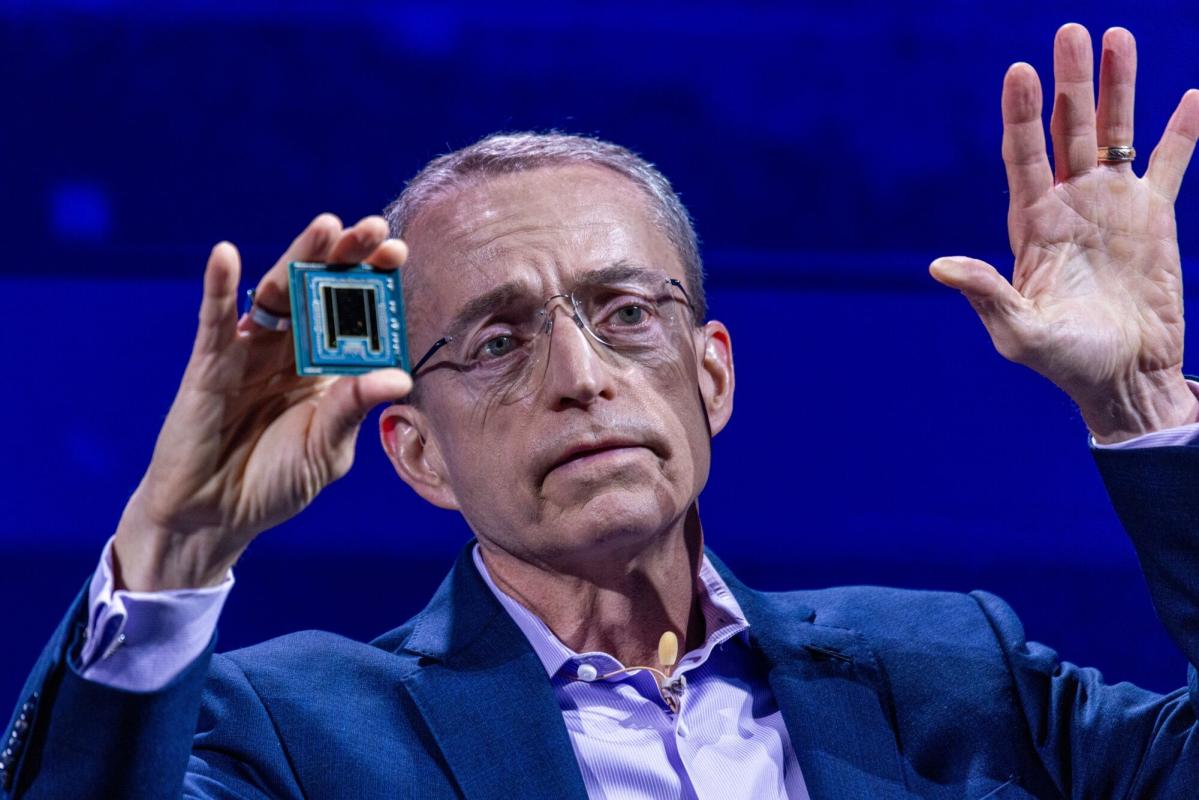

The news follows a meeting of Intel’s board last week, in which executives outlined ways to save money while keeping CEO Pat Gelsinger’s long-term turnaround plan on track. The CEO’s effort hinges on turning Intel into a foundry, but the Santa Clara, California, company has been slow to win customers. A high-profile customer like Amazon represents a major victory.

Intel shares rose as much as 8% to $22.58 on Tuesday, after a 6.4% gain the day before. They had fallen more than 60% through the end of last week.

Gelsinger, who launched a bold comeback attempt for Intel in 2021, has had to scale back some of his ambitions in the name of efficiency. With sales falling and losses mounting, the company last month announced plans to cut 15,000 workers, find $10 billion in cost savings and suspend Intel’s dividend. Now he’s moving to further curtail expansion plans, particularly abroad.

Construction projects in Poland and Germany will be halted for about two years, depending on market demand. Another project in Malaysia will be completed but not put into operation until conditions allow, Intel said.

The postponement of the German plant is a setback for the European Union’s semiconductor ambitions and is likely to lead to fresh commotion in Berlin over where the €10 billion in subsidies should go.

While Intel has paused construction of new factories in Germany and Poland, the company remains committed to U.S. expansion in Arizona, New Mexico, Oregon and Ohio.

The move to separate Intel’s foundry business from the rest of the company is partly intended to reassure potential customers — some of whom compete with Intel — that they’re dealing with an independent supplier. Bloomberg had previously reported that the company was considering the option.

“We still have to learn things about becoming a foundry,” Gelsinger said in the interview. “I need a lot of customers.”

Intel also wants to accelerate efforts to roll back $10 billion in cost savings and better focus its products on AI computing, an area where rival Nvidia Corp. has excelled. And it hopes to reduce its global real estate by about two-thirds by the end of the year.

The company also reiterated plans to sell part of its stake in semiconductor maker Altera Corp. to private equity investors. The company, which Intel bought in 2015, was spun off from operations last year with the goal of going public.

Amazon Web Services is the largest provider of cloud computing, and it could help boost confidence that Intel can compete with companies like Taiwan Semiconductor Manufacturing Co., a leader in foundries. AWS has used Intel processors over the years but has shifted more toward in-house designs, the very products that Intel may now help produce.

The two companies will jointly invest in a custom semiconductor for artificial intelligence computing — what’s known as a fabric chip — in a “multi-year, multi-billion-dollar framework,” according to a statement Monday. The work will rely on Intel’s 18A process, an advanced chipmaking technology.

“Today’s announcement is big,” Gelsinger said Monday of the deal. “This is a very demanding customer with very advanced design capabilities.”

Microsoft Corp., another major cloud computing provider, announced in February plans to use Intel for some of its own chips as well.

In another victory, Intel said earlier Monday that it is eligible for up to $3 billion in U.S. government funding to produce chips for the military. The effort, called the Secure Enclave, is aimed at creating a steady supply of advanced chips for defense and intelligence purposes. That news helped spark Monday’s rally.

The Secure Enclave award is separate from a potential $8.5 billion Chips and Science Act grant that Intel could receive to support factories in four U.S. states. The projects include a facility in New Albany, Ohio, that Intel has said could become the world’s largest chip manufacturing facility.

Intel has a long way to go to regain Wall Street’s full trust. After years of losing ground to rivals and seeing its technological edge, the Silicon Valley pioneer is valued at less than $100 billion. It’s no longer among the top 10 chip companies on that basis. Nvidia now has a market cap of about $2.9 trillion.

Intel shocked investors with a dismal financial report last month, triggering the stock’s biggest one-day drop in decades. Analysts described the announcement as Intel’s worst earnings report ever.

Gelsinger acknowledged in a letter to employees that the chipmaker’s performance has been negatively reviewed — and has fueled speculation about what might happen to the company. The only way to “silence our critics” is to deliver results and execute better, he said. This week’s announcements are a step in that direction, he said.

“Is it good enough? No. Is it substantial? Yes,” he said in the interview. “I have reaffirmed my commitment. We are going to complete a groundbreaking assignment.”

Most read from Bloomberg Businessweek

©2024 Bloomberg LP