Inflation refers to the general increase in the price of goods and services. The U.S. Federal Reserve aims to keep the consumer price index (CPI) of inflation growing at an annual rate of 2%, and the central bank will adjust the federal funds rate (overnight interest rates) if it strays too far from that target.

The CPI hit a 40-year high of 8% in 2022, prompting one of the most aggressive rate-hiking campaigns in Fed history. Inflation has cooled significantly since then, so the central bank appears poised to reverse that policy.

That means interest rates could be cut for the first time since March 2020. If history is any guide, that could trigger a big move in the benchmark. S&P 500 (SNP INDEX: ^GSPC) stock market index — but its direction may surprise you.

The Fed could cut interest rates three times before the end of 2024

The U.S. government injected trillions of dollars in stimulus into the economy in 2020 and 2021 to counter the negative economic effects of the COVID-19 pandemic. At the same time, the Fed lowered interest rates to a historic low of 0% to 0.25% and injected trillions of dollars into the financial system through quantitative easing (QE) by purchasing government and agency bonds.

Loose monetary policy and dramatic increases in the money supply are typically inflationary, but disruptions to global supply chains also pushed up prices. Factories and shipping companies periodically closed around the world to stop the spread of COVID-19, leading to shortages of everything from televisions to cars.

So a cocktail of factors caused CPI to soar in 2022, leading to the flood of rate hikes that followed. The federal funds rate eventually stabilized at 5.25% to 5.50% after the Fed’s last rate hike in August 2023. That’s a long way from the pandemic’s lows.

But here’s the good news: It’s working. The CPI ended 2023 at 4.1% and hit an annualized rate of 3% in June 2024, the most recent reading. In other words, inflation is approaching the Fed’s 2% target.

That’s why most experts expect interest rate cuts to come soon. According to the CME GroupAccording to the FedWatch tool, the Fed is likely to cut rates three times by the end of 2024 (once in September, November, and December).

The stock market does not always respond well to interest rate cuts

The conventional wisdom is that rate cuts are great for the stock market. They reduce returns on risk-free assets like cash and government bonds, which pushes investors into growth assets like stocks and real estate.

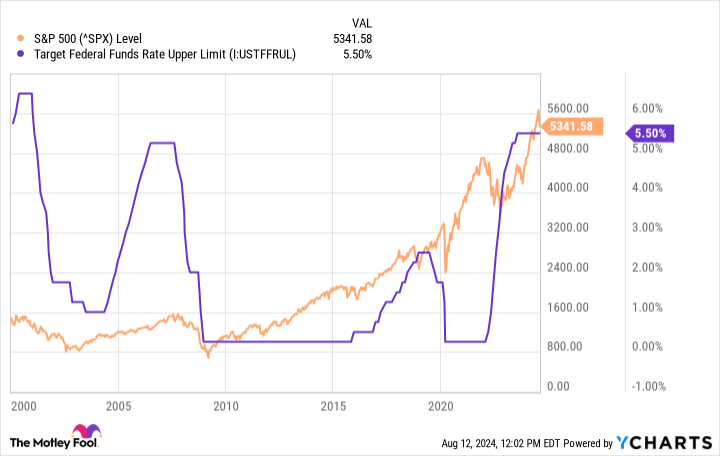

However, if we look at the chart below, which compares the federal funds rate to the S&P 500 since 2000, we can see that falling interest rates are often a precursor to a decline in the stock market.

To be clear, the prevailing trend is always up for the S&P 500, so long-term investors shouldn’t be swayed by the possibility of impending weakness. Additionally, there have been some prevailing themes in the past that cloud this correlation a bit. In other words, we need to look at Why The Fed lowered interest rates during the periods shown in the chart above:

-

In the early 2000s, the dotcom tech bubble burst, causing a recession in the economy. The S&P 500 fell 9.1% in 2000, 11.9% in 2001, and 22.1% in 2002.

-

In the late 2000s, the global financial crisis forced the Fed to take decisive action, which included rapid rate cuts and the introduction of QE for the first time. The S&P 500 fell 37% in 2008.

-

Finally, the sharp decline in interest rates in 2020 was caused by the pandemic. The S&P 500 suffered a peak-to-trough decline of 31.8% in 2020, but actually ended the year on a positive note thanks to all the stimulus I mentioned earlier.

So we can’t say with certainty that the stock market fell because the Fed cut rates. Instead, rates likely fell on each of those occasions because of what else was happening in the underlying economy.

Will it be different this time?

There are currently no signs of an impending crisis for the US economy, nor of a full-blown recession. But there are some signs of weakness. For example, the unemployment rate has risen to 4.3% (from 3.7% in January) and a weaker labor market could be a harbinger of weak consumer spending in the near future.

With CPI nearly back at the Fed’s target, it’s probably not appropriate to pursue a restrictive policy. Furthermore, interest rate moves often have a lagged effect on the economy, so it’s possible that we haven’t even seen the full effect of the Fed’s previous rate hikes yet.

Likewise, any rate cuts later this year likely won’t show up in economic data until sometime in 2025. That means the sooner the Fed starts cutting rates, the better the chance the U.S. economy can avoid unnecessary deterioration in the future.

The stock market trades on corporate earnings, and it’s very difficult for companies to deliver growth in a slowing economy. If Wall Street were to cut earnings expectations, that would almost certainly lead to a period of decline in stocks. In that scenario, the S&P 500 could fall while the Fed is cutting interest rates at the same time.

The Fed typically cuts rates when it sees weakness in the economy, which can signal that the S&P 500 will move lower in the short term. But looming rate cuts aren’t a reason to sell stocks — as I said before, stocks tend to recover over the long term, so any weakness can actually be a buying opportunity.

Don’t miss this second chance at a potentially lucrative opportunity

Ever felt like you missed the boat on buying the hottest stocks? Then you want to hear this.

In rare cases, our expert team of analysts provides a “Double Down” Stocks recommendations for companies they think are about to explode. If you’re worried you’ve already missed your chance to invest, now’s the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled in 2010, you would have $19,172!*

-

Apple: if you invested $1,000 when we doubled in 2008, you would have $41,859!*

-

Netflix: if you invested $1,000 when we doubled in 2004, you would have $349,472!*

We are currently issuing “Double Down” warnings on three incredible companies, and there may not be another opportunity like this anytime soon.

See 3 “Double Down” Stocks »

*Stock Advisor returns as of August 12, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

Interest rates are about to do something they haven’t done since March 2020, and it could cause a big move in the stock market was originally published by The Motley Fool